In a country where artificial islands rise from the sea and glass towers pierce the clouds, it’s easy to comprehend that real estate success is built purely on ambition and capital. But behind the scenes of UAE’s infrastructure boom, a quieter force is taking center stage and it’s not what you would expect.

Across the UAE, top developers are pivoting their focus on ‘proactive risk management’. Why? Because in 2025, building big isn’t enough. With materials costs surging, regulatory frameworks shifting, climate pressures mounting, and global volatility threatening every timeline, even the most visionary projects can falter without a solid grip on risk.

This article dives into the backstage systems keeping the region’s biggest real estate projects on track and how risk, once a back-office formality, is now a frontline strategy for survival, profitability, and long-term dominance.

What Is Construction Risk Management?

Construction risk management is the structured process of identifying, assessing, mitigating, and monitoring risks that may negatively impact a project’s outcomes, whether in terms of safety, schedule, cost, quality, or legal compliance.

In the context of Dubai’s real estate market, risks range from labor availability to regulatory shifts, supply chain interruptions, unforeseen environmental issues, contractor disputes, and design errors. Effective risk management ensures that developers not only meet their targets but also maximising investor confidence, controlling budgets, and protecting the lives and well-being of workers on-site.

In short, risk management has evolved from a checklist item to a strategic business function that supports long-term project performance and organisational resilience.

Understanding the Risks in UAE’s Real Estate Market

Dubai’s real estate landscape continues to evolve as a hub of innovation, luxury, and strategic global investment. As of 2025, the sector remains a magnet for foreign direct investment (FDI), buoyed by Expo City Dubai initiatives, climate-focused urban design, and government-backed smart infrastructure projects. However, with high rewards come heightened risks. The current environment, shaped by geopolitical shifts, inflationary pressures, and regulatory tightening, demands that developers stay more agile and risk-aware than ever.

Here are the key risk categories reshaping real estate project planning across Dubai and the wider UAE:

1. Regulatory Risks and Complexity

In 2025, regulatory complexity has intensified across the UAE. Authorities have introduced stricter environmental and worker welfare regulations. For example, Dubai’s new Green Building Regulations mandates enhanced insulation standards, solar energy integration, and sustainable waste disposal mechanisms in all new commercial and residential builds.

Additionally, the Dubai Real Estate Regulatory Agency (RERA) has tightened project escrow rules and off-plan sales reporting, increasing scrutiny on developers' financial disclosures. Non-compliance may lead to severe penalties, suspension of sales, or license revocation making up-to-date regulatory awareness a cornerstone of risk strategy.

2. Concerning Rise in Financial and Cost Risks

Project costs across the UAE have risen, driven by a complex mix of global and regional pressures. Chief among these are persistent inflation, tariffs, elevated oil prices, and a growing reliance on eco-friendly imported materials, which have seen increased demand across smart and sustainable developments.

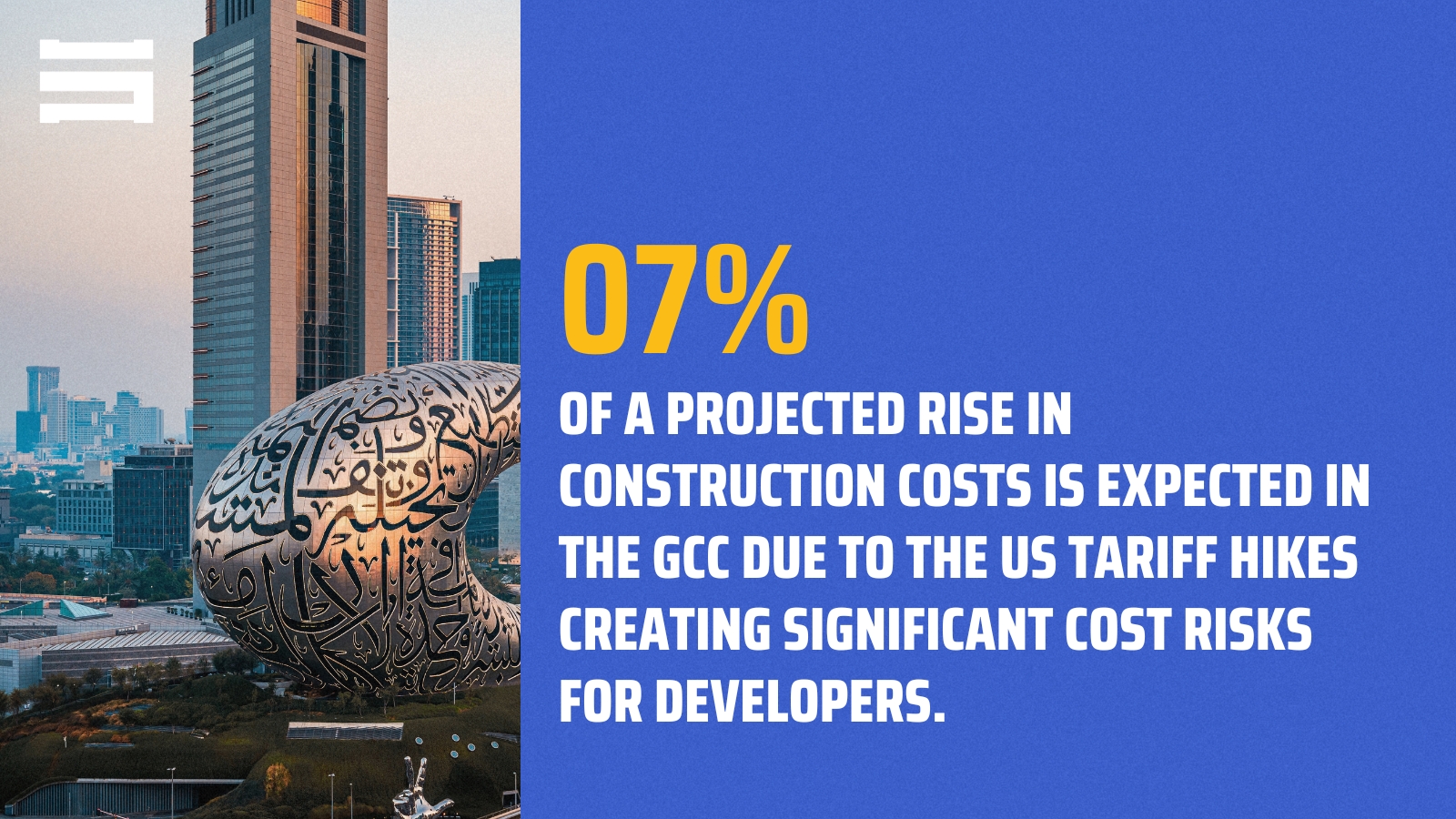

A notable driver of recent cost escalation has been the tariff hikes imposed by the U.S. government. As outlined in Stonehaven’s report, these measures have had a knock-on effect throughout the Gulf Cooperation Council (GCC), with projected cost increases of up to 7% on imported steel, aluminum, mechanical components, and advanced finishes in materials heavily used in UAE megaprojects.

To resolve these financial risks, UAE developers are increasingly adopting multi-supplier strategies, forward purchasing models, and real-time cost-tracking systems. In a market where margins are tight and investor expectations are high, proactive financial risk planning has become not just a safeguard, but a strategic advantage.

3. Environmental and Weather Risks

It is stated that the average global temperature in March was 1.6C higher than in pre-industrial times, and is lenient on threatening that international climate goals are moving out of reach. These weather conditions directly impact site safety, reduce worker productivity, and necessitate strict adherence to new labor regulations. For real estate developers, these environmental shifts translate into tangible risks:

● Reduced productivity on construction sites due to earlier and longer periods of extreme heat

● Mandatory midday break enforcement, extended by the Ministry of Human Resources and Emiratisation (MOHRE), impacting project timelines

● Rising insurance premiums tied to weather-related exposures

● Increased material degradation from sustained heat and dust infiltration

As cities like Dubai push for climate-resilient, high-performance buildings, real estate investors are placing growing emphasis on a project’s ability to withstand environmental stress. Developments that fail to adapt are not only more expensive to operate and maintain, but they also risk becoming less attractive to future buyers and institutional investors focused on ESG and long-term asset value.

In response, forward-thinking developers are adopting climate-adaptive strategies, including:

● Reflective and thermally insulated building materials

● Passive cooling design integrated from the planning stage

● Smart building systems that monitor environmental performance in real time

Environmental volatility is now a core market risk, not a seasonal variable. In 2025, managing these conditions is about protecting asset performance, financial stability, and investor trust in a region increasingly shaped by climate extremes.

4. Operational and Logistical Risks

Despite improvements in digital permitting systems like Dubai’s Building Smart Portal, large-scale developments continue to face coordination hurdles across multinational teams and fragmented supply chains.

Supply chain disruptions remain a persistent risk across large-scale UAE developments. From port delays to material shortages and fragmented subcontractor coordination, these issues are slowing down project progress.

Recent industry reports suggest that over 30% of GCC construction projects have experienced timeline slippage in the past 12 months due to supply chain constraints, a figure that reflects the global ripple effects of trade volatility, shipping reroutes, and increased demand for specialised construction components.

In response, UAE developers are adopting digital tools to minimise disruption. Digital twin technology and real-time risk analytics platforms are increasingly being used to - Track procurement bottleneck, predict delivery delays and coordinate tasks across multinational contractor teams. These technologies are helping developers improve project visibility, maintain schedule integrity, and reduce waste by simulating potential breakdowns before they occur.

5. Reputational and Legal Risks

In a highly visible market like Dubai, project reputation is paramount. With stricter enforcement of labor welfare policies and public safety standards, incidents on-site and this translates to even minor ones by escalating into viral coverage or investor concern. In 2025, a high-profile delay in a waterfront residential project due to safety non-compliance drew significant attention, resulting in legal claims and the withdrawal of a key Gulf-based investment partner.

Furthermore, as more international investors enter the UAE market, there is heightened demand for ESG compliance, transparent reporting, and corporate governance — areas where lapses can quickly damage brand equity.

The Five Principles of Risk Management in Construction Projects

Adopting a structured risk management framework is the key to consistent project performance. Here are the five core principles used by leading UAE developers:

1. Risk Identification: Spot Problems Before They Start

The first step is identifying all potential risks, both internal and external. This might include:

● Site conditions and geotechnical concerns

● Incomplete design documents

● Procurement delays or material shortages

● Labour skill gaps and safety compliance issues

Tools like SWOT analysis, brainstorming workshops, and historical project reviews are frequently used during this phase. In UAE construction, where projects often span years and multiple jurisdictions, a comprehensive risk register from day one is a strategic necessity.

2. Risk Assessment: Rank and Prioritise Risks

Each identified risk is evaluated based on its likelihood and impact. This is typically done using risk matrices that plot:

● High-likelihood, high-impact risks (e.g. permit delays)

● Low-likelihood, high-impact events (e.g. catastrophic weather)

● Low-priority risks that still require basic monitoring

By prioritising risk types, project teams can focus resources where they matter most.

3. Risk Mitigation: Take Proactive Control

Once ranked, risks must be actively managed. This involves:

● Sourcing from multiple suppliers to avoid material delays

● Adding float time into schedules

● Ensuring workers are trained on OSHA and ISO 45001 standards

● Securing project insurance and warranties

In Dubai’s tightly regulated environment, mitigation also includes ongoing stakeholder engagement to align expectations and avoid disputes.

4. Risk Monitoring and Control: Track and Adapt

Risk isn’t static and successful developers treat risk management as a live process. Real-time dashboards, site inspections, and continuous communication help monitor evolving conditions.

Changes in weather forecasts, labor availability, or policy updates require flexible response strategies. Top firms use software tools like BIM and risk analytics platforms to visualize and adjust on the fly.

5. Communication and Documentation: Embed Risk Into Culture

A risk-aware culture ensures that everyone is responsible. Clear communication through toolbox talks, reporting systems, and document trails ensures that decisions are traceable and that lessons from past incidents are shared across teams.

Thorough documentation also supports insurance claims, audits, and future project planning.

Why Leading UAE Developers Are Hiring Risk Management Specialists

Given the scale and complexity of many UAE construction projects, developers are increasingly turning to external risk consultants and management firms to augment internal capabilities.

Strategic Benefits of Hiring a Construction Risk Manager:

● Deep familiarity with UAE-specific regulations and authorities

● Use of predictive analytics and simulation models to forecast risk impact

● Integration with design software like BIM for proactive planning

Operational Support from Construction Risk Management Firms:

● Development of custom risk planning methods and site-specific safety strategies

● Coordination across multinational teams and regulatory bodies

● On-site implementation of mitigation and monitoring processes

Business Outcomes Through Post-Risk Management:

● Greater investor confidence and transparency

● Smoother procurement and tendering processes

● Lower insurance premiums and fewer project delays

These firms are no longer seen as optional consultants but as strategic partners in delivering successful construction projects.

Conclusion

The future of real estate development in the UAE belongs to those who can manage complexity with precision. With tighter regulations, higher investor expectations, and increasingly sophisticated projects, project risk management is a business driver.

By mastering the five pillars of construction risk management from identification, assessment, mitigation, monitoring, and communication, developers can really create the conditions for consistent, safe, and profitable outcomes.

In a market as competitive as Dubai’s, smart risk strategies are the new signature of smart developers.

About us

At Stonehaven, we embed resilience into every stage of your project lifecycle. From high-rise luxury developments to large-scale infrastructure and energy ventures, our risk management services are built to protect your timelines, budgets, and reputation in an increasingly complex regulatory and environmental landscape.

With deep expertise in the UAE’s evolving construction sector, we deliver:

● Comprehensive Risk Assessments tailored to project scope, location, and stakeholder exposure

● Custom Implementation Plans aligned with ISO 31000 and regional frameworks

● Real-Time Risk Monitoring using BIM-integrated platforms and predictive analytics to flag issues before they escalate

● Regulatory Compliance Support to help you navigate permitting, safety audits, and environmental standards with confidence

● Post-Project Risk Reviews to capture lessons learned and continuously improve organisational resilience

Our approach goes beyond identifying threats, we also equip your team with the foresight and agility to turn uncertainty into opportunity. Whether you're launching a new development or optimising existing assets, Stonehaven ensures that risk is managed as a strategic asset and an opportunity.

Build smarter. Operate safer. Deliver today.