The construction market moves fast. Material prices shift, currencies fluctuate, and project costs can change overnight.

To help our clients and partners stay ahead of the curve, we’re proud to introduce Issue 1 of The Stonehaven Cost Index a concise, data-led snapshot of the market’s most influential movements.

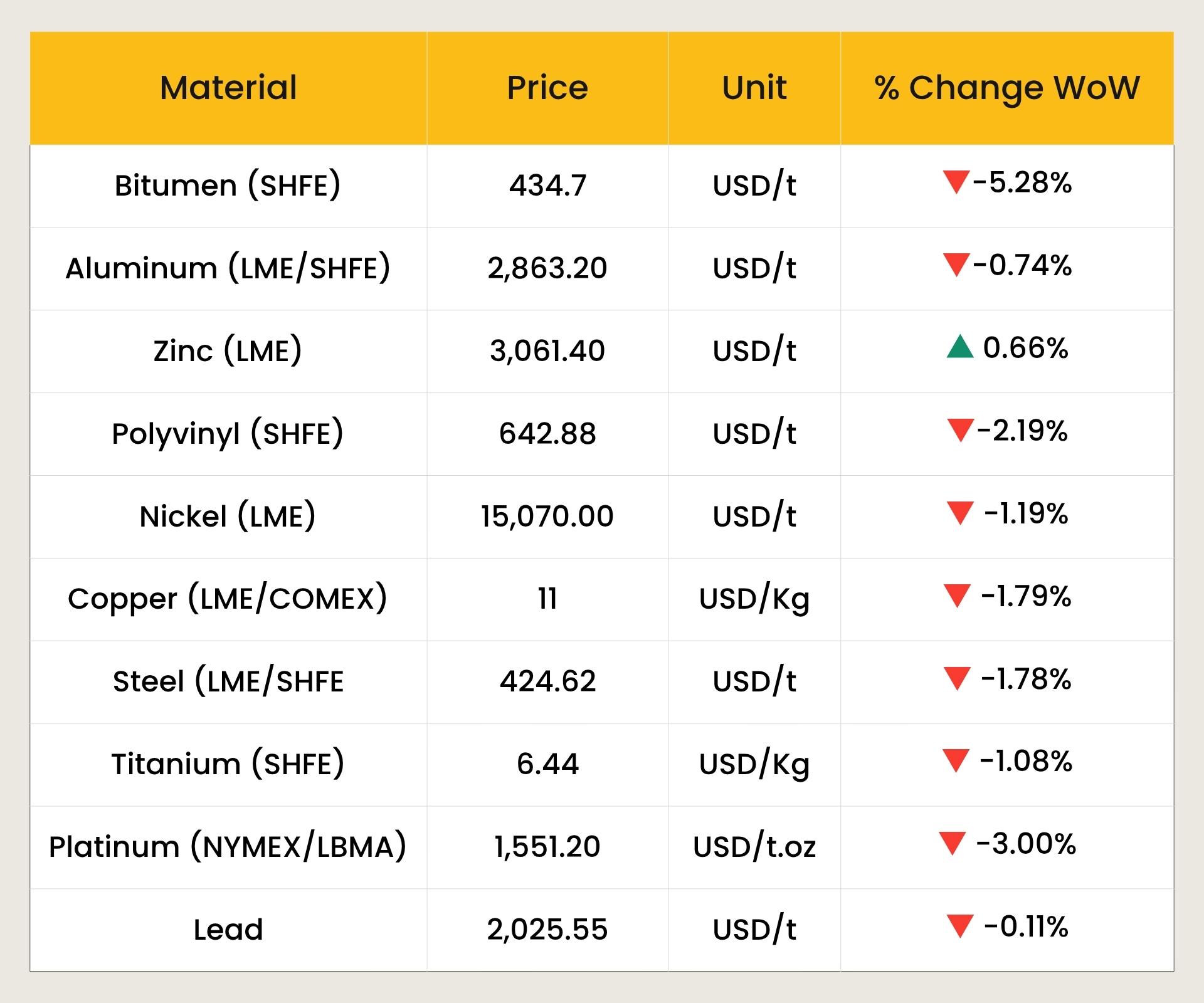

This Week's Market Movers

Every week, our cost management and data intelligence teams will analyse material trends, foreign exchange rates, and inflation drivers that shape project budgets across the GCC. The result is a clear, actionable index that translates market volatility into insight, helping developers, contractors, and consultants make informed cost decisions.

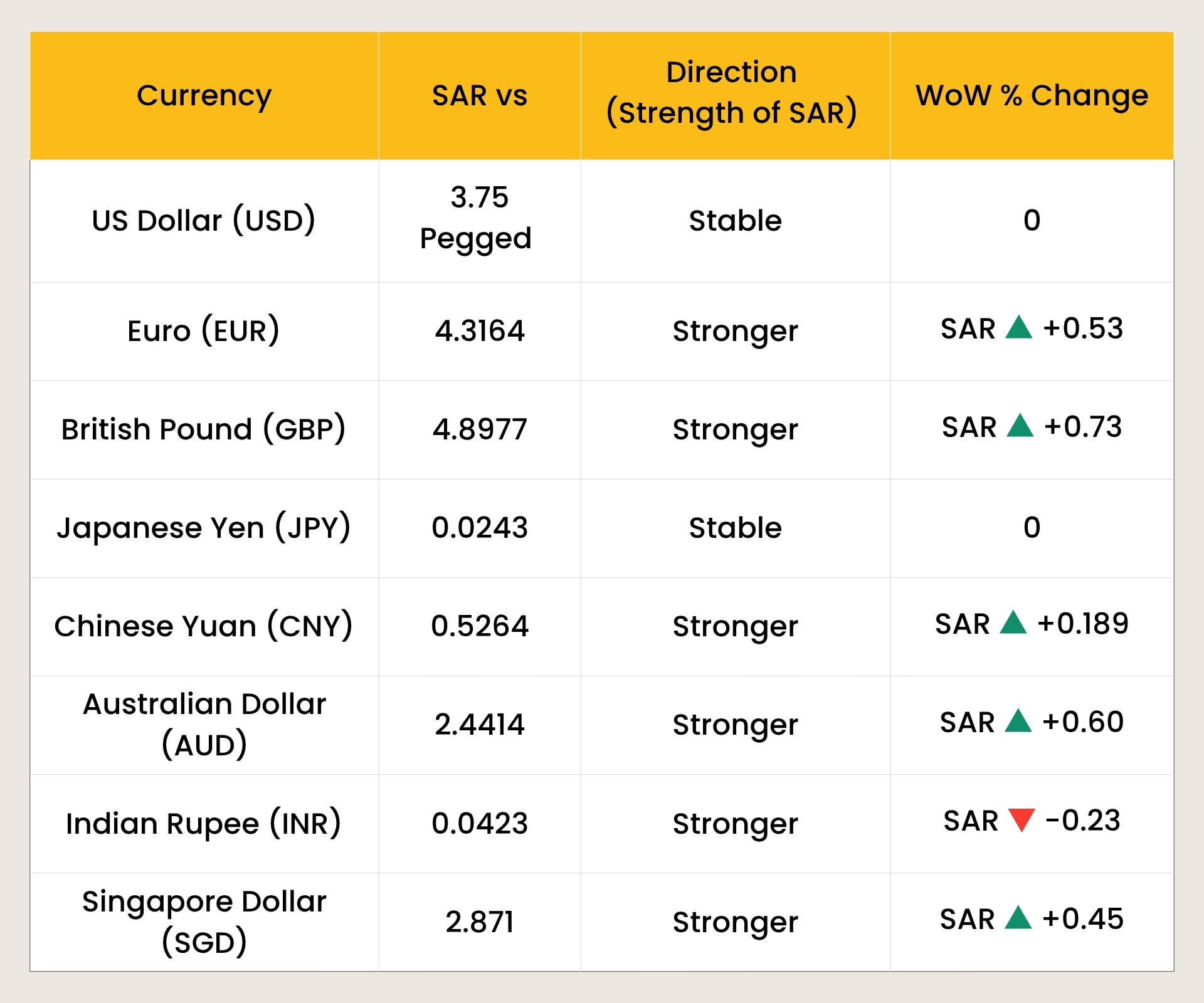

WoW % change (Week on Week Change)

*Rates as of 06th November 2025

Material Movement This Week

The chart below illustrates week-on-week changes in key construction materials, showing how prices fluctuate across global exchanges and their impact on regional cost trends. It highlights market movement at a glance on which materials are rising, which are stabilising, and which are easing. This will help project teams visualise short-term pricing dynamics that influence tendering, procurement, and overall construction budgets.

*Rates as of 06th November 2025

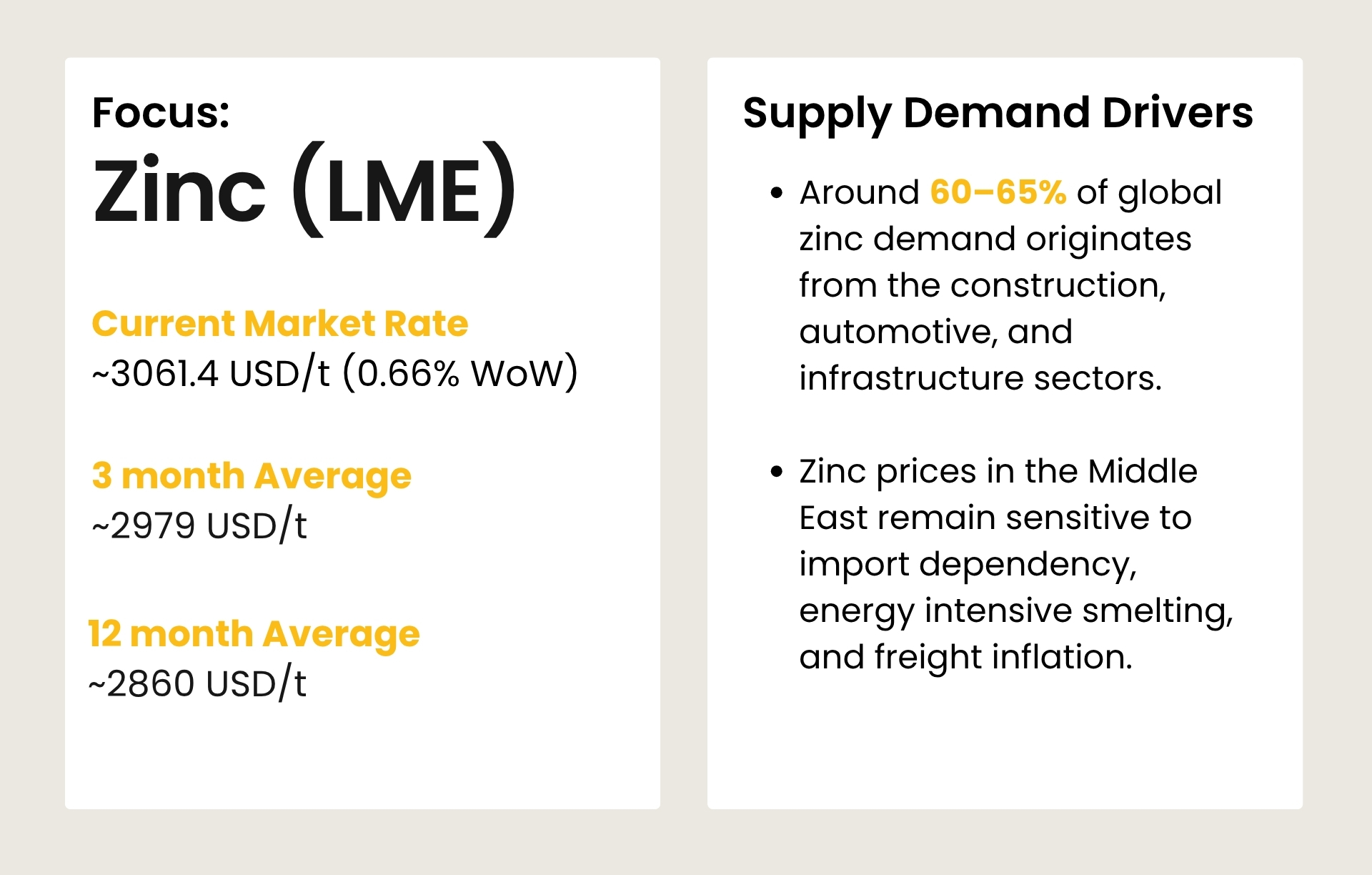

Material of the Week

*Rates as of 06th November 2025

Supply - Demand Drivers

01. Global Supply–Demand Overview

Primary use: Around 60–65% of global zinc demand originates from the construction, automotive, and infrastructure sectors, primarily for galvanized steel, roofing sheets, conduits, and façade systems due to zinc’s corrosion-resistant properties.

Global Mine Supply:

- Global zinc mine output has been constrained by production cutbacks in major mining regions such as China, Peru, and Australia due to lower ore grades and higher energy costs.

02. Demand Drivers in Construction

Galvanized Steel & Structural Applications:

- Zinc demand is dominated by its use in galvanizing steel reinforcement, structural members, and light-gauge sections, protecting them against corrosion - a critical requirement in GCC’s marine and desert environments.

- Increased demand for industrial warehouses, transport hubs, and modular steel structures is sustaining zinc consumption in galvanized products.

Façade and Architectural Systems:

- Used in roofing panels, flashings, downpipes, and cladding systems (e.g., VM Zinc, Rheinzink), zinc remains popular for premium façades where longevity and aesthetics are key.

- The rebound in mixed-use and hospitality projects across Dubai, Riyadh, and Doha has revived tendering activity for zinc-based façade systems.

MEP and Utilities:

- Zinc coatings are integral to cable trays, GI conduits, hangers, and support systems, which form part of every mechanical and electrical installation.

- As project specifications move toward longer service life and reduced maintenance, galvanized components see consistent demand growth.

03. Middle East Context

Steady Construction Activity:

- The GCC’s ongoing construction pipeline, particularly in industrial, residential, and infrastructure sectors continues to generate steady demand for galvanized and coated steel products.

- Government-driven housing and logistics programs in KSA and the UAE have supported zinc intensive product consumption across large-scale developments.

Regional Supply Chain:

- Despite local galvanizing capacity, base material (zinc ingot) dependency keeps GCC markets exposed to global LME volatility.

Local Manufacturers:

- Regional galvanizing plants (e.g., Emirates Steel, Arabian Galvanizing, Zamil) maintain moderate stock cover but align their selling prices to LME-linked zinc surcharges.

- Contractors and steel fabricators therefore experience direct cost correlation with zinc price movements, particularly in large infrastructure and industrial steel packages.

04. Supply Risks & Price Drivers

Zinc prices in the Middle East remain sensitive to import dependency, energy intensive smelting, and freight inflation. The region sources most zinc and galvanised products from China, India, and Europe, making costs vulnerable to LME price movements and shipping delays. Local galvanisze supplier adjust coating rates monthly based on LME trends, passing changes directly to contractors. Although AED/SAR stability limits FX risk, higher energy costs and sustainability driven demand for thicker galvanised coatings continue to support firm pricing for façade, steel, and MEP components.

Stonehaven Cost Index (SCI)

- Index baseline (01 September 2025) = 100

- Current SCI: 101.33 (from 102.62 last week)

Driver Note

The SCI recorded a -1.25% week-on-week decline, indicating a moderation in overall construction input costs. The decrease was mainly driven by bitumen, steel, and copper, reflecting softer global demand and improved supply conditions. Polyvinyl, nickel and platinum also declined, adding to the downward pressure. Zinc was the only notable gainer, supported by stable galvanised steel demand. Diesel prices eased slightly, providing minor relief on logistics and plant operating costs. Overall, the index signals short-term cost softening and improved price stability across GCC construction markets entering November 2025.

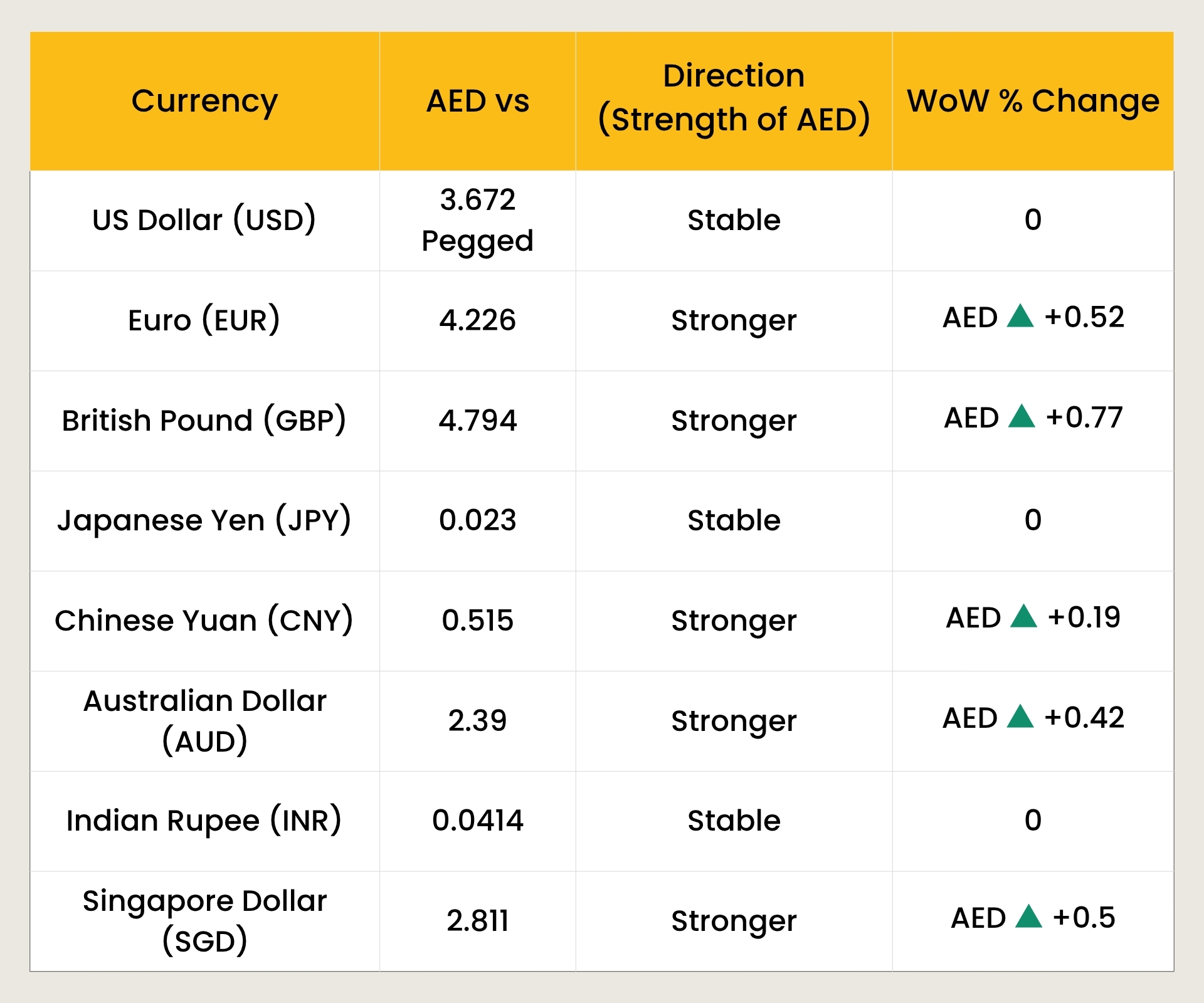

Currency & Inflation Lens

*Rates as of 6th November 2025

*Rates as of 06th November 2025

Stonehaven Analysis

- Both UAE Dirham (AED) and Saudi Riyal (SAR) remained stable against the US Dollar (USD) due to their respective pegs (3.672 and 3.75), while showing mild appreciation against major global currencies.

- This performance carries direct implications for procurement, cash flow, and material logistics across the regional construction supply chain.

Impact on Construction Costs

- Imported Materials: A stronger AED or SAR enhances purchasing power for imported goods. Since a significant portion of construction materials such as steel reinforcement, finishes, mechanical and electrical equipment, and façade components are sourced from globally, the cost of these imports tends to decline in local currency terms.

- Equipment, Plant, and Technology Imports: Major construction equipment such as tower cranes, chillers, elevators, generators, and BMS systems are often procured from Europe, the US, or Japan. A stronger domestic currency reduces the landed cost of such equipment and associated maintenance parts. Consequence, this CapEx reduce will be primly impacted to the projects like high-rise towers, infrastructure, and mixed-use developments.

- Inflation Control and Cost Escalation Risk: Currency strength acts as a natural hedge against imported inflation. As construction markets import a large share of raw materials, a firm AED or SAR helps stabilize the input cost index even when global commodity prices (e.g., steel, copper, oil) fluctuate.

Conclusion

The sustained strength of AED and SAR reinforces cost stability and reduced import inflation in the GCC construction industry. While the peg to the USD helps maintain overall economic stability, their appreciation against other major currencies provides short-term procurement advantages and long-term confidence in cost planning, budgeting, and investment decisions.

Market Forecast & Watchlist

Steel (LME/SHFE)

Forecast: Slight upward bias expected as Chinese output remains constrained and GCC fabrication demand picks up post-holiday.

Watch: Rebar and HRC imports have a potential +0.5% to +1.0% increase if restocking continues.

Copper (LME/COMEX)

Forecast: Mild downside risk amid stronger USD and softer Chinese manufacturing data.

Watch: MEP cable and busbar pricing may remain stable to slightly lower.

Aluminium (LME/SHFE)

Forecast: Minor correction expected as energy prices soften and production normalises.

Watch: Curtain wall, cladding, and ceiling system costs to remain steady or slightly down.

Diesel (UAE Domestic)

Forecast: Slight easing trend following global oil softness; prices may hover around AED 2.65–2.68/L.

Watch: Minor relief on logistics, equipment hire, and plant operation costs.

Stonehaven Forecast Summary

Outlook: Mild upward momentum expected for Steel as regional fabrication demand improves, while Copper may remain range-bound amid mixed global signals. Aluminium is projected to stay broadly stable with limited movement, and Diesel prices are likely to ease slightly following lower crude trends

SCI Bias: Neutral to mildly bearish. Softer diesel and stable aluminium may offset modest strength in steel, keeping overall construction input costs steady in the near term.

Closing Notes

The GCC construction market remains stable and resilient amid moderate shifts in global commodity prices. Continued investment in infrastructure, industrial, and mixed-use developments is sustaining regional demand for steel, copper, aluminium, and fuel-based materials. While supply conditions are improving, freight costs, delivery lead times, and sustainability-driven specifications are expected to remain key factors influencing material pricing and project cost planning through November 2025.

Talk To Our Team

The market’s changing every week, so are your budgets keeping up? Our cost management specialists can help you benchmark, forecast, and protect your project margins using real data from the Stonehaven Cost Index.