The construction market moves fast. Material prices shift, currencies fluctuate, and project costs can change overnight.

To help our clients and partners stay ahead of the curve, we’re proud to introduce Issue 2 of The Stonehaven Cost Index a concise, data-led snapshot of the market’s most influential movements.

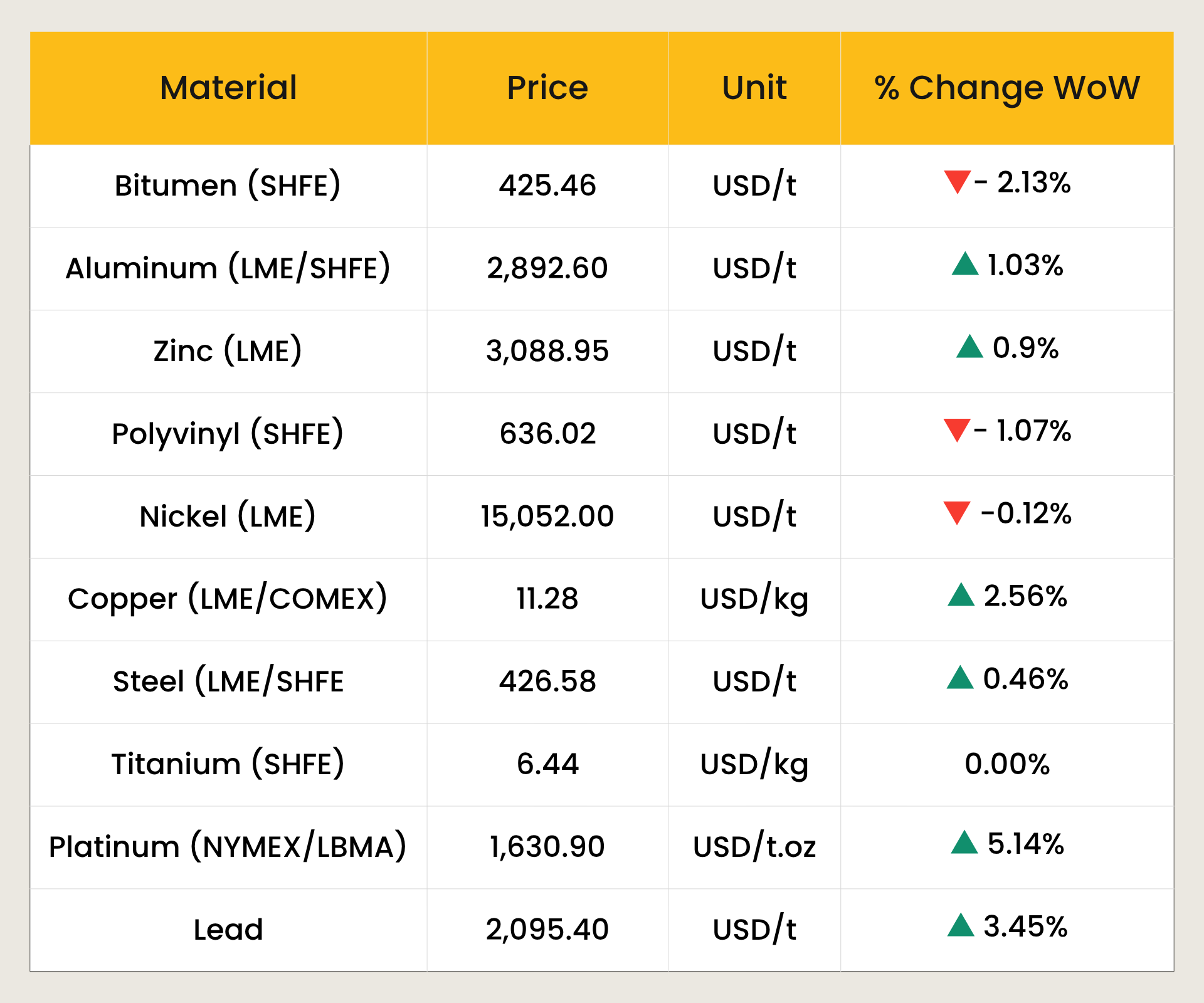

This Week's Market Movers

Every week, our cost management and data intelligence teams will analyse material trends, foreign exchange rates, and inflation drivers that shape project budgets across the GCC. The result is a clear, actionable index that translates market volatility into insight, helping developers, contractors, and consultants make informed cost decisions.

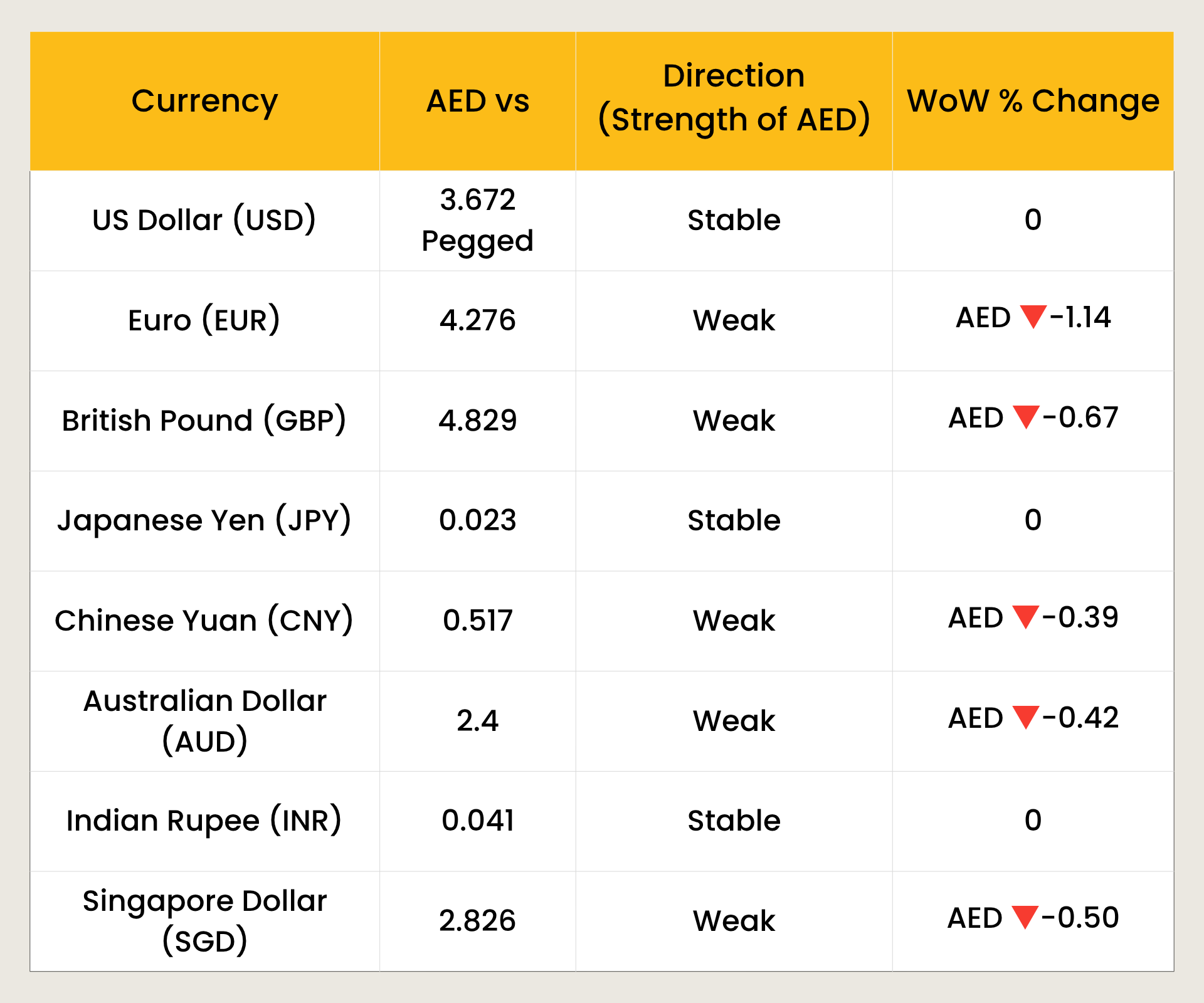

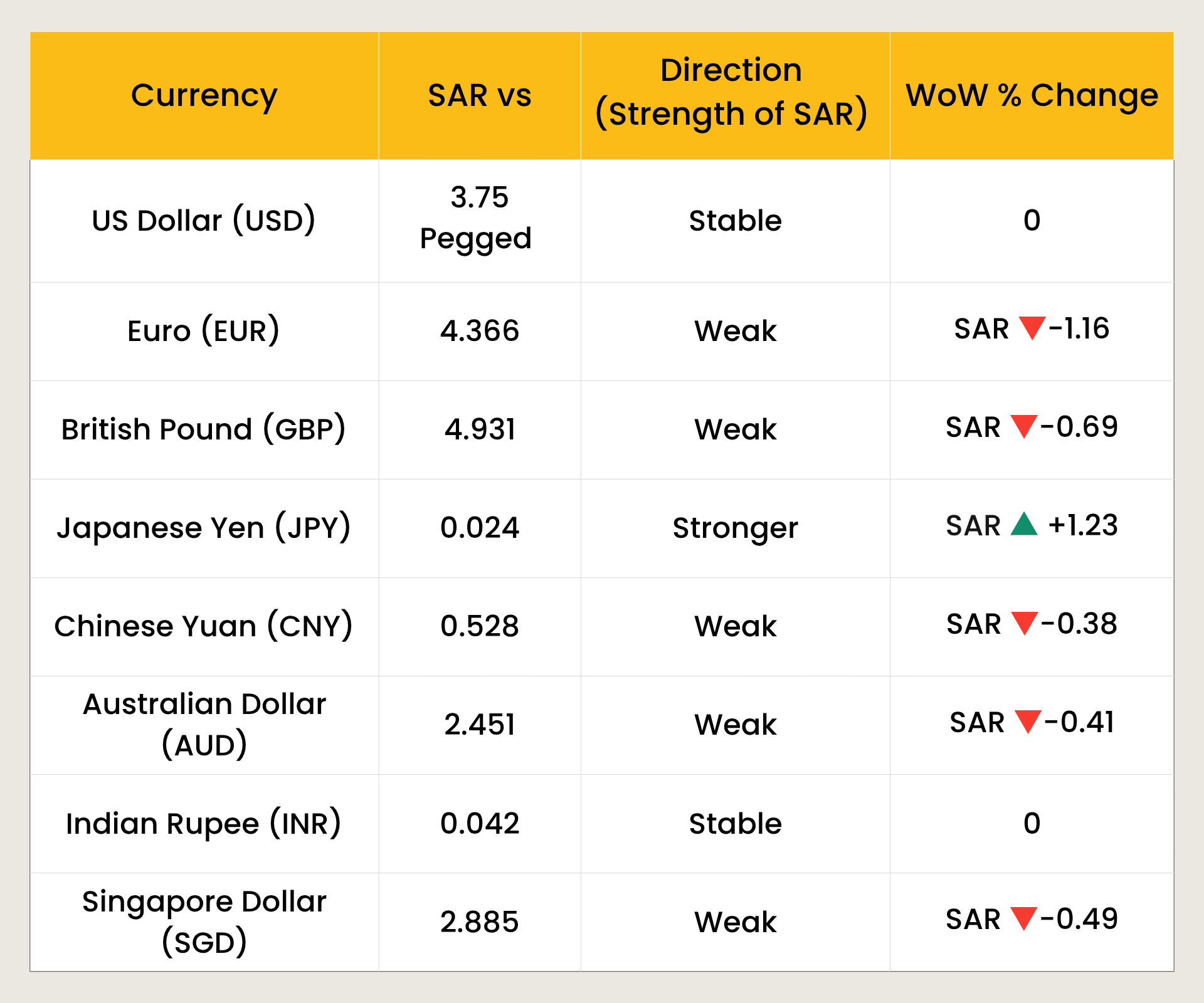

WoW % change (Week on Week Change)

*Rates as of 13th November 2025

Material Movement This Week

The chart below illustrates week-on-week changes in key construction materials, showing how prices fluctuate across global exchanges and their impact on regional cost trends. It highlights market movement at a glance on which materials are rising, which are stabilising, and which are easing. This will help project teams visualise short-term pricing dynamics that influence tendering, procurement, and overall construction budgets.

*Rates as of 13th November 2025

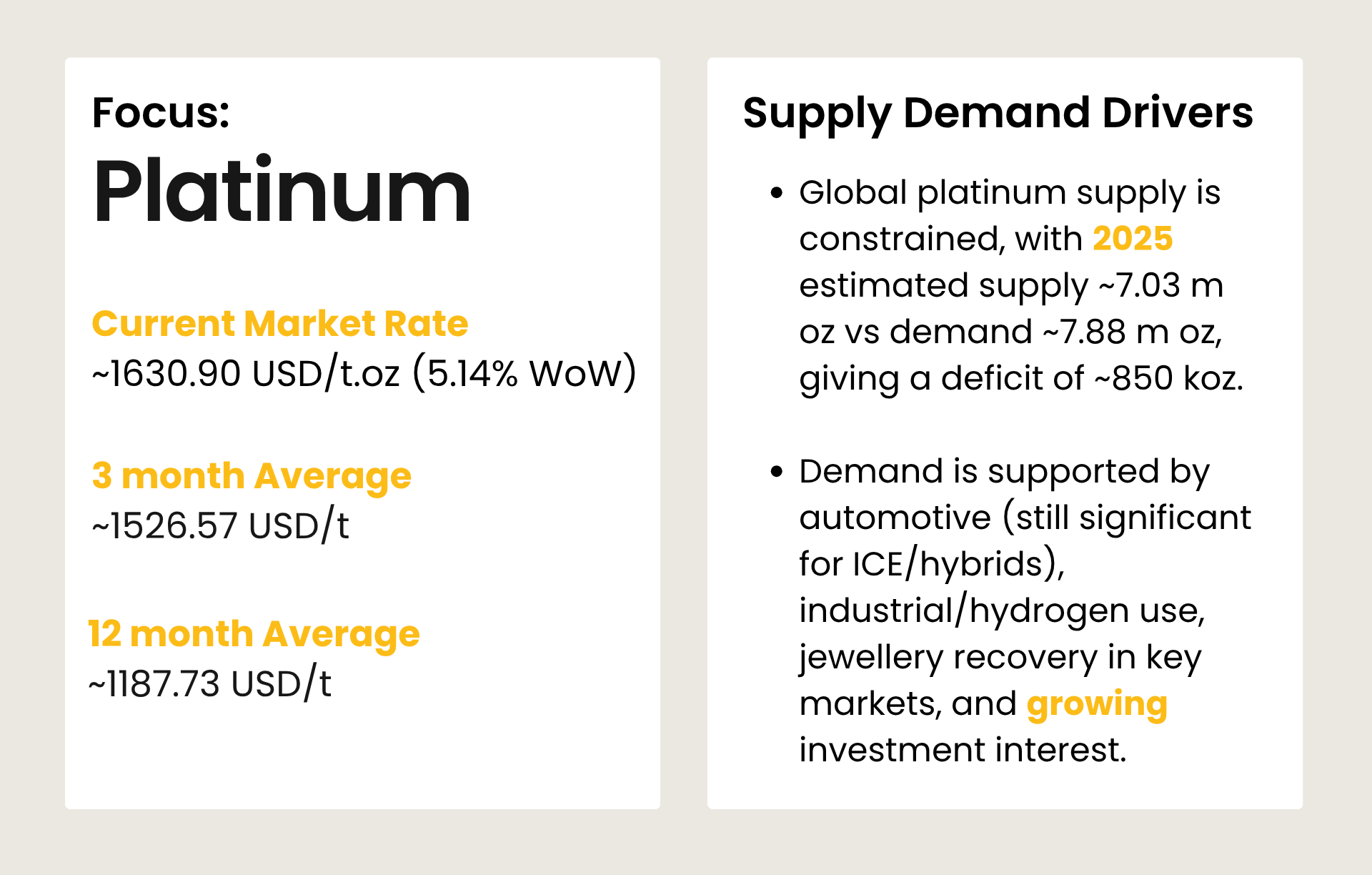

Material of the Week

*Rates as of 13th November 2025

Supply - Demand Drivers

01. Global Supply–Demand Overview

- Global platinum supply is constrained, with 2025 estimated supply ~7.03 m oz vs demand ~7.88 m oz, giving a deficit of ~850 koz.

- Demand is supported by automotive (still significant for ICE/hybrids), industrial/hydrogen use, jewellery recovery in key markets, and growing investment interest.

- Supply growth is limited by mine production constraints, lack of large new projects, and recycling growth is not keeping pace.

- Inventories and above-ground stocks are being drawn down, increasing market tightness.

02. Demand Drivers in Construction

Glass Manufacturing for Façades & High-Performance Glazing:

Large commercial towers, shopping malls, airports, and building façades depend on high-quality float glass. Platinum (Pt) plays a critical role in this sector through its use in Pt-coated equipment and bushings essential to the glass melting and forming processes. The production of toughened, laminated, low-emissivity (low-E), and high-clarity architectural glass all requires Pt-based components in manufacturing.

HVAC, Energy Efficiency & Environmental Control Systems:

Modern buildings particularly those designed to meet LEED require clean air and energy-efficient systems. Platinum (Pt) contributes to these goals through its use in catalytic converters for industrial burners and HVAC heating units, emission control systems in on-site generators, and VOC reduction catalysts in air-handling units.

Sensors, Electronics & Smart Building Components:

Platinum’s physical properties such as stability, conductivity, and corrosion resistance make it essential for applications like precision temperature sensors (use for building management systems (BMS), chilled-water networks, and district cooling integration), control systems, high performance electrical contacts.

Hydrogen & Fuel-Cell Infrastructure (H2 Buildings + Smart Cities):

One of the fastest-growing segments of platinum (Pt) demand is linked indirectly to the construction sector. Platinum is increasingly used in applications such as fuel-cell backup power systems for data centres, hospitals, and airports; hydrogen-ready buildings that employ fuel cells or combined heat and power (CHP) systems; and district energy networks transitioning to hydrogen, which rely on Pt-based catalysts.

03. Middle East Context

Although platinum (Pt) is not a direct construction material, it plays a critical indirect role in several fast-growing Middle East development sectors. Regional mega-projects, clean-energy programs, and advanced building technologies are creating structural demand for platinum-linked systems.

Hydrogen & Clean-Energy Infrastructure (Major Demand Driver):

The GCC construction sector consumes substantial volumes of sealants, waterproofing membranes, paints and coatings, insulation foams, and other building materials due to the region’s large-scale developments, harsh climatic conditions, and stringent performance requirements. The platinum (Pt) plays a critical catalytic role in the upstream industrial processes that manufacture many chemicals and polymers used in GCC construction materials. Although platinum is not present in the final construction products, it is essential to their production.

Stonehaven Cost Index (SCI)

Index baseline (01 September 2025) = 100

Current SCI: 101.83 (from 101.33 last week)

Driver Note:

The SCI rose to 101.83 from 101.33 this week (+0.50%), mainly driven by increases in copper, aluminium, steel, lead, and a sharp rise in platinum, which though not a core construction material, adds minor pressure on specialised MEP and electrical components. Softening in bitumen and polyvinyl provided limited relief, with nickel and titanium remaining stable. Overall, non-ferrous metals continue to push the SCI mildly upward.

Currency & Inflation Lens

*Rates as of 14th November 2025

*Rates as of 14th November 2025

Stonehaven Analysis

Both AED and SAR remain stable under their USD pegs, but weakened moderately against EUR, GBP, CNY, AUD and SGD during the week, reflecting global USD strength. This results in mild upward pressure on Euro and Asia sourced construction materials, while USD-denominated commodities remain unaffected.

JPY weakness continues to offer cost advantages for Japanese origin technical equipment. Overall FX impact on GCC construction costs this week is low, with procurement risks contained to selective high-spec imported systems

Impact on Construction Costs

Supply Chain & Cashflow Impact:

Advance payments to foreign suppliers have become slightly more expensive due to currency movements, placing additional pressure on project cashflow. In addition, suppliers may reduce validity periods for quotations (e.g., from 30 days → 7–14 days).

Imported Materials:

Most European and Asian suppliers provide quotations in their local currencies (EUR, GBP, CNY, SGD). With the AED weakening, the cost of imported material like façade systems and glazing hardware, lifts and escalators, architectural lighting, and similar materials have increased. Prices are increasing in AED/SAR terms for new quotations and variation orders. Existing contracts with currency-fluctuation clauses may also be subject to price adjustments.

Cost Advantage for Japanese-Origin Equipment:

The SAR has strengthened by approximately 1.23% against the JPY (with the AED remaining stable), creating a cost advantage for Japanese HVAC controls, electrical testing equipment, sensors, and automation units. As a result, Japan-manufactured technical packages are experiencing a slight reduction in cost, particularly for procurement in KSA.

Conclusion

The weakening of AED/SAR against major non-USD currencies results in mild cost pressure on imported construction materials, particularly façade systems, lighting, and interior finishes sourced from Europe and Asia. Core USD-linked commodities remain stable, safeguarding major structural and MEP packages. Japanese-origin technical systems become marginally cheaper, benefiting KSA projects.

Overall, FX impact on construction costs is low, but selective imported packages may see slight price adjustments in upcoming tenders and VO negotiations.

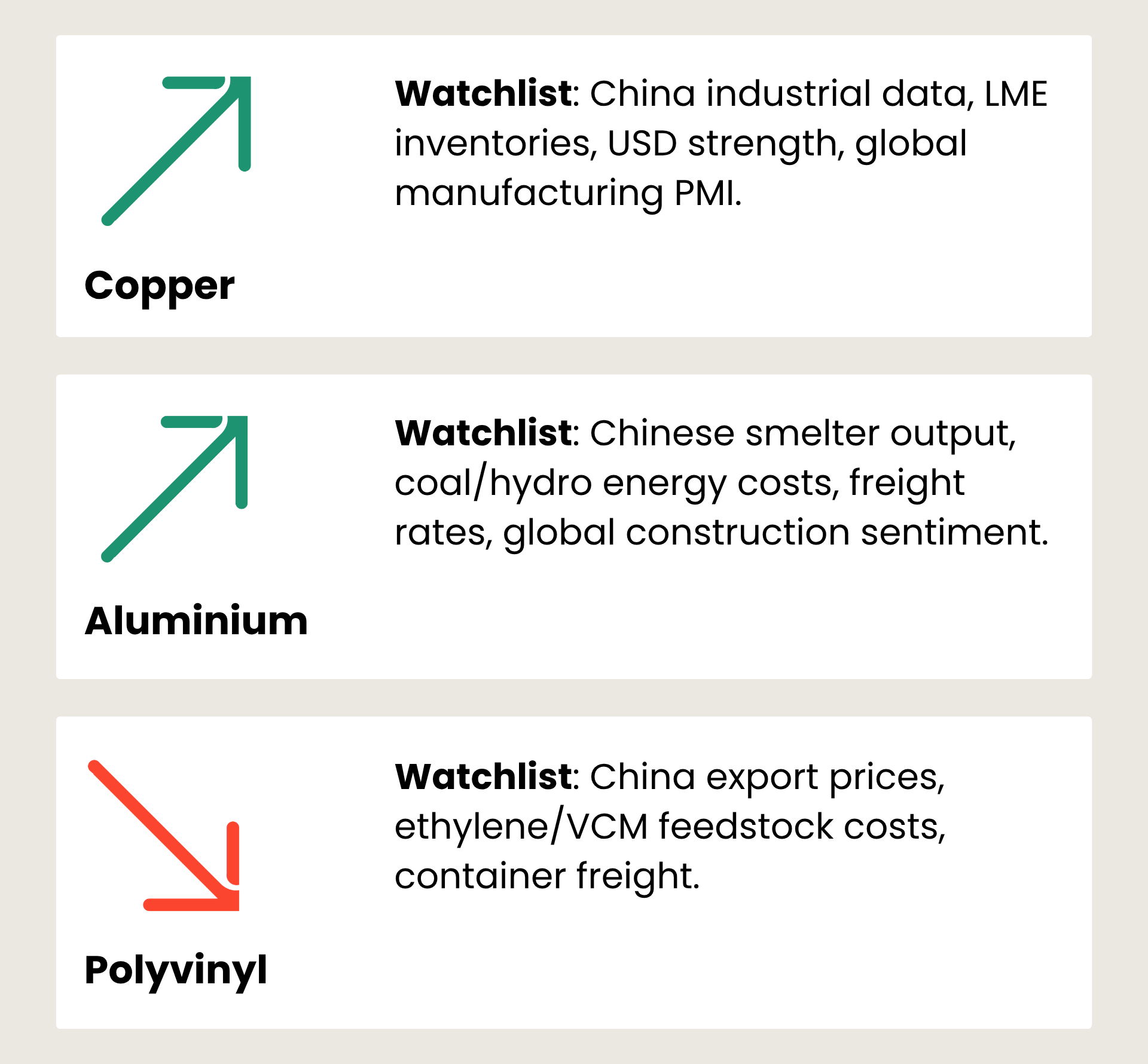

Market Forecast & Watchlist

Copper - Mild Uptrend (▲)

Forecast: Stable to higher (+0% to +2%) – supported by energy-transition demand.

Watchlist : China industrial data, LME inventories, USD strength, global manufacturing PMI.

Bitumen – Further Softening (▼)

Forecast: Likely further decline (–1% to –2%) – crude softening.

Watchlist : Brent crude trend, refinery operating rates, seasonal demand from road projects.

Aluminium – Moderate Upward Momentum (▲)

Forecast: Slight increase (+0.5% to +1.5%) – steady demand, tight energy supply.

Watchlist : Chinese smelter output, coal/hydro energy costs, freight rates, global construction sentiment.

Polyvinyl (PVC Resin) – Weak Trend (▼)

Forecast: Slight decline (–0.5% to –1.5%) through weak Asian demand.

Watchlist : China export prices, ethylene/VCM feedstock costs, container freight.

Stonehaven Forecast Summary

Next week’s outlook indicates mild upward pressure on key construction metals (copper, aluminium), while bitumen and PVC continue to soften, offering some relief for civil and MEP infrastructure packages. Platinum’s upward trend may affect specialist equipment and high-precision components.

Overall, core structural materials remain stable, with cost risks concentrated in MEP-intensive and façade-related packages.

Closing Notes

Overall, the construction market remains stable with selective upward pressure driven by movements in non-ferrous metals, particularly copper, aluminium, and platinum. Softening in bitumen and PVC provides limited relief for civil and infrastructure works, while core USD-linked materials such as steel remain largely unchanged. FX fluctuations continue to exert mild cost pressure on Euro and Asia sourced imports, although Japanese-origin technical systems benefit from favourable currency movements.

In summary, the cost environment for next week is expected to remain steady, with manageable risk levels. Attention should remain on MEP-intensive and façade-related packages, where both commodity and currency trends may influence pricing. The overall impact on project budgets is modest, and procurement planning should continue with normal vigilance.

Talk To Our Team

The market’s changing every week, so are your budgets keeping up? Our cost management specialists can help you benchmark, forecast, and protect your project margins using real data from the Stonehaven Cost Index.