The construction market moves fast. Material prices shift, currencies fluctuate, and project costs can change overnight.

To help our clients and partners stay ahead of the curve, Issue 4 of The Stonehaven Cost Index is a concise, data-led snapshot of the market’s most influential movements this week.

Our cost management team will break down weekly market changes to help you stay ahead of cost pressures.

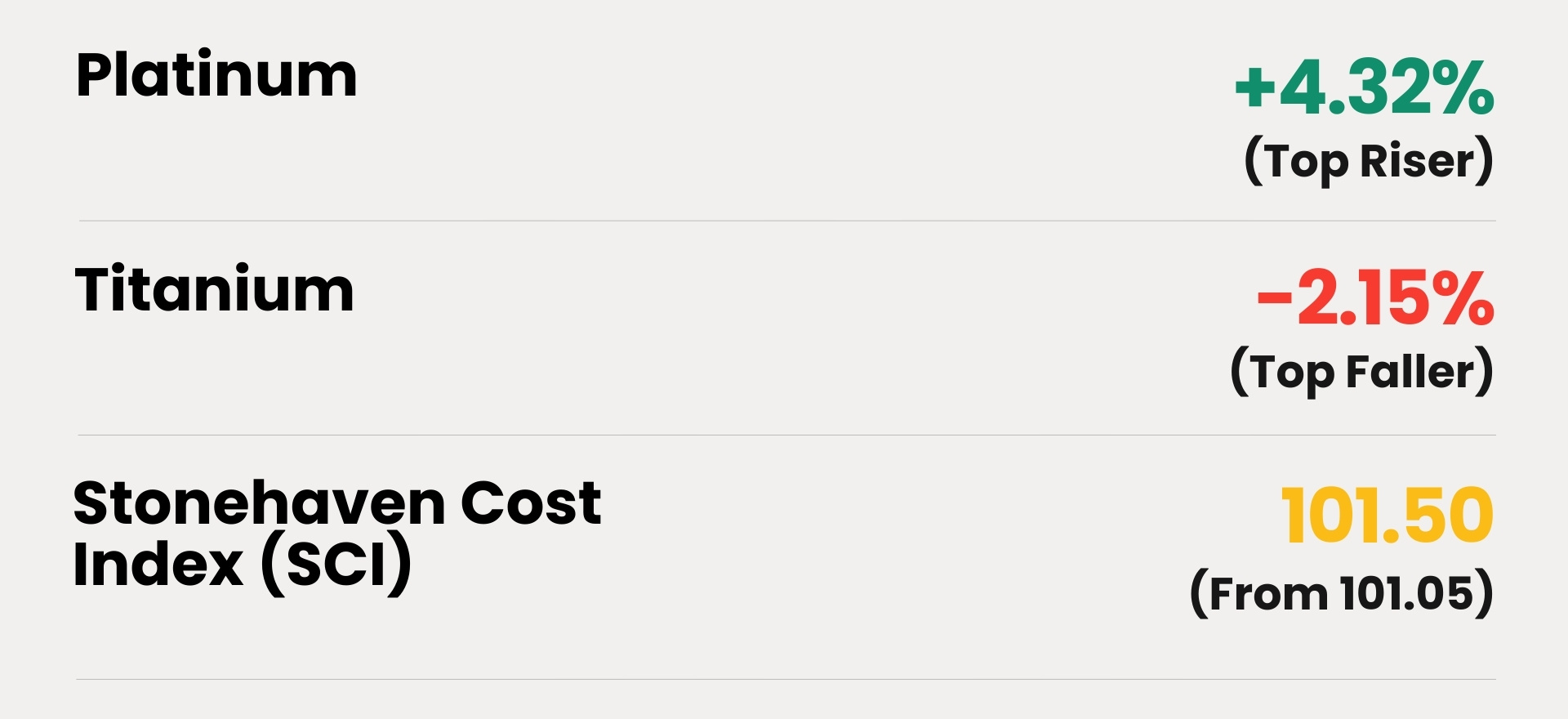

Key Takeaways For Your Projects This Week

SCI edges up to 101.50 (▲ 0.44%) – moderate upward pressure on GCC construction costs, driven mainly by stronger global metals pricing.

Metals are up - aluminium, copper, zinc, nickel and steel all recorded gains, increasing pressure on façade, structural and MEP packages at tender and variation stage.

Bitumen and polymers easing – softening in bitumen and polyvinyl prices creates some cost relief for roadworks, waterproofing and select civils scopes.

FX still a low-risk factor – AED and SAR remain firmly pegged to the USD, with only mild depreciation against EUR/GBP/Asian currencies and limited impact on most imported materials.

This Week's Market Movers

Every week, our cost management and data intelligence teams will analyse material trends, foreign exchange rates, and inflation drivers that shape project budgets across the GCC. The result is a clear, actionable index that translates market volatility into insight, helping developers, contractors, and consultants make informed cost decisions.

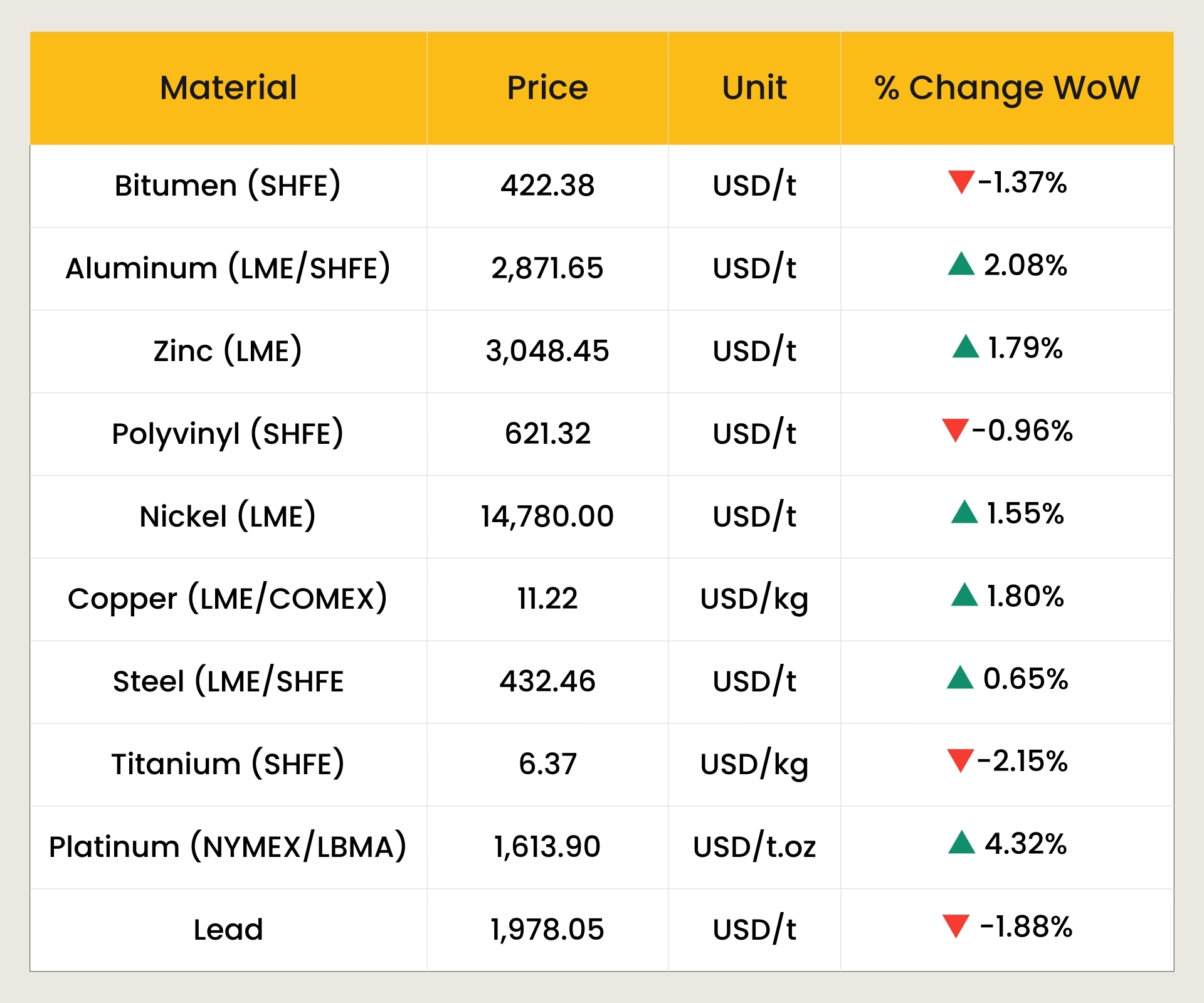

WoW % change (Week on Week Change)

Material Movement This Week

The chart below illustrates week-on-week changes in key construction materials, showing how prices fluctuate across global exchanges and their impact on regional cost trends. It highlights market movement at a glance on which materials are rising, which are stabilising, and which are easing. This will help project teams visualise short-term pricing dynamics that influence tendering, procurement, and overall construction budgets.

*Rates as of 27th November 2025

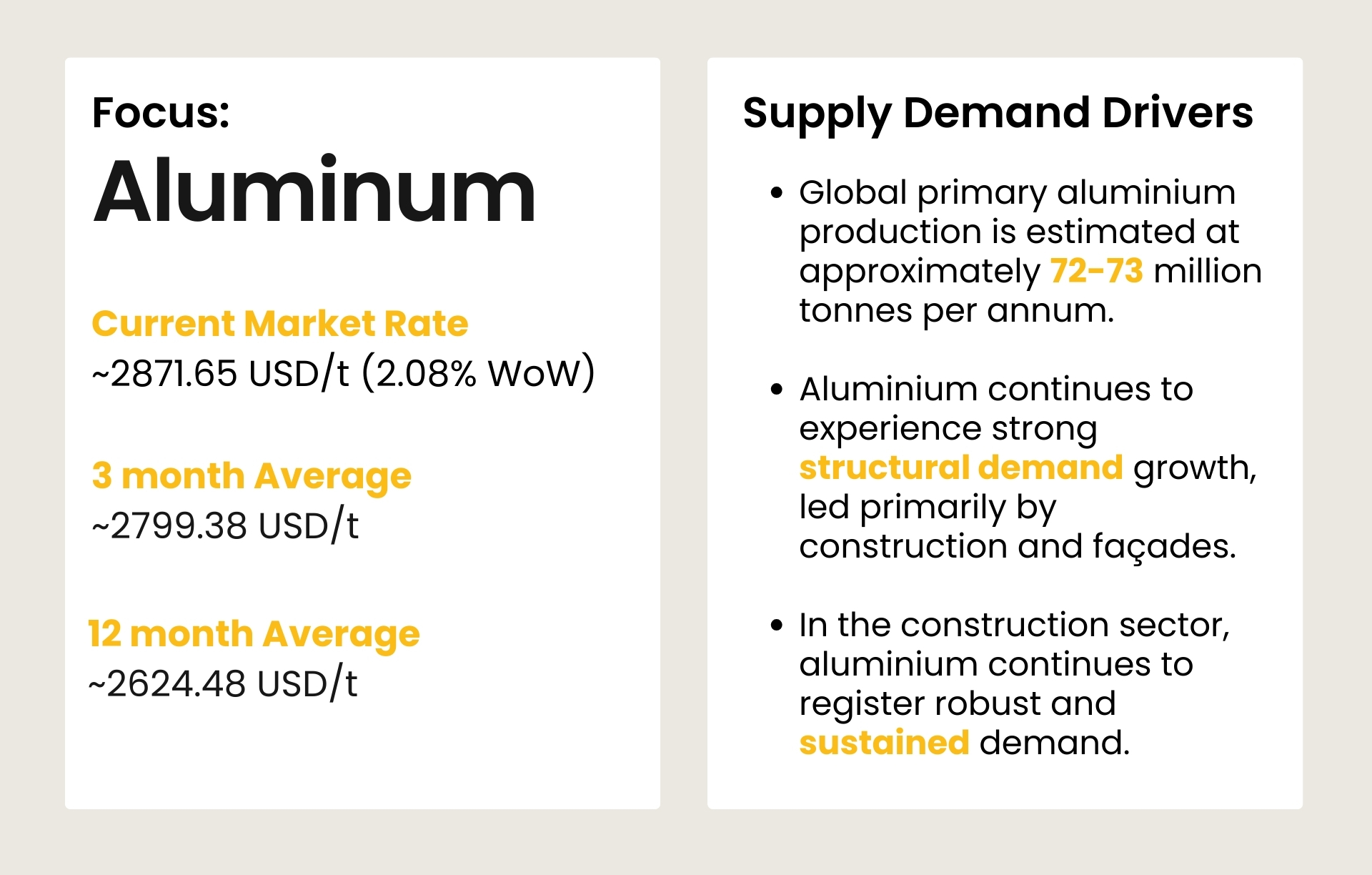

Material of the Week

*Rates as of 27th November 2025

Supply - Demand Drivers

01. Global Supply–Demand Overview

Global primary aluminium production is estimated at approximately 72-73 million tonnes per annum. Of this, China accounts for nearly 60% of total global output.

However, further supply growth remains constrained by national production-capacity caps, rising energy costs, and increasingly stringent carbon-emission regulations. These factors continue to place upward pressure on smelting costs and limit the pace at which global aluminium supply can expand.

Aluminium continues to experience strong structural demand growth, led primarily by construction and façade applications, alongside increasing utilisation in the electric-vehicle, automotive, and renewable-energy sectors, including solar infrastructure and grid-cable systems.

Overall global aluminium demand is projected to rise by approximately 35–40% by 2030.

02. Demand Drivers in Construction

In the construction sector, aluminium continues to register robust and sustained demand owing to its lightweight nature, corrosion resistance, architectural versatility, and favourable sustainability profile.

Its application spans a wide range of building component and applications, making it a key material in modern construction.

Façade and Curtain Wall Systems

High utilisation in unitised and stick systems due to lightweight properties, corrosion resistance, and design flexibility.

Windows, Doors, and Glazing Frames

Preferred for durability, thermal performance, and architectural aesthetics.

Cladding and Architectural Features

Extensive use in external cladding, shading devices, fins, louvers, canopies, and feature elements.

Sustainability Requirements

Favourable embodied-carbon profile and recyclability increase its selection in green-building and ESG-driven projects.

Infrastructure & Utility Installations

Use in cable trays, handrails, balustrades, signage systems, bridges, and transport infrastructure.

03. Middle East Context

In the Middle East, aluminium plays a pivotal role in major development programmes, driven by the region’s extensive portfolio of towers, commercial hubs, and large-scale infrastructure projects.

Its performance under harsh climatic conditions particularly intense heat, elevated humidity, and saline coastal exposure makes it the preferred choice for façades, glazing systems, and external architectural features across the UAE, KSA, and Qatar.

Additionally, the growing emphasis on sustainability, energy efficient building envelopes, and compliance with Green Building Regulations continues to drive the preference for aluminium solutions in both public and private sector developments.

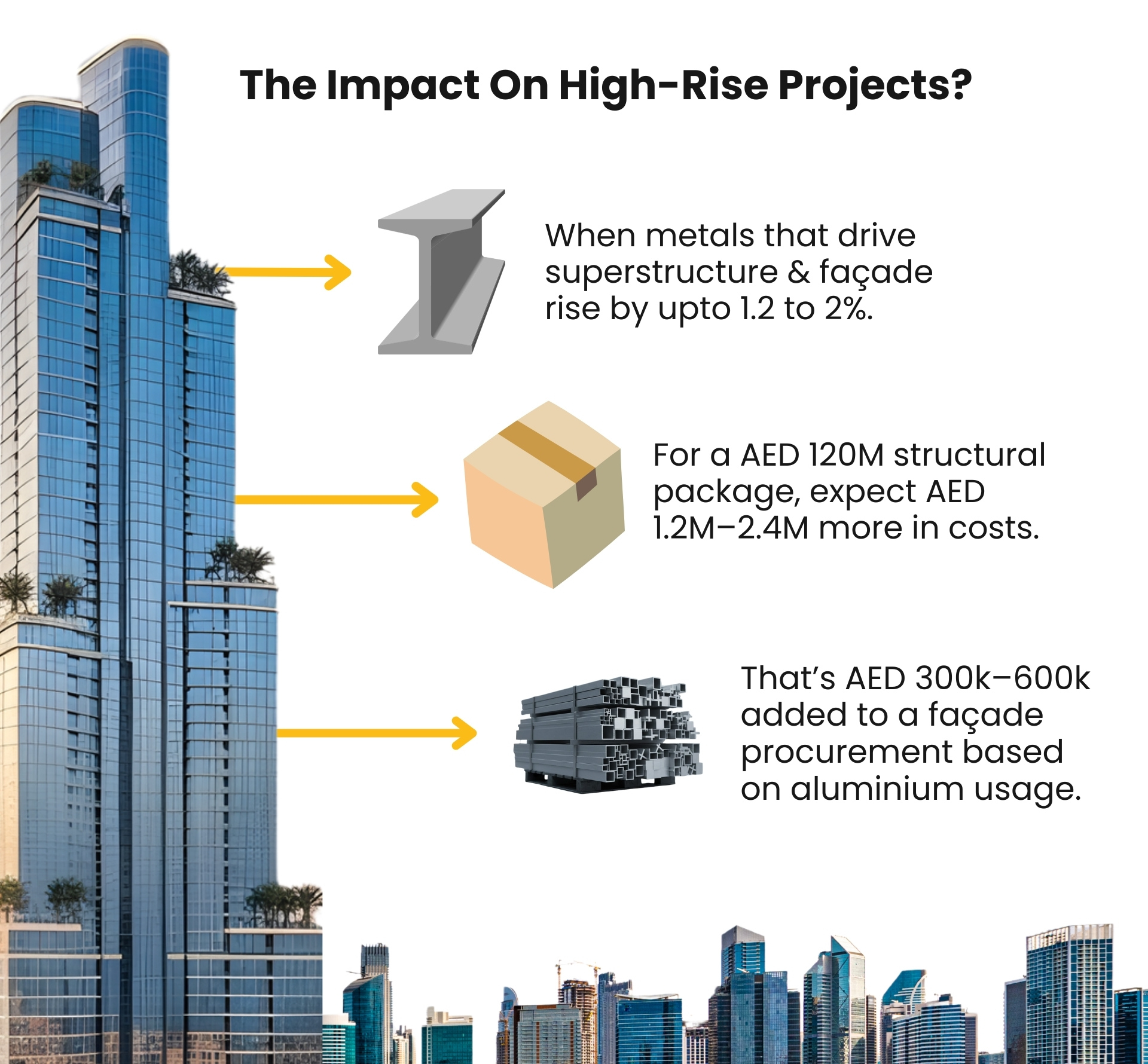

Given aluminium’s central role in façade and envelope systems, increases in global aluminium prices directly raise construction costs across glazing, shading, cladding, and related MEP and architectural components.

As most aluminium products are imported, GCC projects remain highly sensitive to global price movements, resulting in higher procurement costs and added pressure on contractor margins, cost plans, and variation assessments.

Stonehaven Cost Index (SCI)

Index baseline (01 September 2025) = 100

Current SCI: 101.50 (from 101.05 last week)

Driver Note:

Commodity prices strengthened this week, led by aluminium, copper, zinc, nickel and steel. These increases contributed to the Stonehaven Cost Index rising from 101.05 to 101.50 (▲ 0.44%) , reflecting moderate upward pressure on construction material costs. Minor declines in bitumen, polyvinyl, titanium and lead did not offset the overall upward trend.

Currency & Inflation Lens

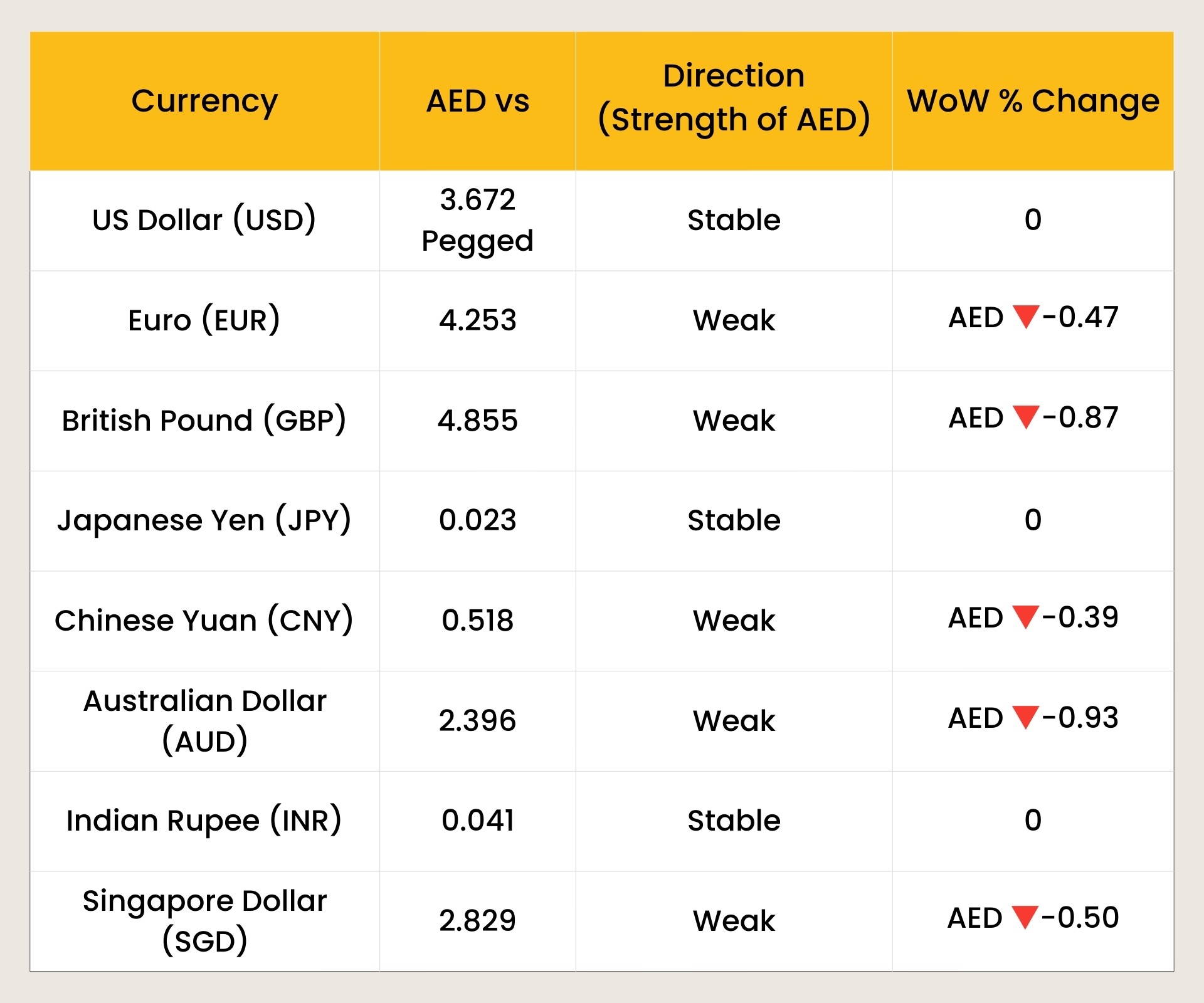

*Rates as of 27th November 2025

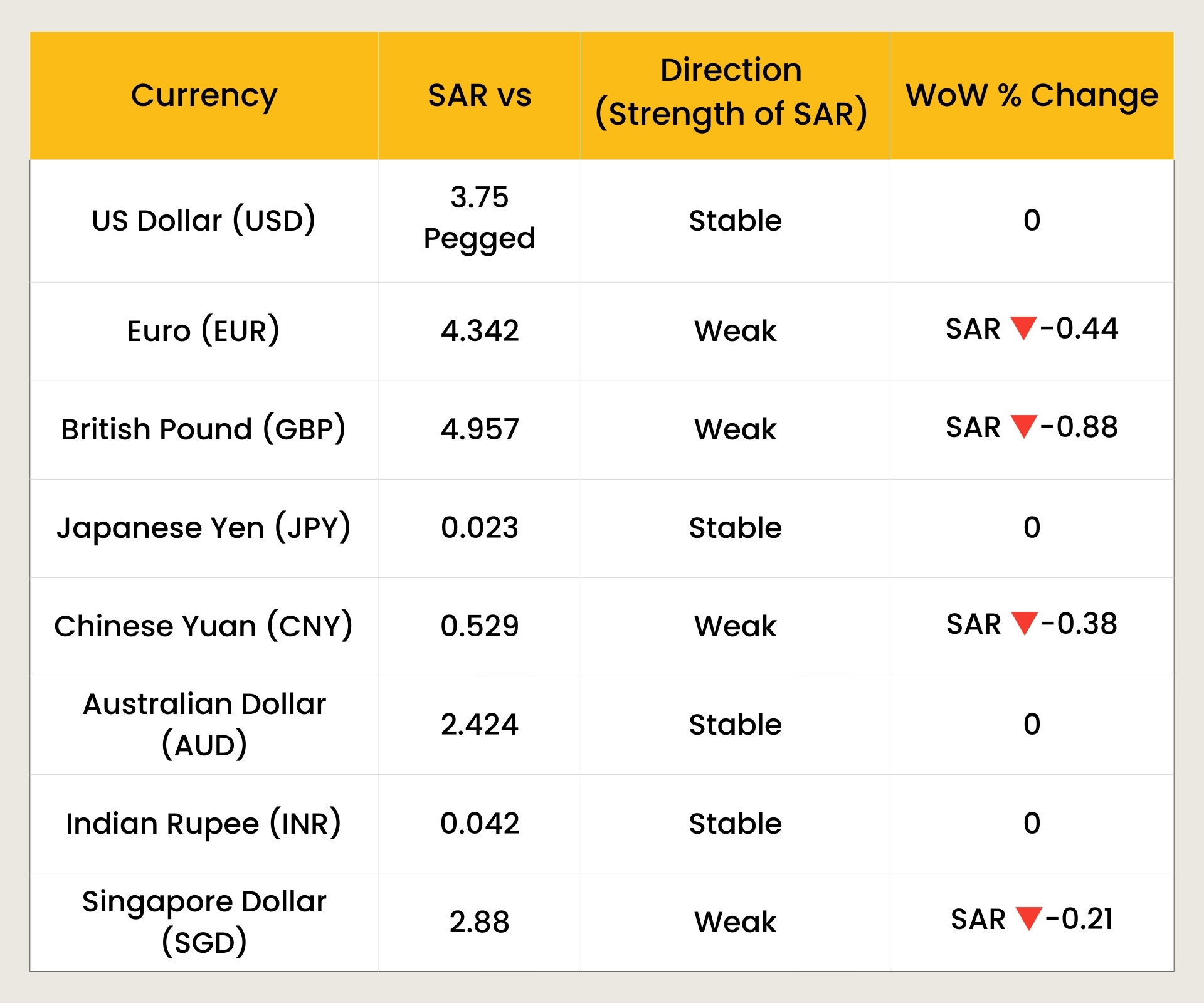

*Rates as of 27th November 2025

Stonehaven Analysis

Currency movements remain broadly stable across the GCC, with the AED and SAR maintaining their long-standing USD pegs. The week saw mild depreciation of the AED and SAR against major global currencies ranging between -0.38% to -0.93%, while INR and JPY remained stable.

For GCC construction projects, these shifts have minimal immediate cost impact due to the USD peg; however, slight weakening against European and Asian currencies may marginally affect imported material and equipment costs sourced from those regions.

Impact on Construction Costs

With both the AED and SAR remaining firmly pegged to the USD, currency-related volatility continues to be minimal, offering a stable environment for GCC construction budgets.

The slight depreciation of AED/SAR against the EUR, GBP, CNY, AUD and SGD observed this week introduces only a marginal upward cost pressure on imported materials and equipment sourced from Europe and Asia including façade systems, aluminium components, MEP equipment, lifts, ELV systems, and specialised architectural finishes.

Although the shifts are relatively small (-0.38% to -0.93%), prolonged movement at this level could result in modest increases in landed import costs.

Overall FX conditions remain stable, and construction cost dynamics continue to be driven primarily by global commodity pricing, supply-chain factors, and supplier capacity rather than exchange-rate shifts. Procurement remains predictable, and the risk of FX-induced cost escalation is low under current conditions.

Conclusion

The current AED and SAR strength offers a favourable pricing window for most imported construction materials, supporting cost-plan stability and reducing variation exposure. Only packages dominated by USD-denominated commodities such as steel, copper, and aluminium remain largely unaffected by these FX movements.

Market Forecast & Watchlist

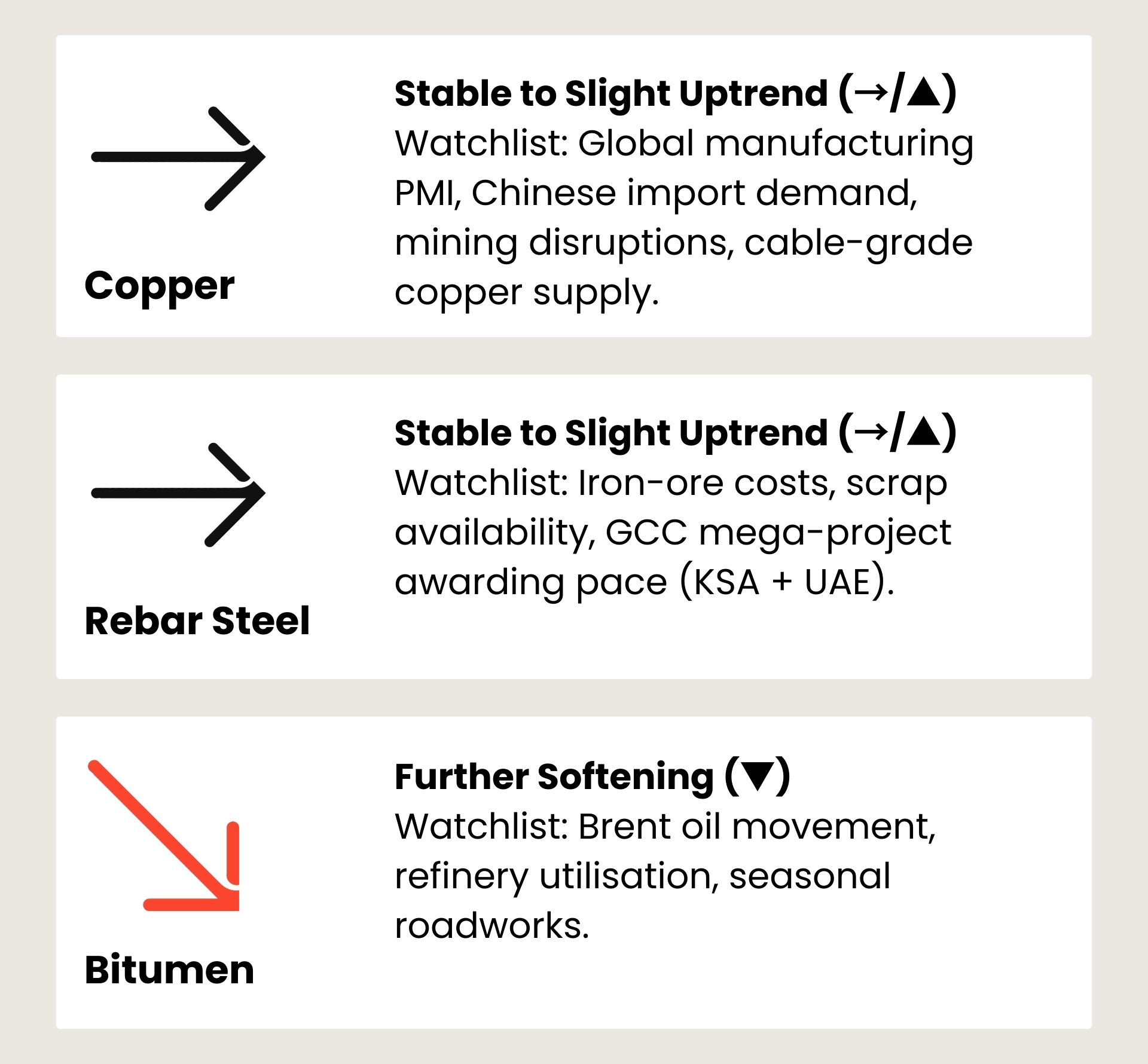

Copper – Stable to Slight Uptrend (→ / ▲)

Forecast: 0% to +2%. Strong demand from electrical works, ELV, ICT, and renewable-energy installations supports price stability.

Watchlist: Global manufacturing PMI, Chinese import demand, mining disruptions, cable-grade copper supply.

Rebar Steel – Flat (→)

Forecast: 0%. Regional production remains strong, meeting GCC demand. No major volatility expected unless raw-material inputs (iron ore, scrap) shift sharply.

Watchlist: Iron-ore costs, scrap availability, GCC mega-project awarding pace (KSA + UAE).

Ready-Mix Concrete – Stable (→)

Forecast: 0%. Tied to cement, aggregates, and diesel prices; stable unless diesel jumps significantly.

Watchlist: Local batching plant capacity, project sequencing, temperature-related productivity.

Bitumen – Softening (▼)

Forecast: –1% to –2%. Following weaker crude trends and quieter road-construction cycles.

Watchlist: Brent oil movement, refinery utilisation, seasonal roadworks.

Stonehaven Forecast Summary

For next week, copper is expected to remain on a slight upward trend supported by steady global demand from electrical and MEP works, while rebar steel prices are forecast to stay flat with ample GCC mill supply balancing project requirements.

Ready-mix concrete is anticipated to remain stable as cement, aggregates, and diesel inputs show no significant movement. Bitumen is likely to continue its mild softening in line with weaker crude sentiment and slower roadwork demand. Overall, next-week cost pressure across these key materials remains low.

Closing Notes

Overall, this week’s market conditions indicate a stable cost environment for GCC construction, with moderate upward movement in global metals balanced by softening in bitumen and polymers. Aluminium, copper, zinc, nickel, and steel recorded gains, contributing to a slight rise in the Stonehaven Cost Index, while FX stability under the AED and SAR, USD peg continues to support predictable procurement with minimal currency-driven risk.

Core construction materials such as rebar, ready-mix concrete, and cement remain steady, and next-week forecasts point to low cost-pressure across major categories. Procurement conditions remain favourable, with only globally traded metals requiring closer monitoring in the short term.

Talk To Our Team

The market’s changing every week, so are your budgets keeping up? Our cost management specialists can help you benchmark, forecast, and protect your project margins using real data from the Stonehaven Cost Index.