This Week’s Cost Intelligence

To help our clients and partners stay ahead of the curve, we built the Stonehaven Cost Index as a concise, data-led snapshot of the market’s most influential movements this week.

Our cost management team will break down weekly market changes to help you stay ahead of cost pressures.

Key Takeaways For Your Projects This Week

Aluminium and regional steel remain steady

Mild positive movement in aluminium and flat rebar steel pricing creates a relatively stable environment for core structural and façade procurement.

Titanium and coatings inputs easing

Titanium shows a downward movement offering minor relief for paint, protective coatings, and architectural finishing packages.

FX remains low-risk for projects

AED and SAR pegs continue to stabilise import dynamics. Minimal week-on-week movement against EUR/GBP/Asian currencies keeps currency-driven cost escalation low.

Shipping pressures rising

Baltic Dry Index up 10.04% therefore signalling higher bulk freight costs globally. GCC projects relying on imported cementitious materials, metals, or heavy equipment may see freight premiums feeding into Q1 2026 pricing.

This Week's Market Movers

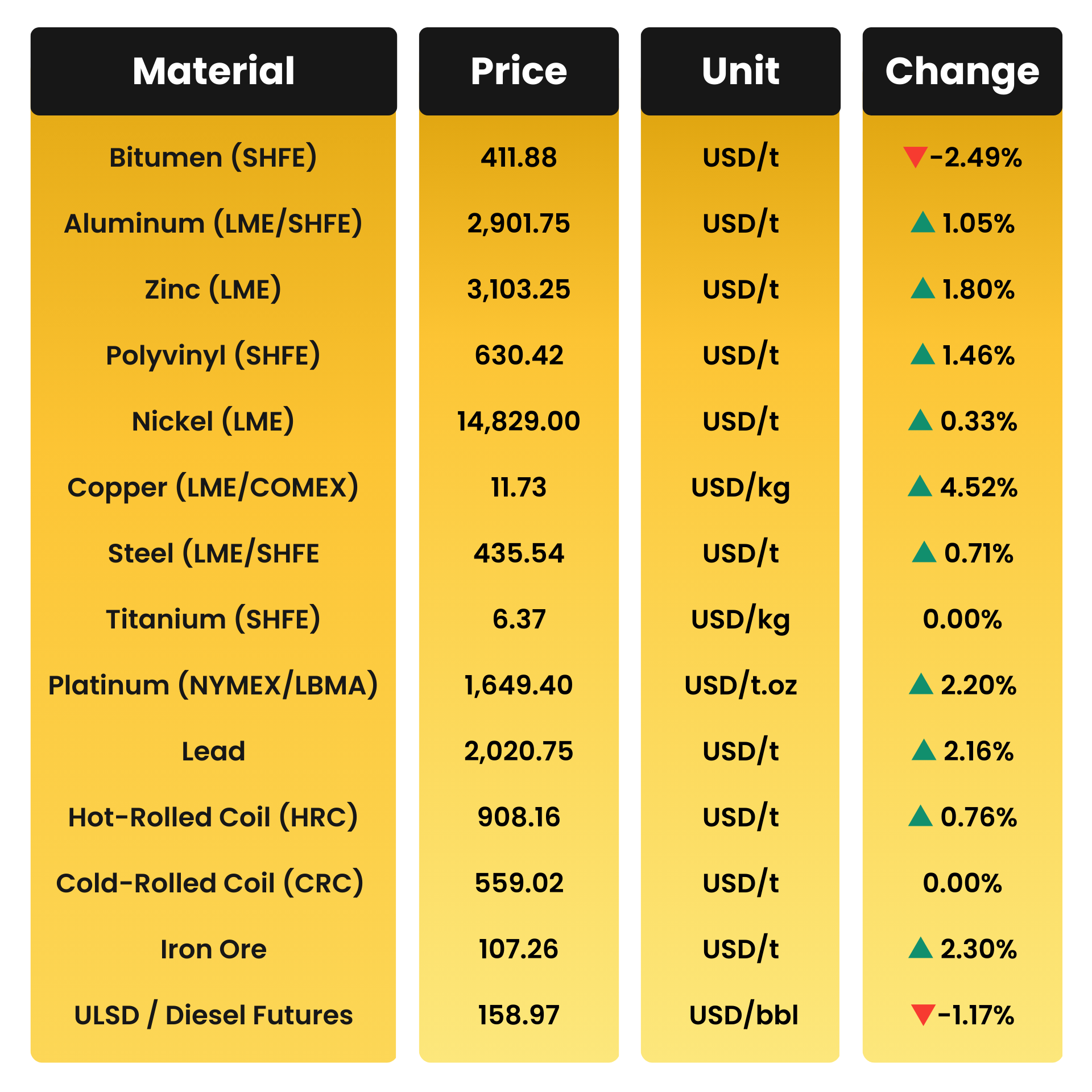

Material Movement This Week

*Rates as of 05th December 2025

Material of the Week

*Rates as of 05th December 2025

The Supply & Demand Drivers

01. Global Supply and Demand Overview

Primary Use

Approximately 45% of copper demand originates from construction and building services, mainly in wiring, busbars, switchgear, HVAC, and plumbing.

Global Mine Supply

Chile and Peru (jointly ≈ 35 % of global output) have faced production disruptions due to community protests, weather events, and grade declines.

New supply from the DRC and Mongolia offers only partial relief.

Concentrate supply tightness has lowered smelter treatment charges, indicating a deficit market in refined copper.

02. Demand Drivers in Construction

Electrical Infrastructure

Copper remains the preferred conductor for high-reliability power, fire alarm, and data systems.

The ongoing electrification of buildings, energy-efficient HVAC, and smart controls have increased copper intensity per m² of built area.

Building Services

Used in LV panels, earthing systems, bus ducts, plumbing (in some premium projects), and condenser coils for chillers and VRF systems.

Green Construction Trends

“Low-carbon building” initiatives in Europe and the GCC are shifting focus to energy-efficient materials indirectly increasing copper usage in smart metering, renewable integration, and electrical infrastructure.

Copper Futures Impact

If applicable, highlight any geopolitical risks affecting the market, such as potential supply disruptions or changes in Chinese demand.

03. Middle East Context

Steady Construction Activity

GCC countries (particularly UAE, KSA, and Qatar) maintain strong pipelines of hospitality, infrastructure, and mixed use developments all MEP intensive.

Copper’s share in project costs is concentrated in electrical and mechanical packages, which together form 25 - 35 % of total construction cost.

Regional Supply Chain

The region imports over 90 % of its copper-based products (wires, busbars, pipes) from India, China, and Europe

Recent freight escalation (10 - 15 %), coupled with port congestion, has pushed landed copper cable prices up AED 1,800–2,200/t over Q3–Q4 2025.

Local Manufacturers

UAE and KSA cable producers (e.g., Ducab, Riyadh Cables) hedge against LME volatility but still pass on LME surcharges monthly to clients, meaning construction rates closely track LME trends.

Stonehaven Cost Index (SCI)

Index baseline (01 September 2025) = 100

Current SCI: 103.30 (up from 101.50 last week)

WoW change: ▲+1.77%

Change vs baseline: ▲+3.30%

Driver Note

Commodity prices strengthened this week, driven primarily by increases in diesel, aluminium, platinum, zinc, nickel, and steel. These movements contributed to the Stonehaven Cost Index rising from 101.50 to 103.30 (▲ 1.77%), indicating modest upward pressure on construction project costs.

Although bitumen recorded a slight decline, this softening was insufficient to counterbalance the broader upward trend across key construction-related commodities, reinforcing a mildly inflationary outlook for upcoming project procurement cycles

Currency & Inflation Lens

AED vs Key Trading Currencies

*Rates as of 05th December 2025

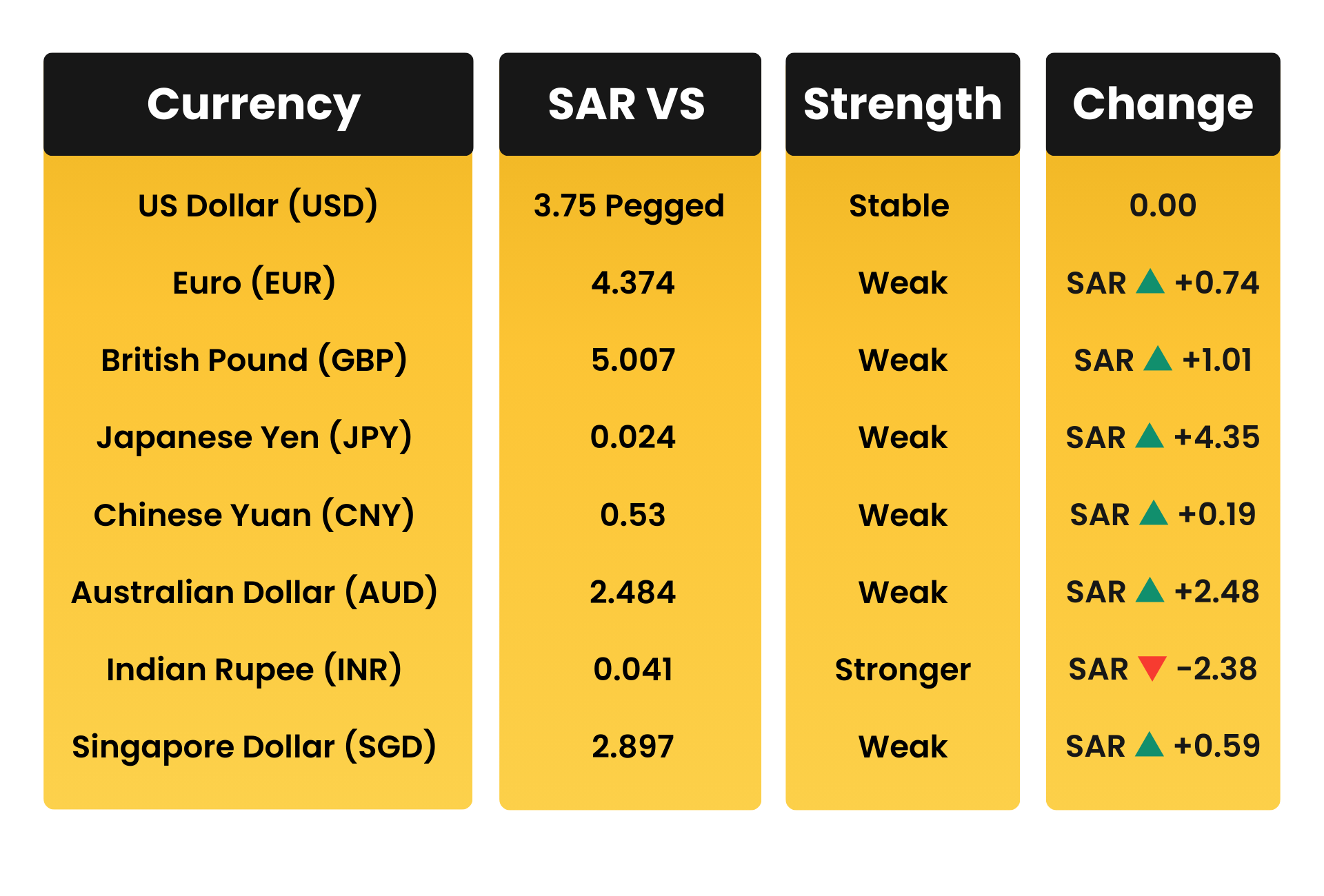

SAR vs Key Trading Currencies

*Rates as of 05th December 2025

Stonehaven Analysis

Currency movements this week for the UAE Dirham (AED) and Saudi Riyal (SAR) remain stable due to their peg to the US Dollar (USD).

Both currencies have shown a slight strengthening against the Indian Rupee (INR) compared with recent week's overall stability. The weakening of the Indian Rupee and strengthening of the Australian Dollar could affect cost projections for materials sourced from India and Australia.

For GCC construction projects, this currency movement continues to pose a risk in terms of imported material costs. However, the immediate cost impact remains minimal because of the USD peg, which helps limit short-term volatility.

Impact On Construction Costs

With both the AED and SAR firmly pegged to the USD, currency-related volatility remains limited, ensuring a stable environment for construction budgets across the UAE and Saudi Arabia.

The slight depreciation of AED/SAR this week against the EUR, GBP, CNY, AUD, and SGD introduces only marginal upward pressure on copper-related imported materials commonly used in GCC construction projects, particularly electrical cabling, busbars, grounding systems, and other copper-intensive MEP components sourced from Europe and Asia.

Although the observed fluctuations remain within a narrow range (-2.48% to +2.44%), sustained movement at these levels could result in modest increases in landed costs for copper-based materials.

Overall, FX conditions remain stable, and current construction cost trends in the GCC are influenced more by global copper prices, commodity market dynamics, and supply-chain capacity than by exchange-rate shifts. Procurement remains predictable, and the risk of FX-driven cost escalation remains low under present conditions.

Global Inputs & Freight Benchmarks

Logistics & Freight – Construction Cost Multipliers

STONEHAVEN Analysis

Baltic Dry Index (BDI) rose by 10.04%, indicating higher bulk commodity demand, particularly for iron ore and coal, which may lead to increased transport costs for materials like steel and cement.

Baltic Capesize Index surged by 19.99%, reflecting strong demand for large-capacity vessels, particularly for bulk goods. This could add cost pressure on steel production materials.

Baltic Panamax Index fell -6.37%, showing weakness in demand for medium-sized bulk carriers, potentially offering some relief for materials shipped on Panamax vessels.

Global Container Freight Index dropped -0.56%, suggesting softening in containerized cargo shipping, but the decline is modest and unlikely to significantly impact project costs for containerised goods.

Implications for GCC Construction?

The increase in the BDI and Capesize Index suggests higher transport costs for bulk materials such as steel and aggregates. In contrast, the minor decline in the Global Container Freight Index has a limited impact on containerised goods.

Conclusion

FX movements against non-USD currencies remained modest this week, with the largest fluctuations occurring against the INR and AUD at approximately 2–2.5%. Owing to the USD peg, such variations fall within normal volatility ranges for the AED and SAR. However, these shifts may still be material for projects with significant India or Australia linked import exposure.

Copper based materials including electrical cables and wires, busbars, and copper tubes and pipes are predominantly sourced from India and the United States. With both the USD and INR continuing to demonstrate relative strength and stability, the FX impact on the landed cost of copper related materials in the UAE and Saudi Arabia remains minimal.

As a result, short term pricing for copper-intensive packages is expected to remain primarily driven by underlying commodity market movements rather than currency effects.

Additionally, the increase in the BDI and Capesize Index will likely drive higher costs for bulk materials, while the softening of the Global Container Freight Index will keep containerised cargo shipping costs minimal.

Market Forecast & Watchlist

Aluminum – Mild Uptrend (▲)

Forecast: +1% to +2% - supported by tight global supply, higher smelting costs, and steady demand from façades and glazing systems.

Watchlist: China smelter caps, global energy prices, LME inventory levels, GCC façade procurement cycles.

Rebar Steel – Flat (→)

Forecast: 0% - regional production remains strong, meeting GCC demand. No major volatility expected unless raw-material inputs (iron ore, scrap) shift sharply.

Watchlist: Iron-ore costs, scrap availability, GCC mega-project awarding pace (KSA and UAE).

Titanium – Softening (▼)

Forecast: –1% - weaker demand from pigment markets and stable ore supply.

Watchlist: Demand for architectural coatings using titanium dioxide (paint and protective finishes).

Concrete – Stable (→)

Forecast: 0% - no expected movement in cement or aggregate prices.

Watchlist: Cement plant output, aggregate supply, site manpower productivity.

Stonehaven Forecast Summary

Next week’s material outlook suggests limited cost pressure for the construction industry, with most key inputs remaining stable.

Aluminium’s mild uptrend may increase costs for façade, glazing, and architectural metal packages, while flat rebar steel pricing supports continued stability in structural works and reinforcement budgets.

The softening trend in titanium indicates no additional cost burden for specialist metal components, and stable concrete prices ensure predictability for major structural and infrastructure pours. Overall, the construction sector can expect a steady pricing environment, with only aluminium contributing marginal upward pressure on project costs.

Closing Notes

Overall, this week’s market conditions indicate a stable cost environment for GCC construction, with moderate upward movement in global metals balanced. Aluminium, copper, zinc, nickel, steel and diesel recorded gains, contributing to a slight rise in the Stonehaven Cost Index, while FX stability under the AED and SAR, USD peg continues to support predictable procurement with minimal currency driven risk.

Core construction materials such as rebar, ready-mix concrete, and cement remain steady, and next-week forecasts point to low cost-pressure across major categories. Procurement conditions remain favourable, with only globally traded metals requiring closer monitoring in the short term.

Summary & Commercial Guidance

-

Overall cost environment remains stable across the GCC, with no major escalation risk in the near term.

-

Core materials (rebar, concrete, cement) remain steady, supporting predictable structural and civil cost planning.

-

Metals such as aluminium, copper, zinc, nickel, and steel show mild increases, requiring light monitoring but not immediate budget adjustments.

-

FX stability under the AED & SAR, USD peg continues to minimise currency related risk for imported materials.

-

No immediate requirement to increase project contingencies or risk allowances, However, project-specific risk profiles especially metal-intensive packages should continue to be reviewed against live procurement strategies.

-

Current Procurement conditions remain supportive, of early commitment strategies for metal-intensive packages, subject to project specific cash flow and risk considerations.

Overall, it is recommended to maintain the current procurement strategy, continue close monitoring of metal price movements, and progress with cost planning confidently over the coming weeks.

Important Disclaimer

The Stonehaven Cost Index (SCI) is provided for general information only and does not constitute a commitment, guarantee, or offer to contract at any price level. The index is based on publicly available commodity data and internal market assessments as at *05 December 2025.

Actual project costs will depend on project-specific scopes, procurement routes, and commercial negotiations. Stonehaven Project Management Service LLC accepts no liability for any loss arising from reliance on this document without appropriate project-specific advice.

Talk To Our Team

The market’s changing every week, so are your budgets keeping up? Our cost management specialists can help you benchmark, forecast, and protect your project margins using real data from the Stonehaven Cost Index.