This Week’s Cost Intelligence

To help our clients and partners stay ahead of the curve, we built the Stonehaven Cost Index as a concise, data-led snapshot of the market’s most influential movements this week.

Our cost management team will break down weekly market changes to help you stay ahead of cost pressures.

Key Takeaways For Your Projects This Week

Most core construction commodities remain stable

Week-on-week movements across bitumen, aluminium, zinc, copper, HRC, CRC, iron ore, and ULSD remain contained within ±0.5%.

Selective easing offsets isolated price increases

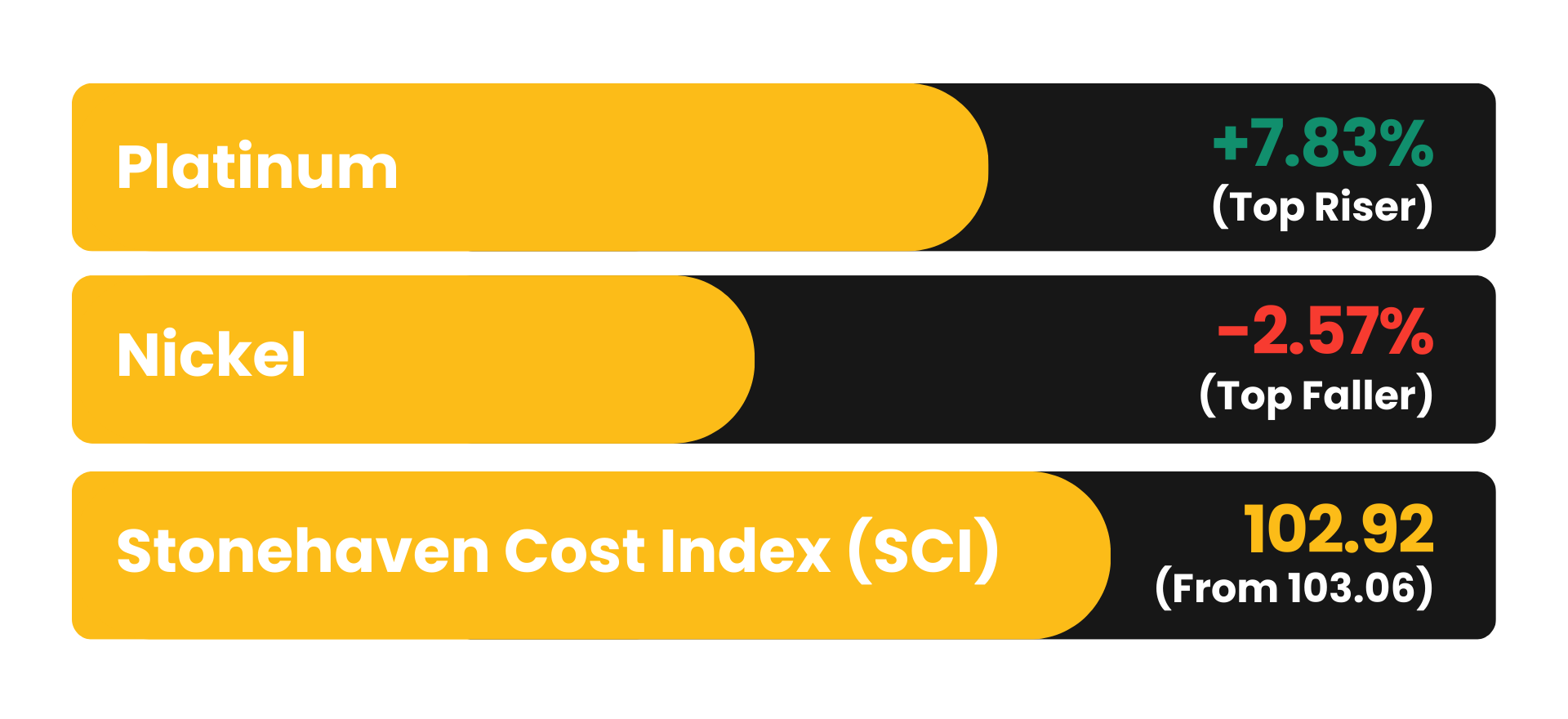

Nickel recorded the largest decline this week (▼2.57%), while polyvinyl and lead also softened.

Platinum volatility remains isolated

Platinum was the top riser this week (▲7.83%), representing a concentrated volatility event rather than a broad-based trend.

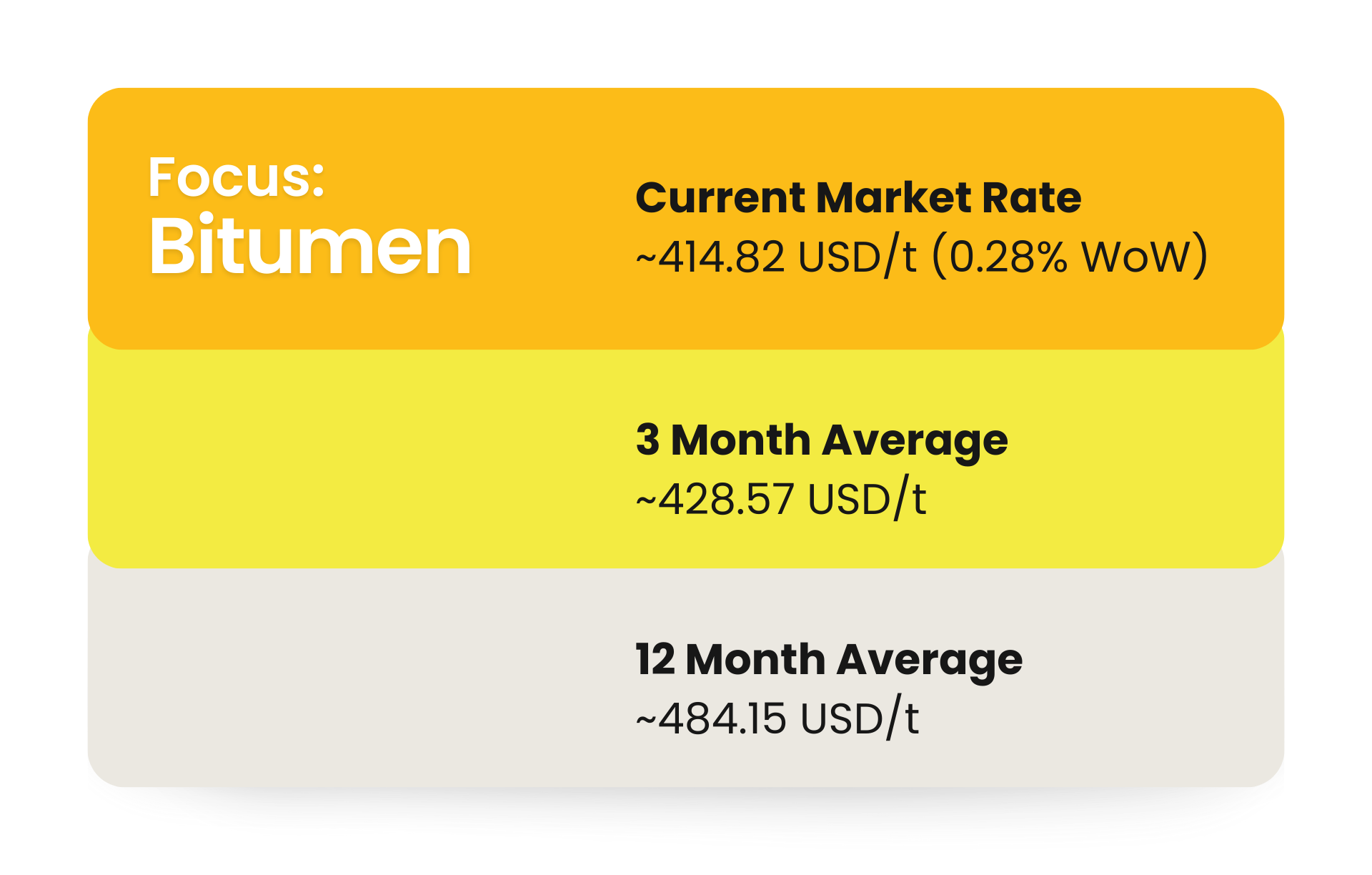

Bitumen shows marginal upward pressure but remains below averages

Bitumen edged up by ▲0.28% WoW to ~414.82 USD/t, remaining well below both its 3-month and 12-month averages.

FX remains cost-neutral to mildly supportive for GCC projects

AED and SAR pegs continue to anchor USD-priced commodities, while strengthening against EUR, GBP, CNY, and other non-USD currencies provides marginal cost relief on imported finishes, MEP components, additives, and logistics-related inputs.

Bulk freight easing offsets container shipping pressure

Bulk freight indices corrected sharply this week, with the Baltic Dry Index down ▼18.32%, supporting lower landed costs for bulk-imported materials.

This Week's Market Movers

Material Movement This Week

*Rates as of 15th December 2025

Material of the Week

*Rates as of 15th December 2025

The Supply & Demand Drivers

01. Global Supply and Demand Overview

Key Supply Drivers

Refinery configuration: Modern refineries increasingly favour lighter fuels and petrochemical feedstocks, reducing residual output available for bitumen.

Crude slate quality: Heavier crude oils yield higher bitumen volumes; global shifts toward lighter crudes have tightened supply.

Export controls & prioritisation: Major producers (Middle East, Russia, India) periodically prioritise domestic infrastructure demand, limiting export volumes.

Key Demand Drivers

Public infrastructure investment: Roads, highways, airports, and logistics corridors.

Urbanisation & maintenance cycles: Mature markets increasingly driven by resurfacing rather than new build.

Seasonality: Peak demand typically occurs in Q2–Q3 in most regions due to weather constraints.

02. Demand Drivers in Construction

Bitumen demand within the construction sector is highly concentrated, with usage dominated by transport infrastructure and maintenance activities. Demand is policy-led, seasonal, and closely linked to public capital expenditure rather than private building construction.

Road Construction & Highway Expansion (Primary Driver)

The single largest source of bitumen demand globally across,

-

New highways, expressways, urban roads, and access corridors.

-

Expansion of logistics and freight networks.

-

Strong correlation with government infrastructure budgets.

Demand sensitivity: Very high – any increase or delay in road programmes has immediate volume impact

Airport & Transport Infrastructure (Secondary Driver)

-

Runways, taxiways, aprons, and service roads.

-

Major upgrades driven by capacity expansion and safety compliance.

-

Lower volume than roads but high bitumen intensity per project.

Demand sensitivity: Medium – project-specific and capital-cycle dependent.

Road Maintenance, Rehabilitation & Resurfacing

A structurally stable and recurring demand driver,

-

Periodic resurfacing, overlay works, and pothole rehabilitation.

-

Pavement strengthening due to heavier traffic loads.

-

Asset management driven rather than discretionary.

Demand sensitivity: Low – provides baseline demand even during economic slowdowns.

03. Middle East Context

In the Middle East, bitumen demand is highly infrastructure-led, dominated by road construction, rehabilitation, and transport connectivity programmes. The region’s market is characterised by strong public-sector sponsorship, extreme climatic conditions, and high-performance specification requirements, all of which materially influence consumption patterns and pricing behaviour.

Infrastructure-Led Demand Profile

-

National road networks, expressways, interchanges, and logistics corridors are the primary consumers of bitumen.

-

Major airport expansions, industrial zones, and port-linked roadworks provide secondary demand.

-

Private building construction has minimal direct impact on bitumen volumes.

Implication: Demand visibility is tied to government capital programmes, not speculative real estate cycle

Climate-Driven Specification

-

Extreme temperatures necessitate polymer modified and high penetration grade bitumen.

-

Higher binder content and enhanced performance specifications increase bitumen intensity per km of roadway.

-

Shorter pavement life cycles in high-heat environments drive frequent resurfacing.

Implication: The Middle East consumes more bitumen per asset lifecycle than temperate markets.

Maintenance-Heavy Demand Structure

-

Heavy axle loads, logistics traffic, and thermal stress accelerate pavement deterioration.

-

Ongoing rehabilitation and overlay programmes form a stable baseline demand, even during economic slowdowns.

Implication: Maintenance spending acts as a demand stabiliser, reducing downside risk.

Stonehaven Cost Index (SCI)

Index baseline (01 September 2025) = 100

Current SCI: 102.92 (easing from 103.06)

WoW change: ▼-0.13%

Change vs baseline: ▲+2.92%

Driver Note

Most construction commodities remained broadly stable this week, with price movements contained within ±0.5%, including bitumen, aluminium, zinc, copper, HRC, CRC, iron ore, and ULSD. Despite this stability, the Stonehaven Cost Index (SCI) eased from 103.06 to 102.92, representing a week-on-week decline of (▼ 0.13%).

The downward movement was driven by softening across several key construction inputs. While bitumen recorded a marginal increase, it was insufficient to offset the declines elsewhere. Overall, the week reflects modest easing in construction cost pressures, with no evidence of broad-based inflationary momentum.

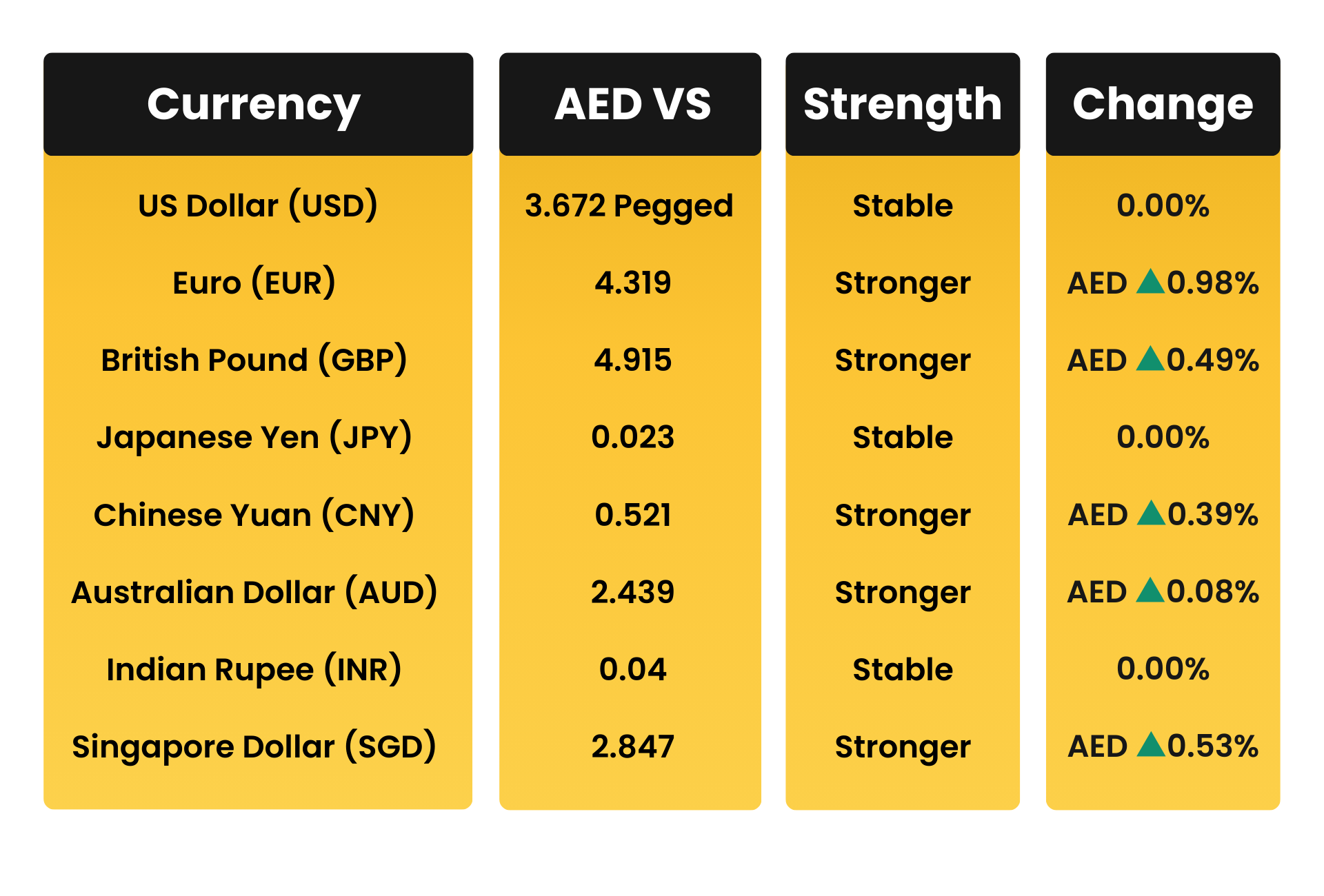

Currency & Inflation Lens

AED vs Key Trading Currencies

*Rates as of 16th December 2025

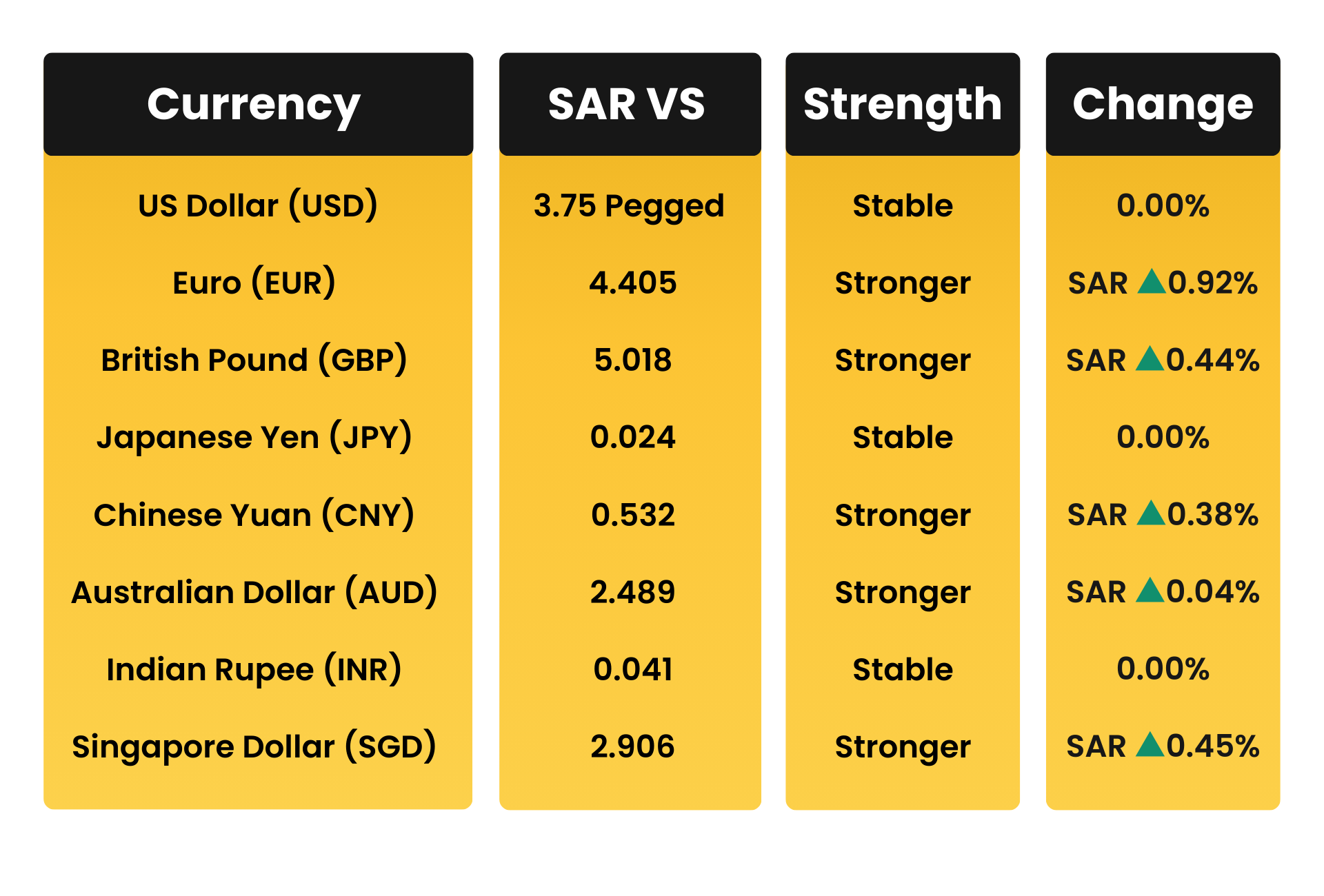

SAR vs Key Trading Currencies

*Rates as of 16th December 2025

Stonehaven Analysis

During the week under review, both the UAE Dirham (AED) and Saudi Riyal (SAR) remained firmly pegged to the US Dollar, maintaining full stability against USD with no week-on-week movement.

Against major non-USD trading currencies, both currencies strengthened, particularly versus the Euro, British Pound, Chinese Yuan, Australian Dollar, and Singapore Dollar.

Given that most construction commodities, including bitumen, are priced in USD, the peg continues to provide a strong stabilising effect on base material costs across GCC markets.

The observed strengthening against non-USD currencies offers marginal cost relief on imported additives, modifiers, and logistics components with European and Asian exposure.

As a result, FX movements are currently cost-neutral to mildly supportive for bitumen pricing. Near-term bitumen cost trends will therefore remain driven primarily by refinery supply, freight costs, and seasonal infrastructure demand, rather than currency volatility.

Impact On Construction Costs

The strengthening of both the UAE Dirham (AED) and Saudi Riyal (SAR) against key non-USD trading currencies provides a mild cost-supportive effect for construction projects in the UAE and KSA.

As the majority of primary construction commodities, including steel, cement, and fuel, are priced in USD, the USD peg continues to shield projects from direct FX volatility.

However, the improved strength against the Euro, GBP, CNY, AUD, and SGD reduces landed costs for imported materials, specialist finishes, MEP components, additives, plant, and logistics services sourced from Europe and Asia.

This offers limited downside support to overall construction costs, partially offsetting inflationary pressure arising from freight rates, labour constraints, and seasonal demand.

Overall, the current FX environment is assessed as cost-neutral to marginally deflationary, with no immediate escalation risk to GCC construction budgets driven by currency movements.

Global Inputs & Freight Benchmarks

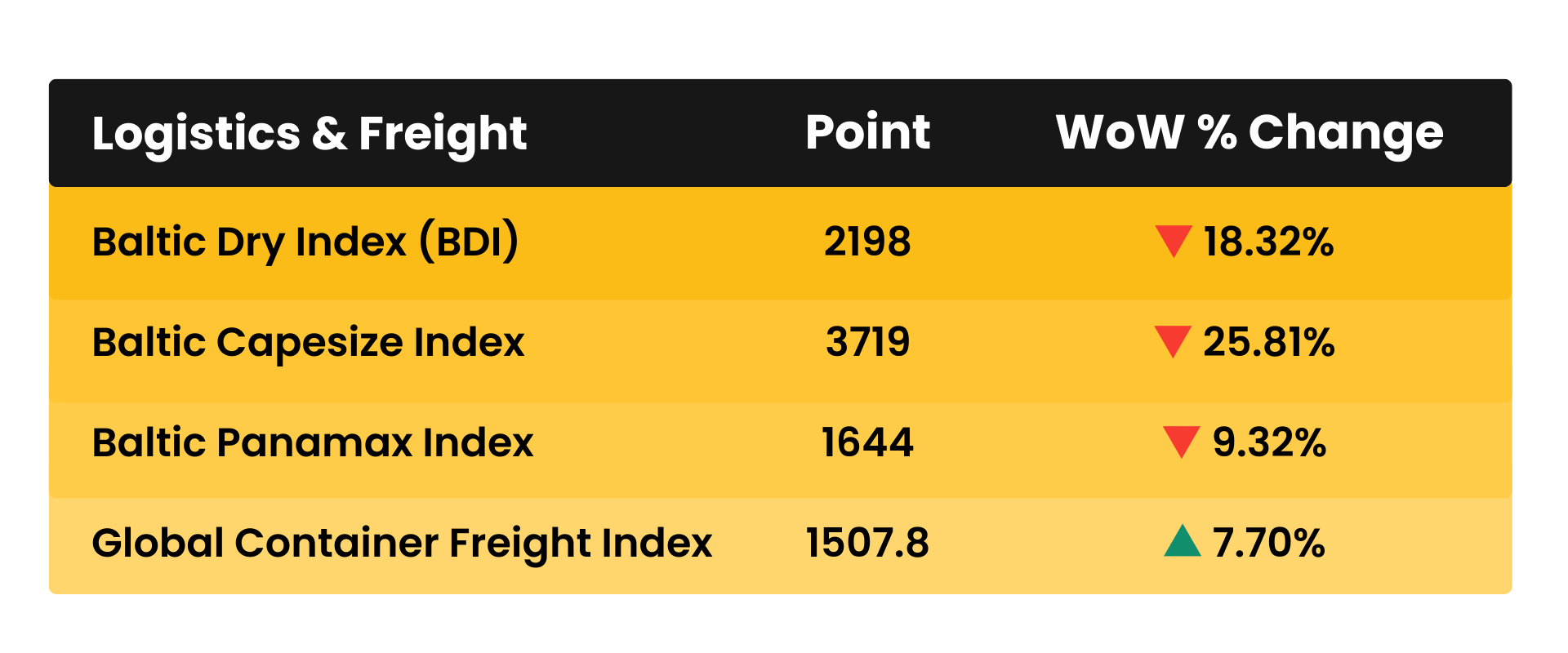

Logistics & Freight – Construction Cost Multipliers

*Rates as of 15th December 2025

Stonehaven Analysis

During the week under review, global bulk freight indicators recorded a sharp correction, with the Baltic Dry Index (BDI) declining by 18.32% WoW, driven primarily by significant falls in the Capesize (▼25.81%) and Panamax (▼9.32%) segments.

This reflects weakening bulk cargo demand and increased vessel availability, particularly across iron ore, coal, and bulk raw material routes. In contrast, the Global Container Freight Index increased by 7.70% WoW, indicating continued pressure within containerised trade lanes due to capacity constraints and port congestion.

From a construction cost perspective, the easing in bulk freight rates provides downward cost support for bulk-imported materials such as aggregates, iron ore, and cement-related inputs.

However, rising container freight rates continue to exert upward pressure on finished goods, MEP equipment, and packaged construction materials.

Overall, logistics conditions are mixed, with net impacts assessed as cost-neutral to mildly supportive, depending on material type and supply chain exposure.

Conclusion

Taken together, construction input markets remain broadly stable, with most commodity movements contained within a narrow range and selective softening offsetting isolated price increases.

While bitumen recorded a marginal week on week rise, underlying supply demand dynamics remain tight but manageable, particularly within Middle East infrastructure markets.

The continued USD peg of both AED and SAR provides a strong anchor against FX volatility, while the recent strengthening against non-USD currencies offers limited downside support on imported materials, additives, and logistics-related costs.

In parallel, the sharp correction in bulk freight indices is easing cost pressure on bulk materials, partially offset by continued firmness in containerised shipping.

Taken together, the current environment points to a stable to mildly easing construction cost outlook for the GCC, with near term risks concentrated around seasonality, refinery allocation, and execution driven demand, rather than currency or systemic inflation pressures.

Market Forecast & Watchlist

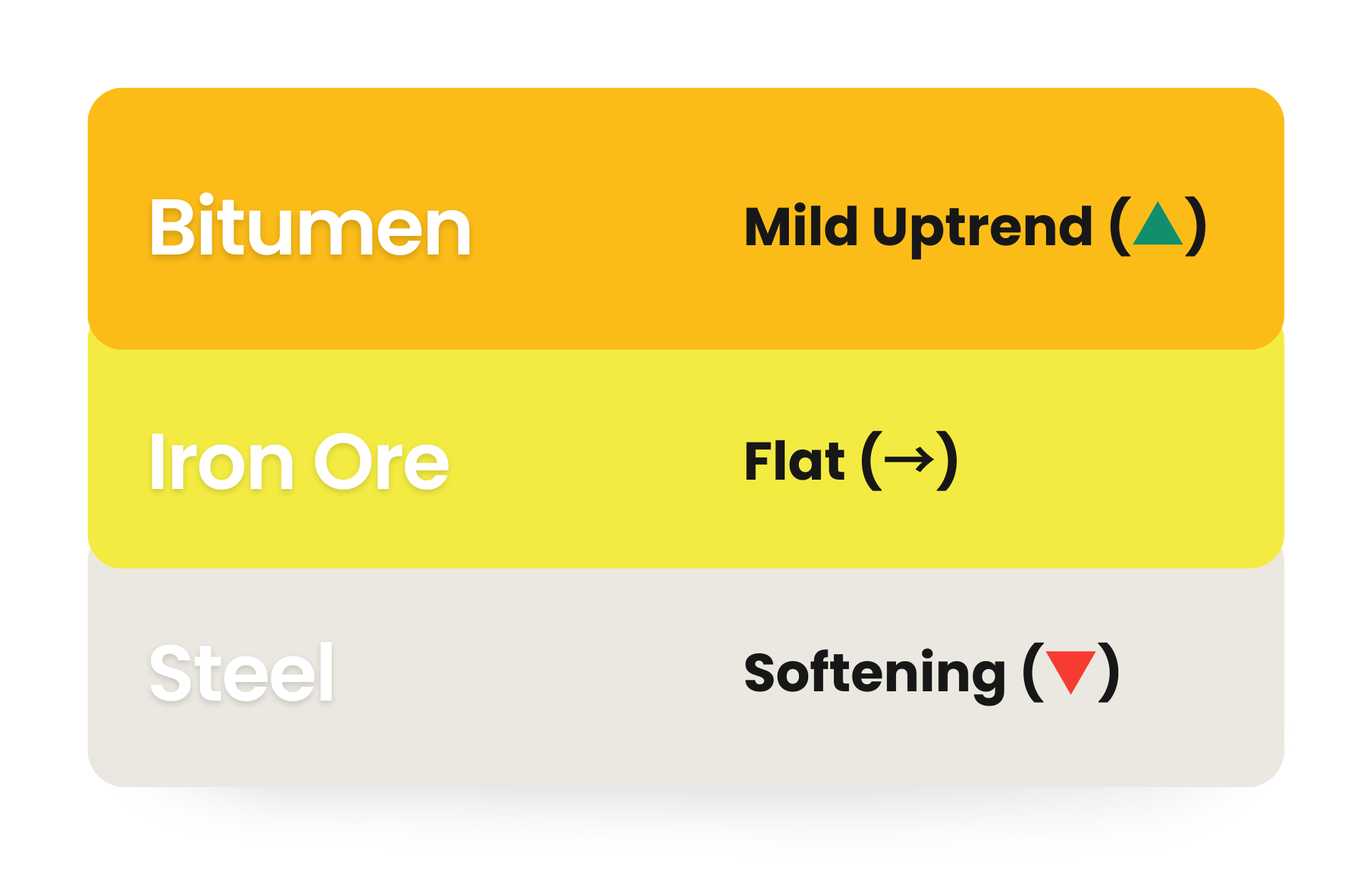

Bitumen – Mild Uptrend (▲)

Forecast: Expected to remain mildly upward, supported by seasonal road and infrastructure demand across GCC markets and disciplined refinery output. Price movements are likely execution-led rather than FX driven.

Watchlist : Refinery maintenance schedules, export prioritisation, and acceleration of GCC road programmes during peak execution windows.

Iron Ore: – Flat (→)

Forecast: Tracking steel demand and benefiting from reduced freight pressure, no immediate escalation signal.

Watchlist : Containerised Materials & MEP Equipment, continued volatility in container freight rates and port congestion risks.

Steel (HRC & CRC): – Softening (▼)

Forecast: Stable to slightly soft, benefiting from easing bulk freight rates and moderated global demand; downside risk limited by production controls.

Watchlist : Any unexpected production cuts, trade restrictions, or rebound in global construction demand.

Stonehaven Forecast Summary

This week’s commodity movements indicate a broadly stable to mildly easing construction cost environment across the GCC.

The easing and stability observed in key construction inputs, including aluminium, copper, steel, HRC, CRC, iron ore, and ULSD, have contributed to a more balanced cost outlook for the construction market.

Commodity movements remain largely contained, supported by stable steel inputs, easing bulk freight rates, and continued currency stability under the USD peg.

While bitumen presents a modest upside risk, this is driven primarily by seasonal execution demand and supply side discipline, rather than macroeconomic or FX volatility.

The strengthening of AED and SAR against non-USD currencies, combined with softer bulk logistics costs, continues to provide partial cost offsets across imported materials and supply chains.

Overall, near-term cost risk remains selective and manageable, with prudent procurement and close monitoring of bitumen supply, logistics conditions, and execution pacing recommended for infrastructure-led projects.

Summary & Commercial Guidance

-

Road & Infrastructure Packages: Bitumen should be treated as a managed risk item, with early procurement, indexed pricing, or short-term validity periods recommended during peak execution windows.

-

Structural & Steel Works: Current softness in HRC, CRC, and iron ore supports cost certainty for structural and reinforcement packages. No immediate escalation allowances are warranted beyond standard contingencies.

-

MEP, Finishes & Specialist Imports: Strengthening of AED and SAR against EUR, GBP, and CNY offers procurement advantage for imported components; however, exposure to container freight volatility should be closely monitored.

-

Procurement Strategy: Adopt a selective early buy approach for bitumen heavy scopes, while maintaining competitive tendering and flexible sourcing for steel and general construction materials.

Overall, it is recommended to maintain the current procurement strategy, continue close monitoring of metal price movements, and progress with cost planning confidently over the coming weeks.

Overall Commercial Position

Cost risk remains selective, manageable, and execution-led, with no evidence of systemic inflationary pressure. Focus should remain on timing, logistics coordination, and supply side discipline, rather than broad cost escalation assumptions.

Important Disclaimer

The Stonehaven Cost Index (SCI) is provided for general information only and does not constitute a commitment, guarantee, or offer to contract at any price level. The index is based on publicly available commodity data and internal market assessments as at 15 December 2025.

Actual project costs will depend on project-specific scopes, procurement routes, and commercial negotiations. Stonehaven Project Management Service LLC accepts no liability for any loss arising from reliance on this document without appropriate project-specific advice.

Talk To Our Team

The market’s changing every week, so are your budgets keeping up?

Our cost management specialists can help you benchmark, forecast, and protect your project margins using real data from the Stonehaven Cost Index.