This Week’s Cost Intelligence

To help our clients and partners make faster, better-informed decisions, we developed the Stonehaven Cost Index, a clear, data-driven view of the cost movements shaping the construction market each week.

Our cost management team distils real-time changes into practical insight, so you can anticipate pressure before it hits your budgets.

Key Takeaways For Your Projects This Week

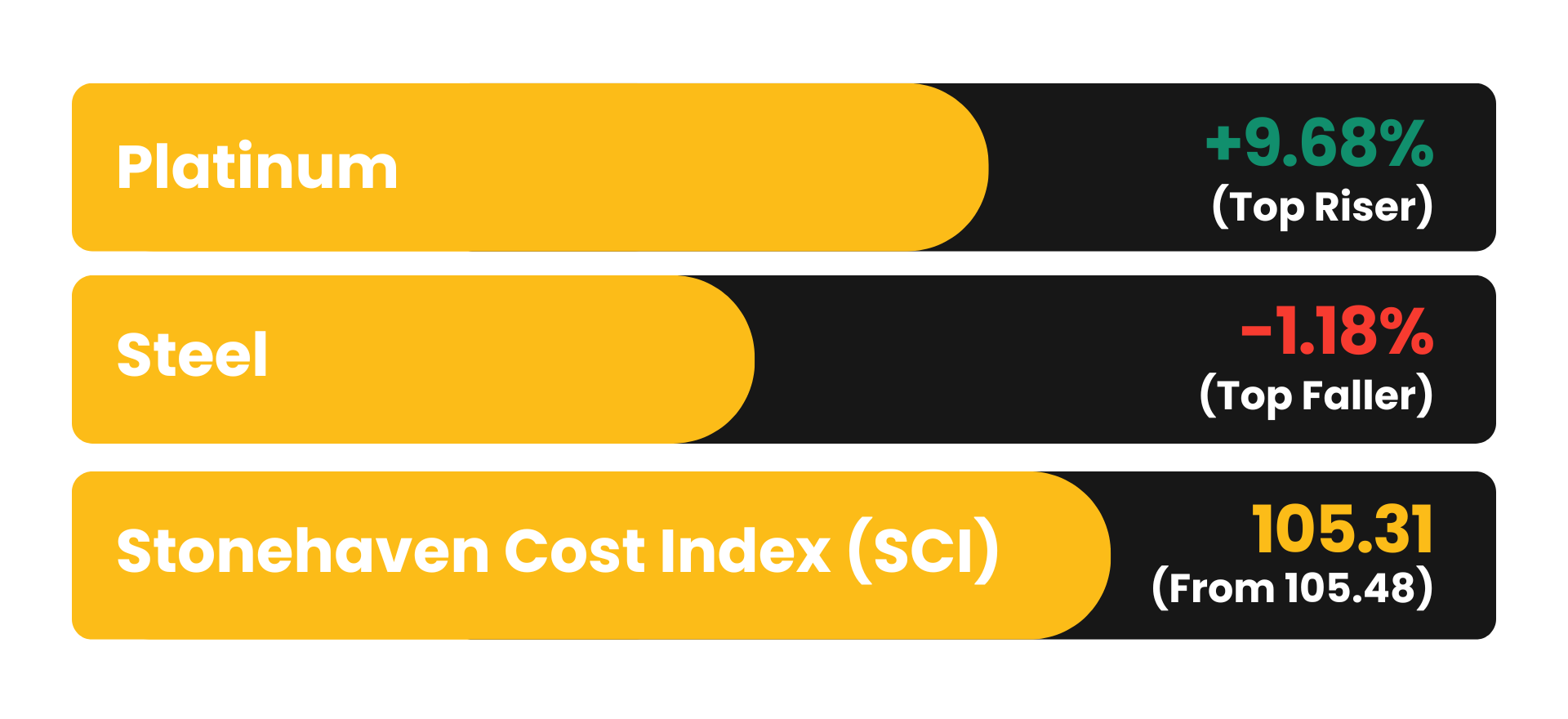

Core construction inputs remain largely stable with week-on-week movements across polyvinyl ▼0.10%, titanium ▼0.03%, and steel ▼1.18% staying contained. This indicates broad cost stability across primary bulk construction materials despite selective metal strength.

Base metals continue to drive upward pressure led by copper and nickel. Copper increased ▲6.29% week on week, while nickel rose ▲4.04%, sustaining cost pressure on MEP systems, stainless steel components, façades, and specialist finishes. Aluminium ▲3.39% and zinc ▲3.68% reinforced this upward trend.

Platinum recorded the sharpest increase at ▲9.68% this week. This reflects an isolated, commodity-specific volatility event rather than a broader inflationary trend across construction inputs.

Steel prices declined▼1.18% week on week, providing short-term cost relief for structural frames, reinforcement, and fabricated steel packages, partially offsetting inflationary pressure from base metals.

Bitumen prices increased ▲4.38% week on week to approximately USD 442 per tonne. While this signals short-term upward pressure, pricing remains within a manageable range for roadworks and infrastructure packages.

This Week's Market Movers

Material Movement This Week

*Rates as of 06th January 2026

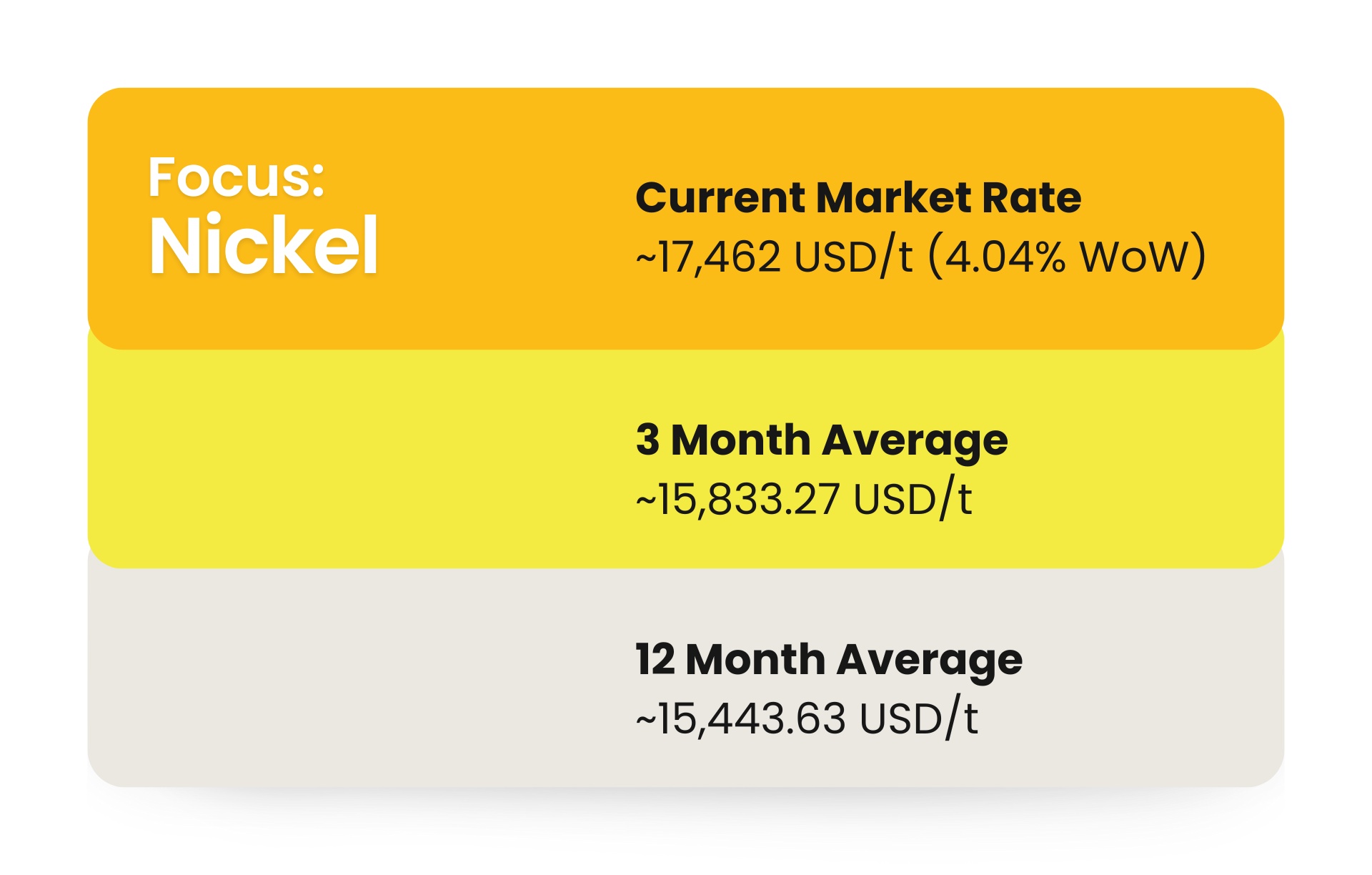

Material of the Week

*Rates as of 06th January 2026

The Supply & Demand Drivers

01. Global Supply and Demand Overview

Key supply drivers: Nickel supply is generally categorised into Class 1 nickel, being high-purity material traditionally utilised in alloy steels and stainless steel production, and Class 2 nickel, comprising lower-grade products such as nickel pig iron (NPI) and ferronickel, which are predominantly consumed within the stainless steel sector.

The global nickel supply chain is subject to several material commercial and strategic risks, including export restrictions and policy interventions (notably in Indonesia), increasing ESG and environmental permitting constraints, the energy-intensive nature of nickel processing, and a pronounced concentration risk arising from heavy reliance on a limited number of producing jurisdictions.

Key demand drivers: Construction demand is embedded within stainless steel consumption, notably:

- Structural and architectural stainless steel

- Coastal / marine / infrastructure projects

- High-end commercial, healthcare, and transport facilities

Construction demand moves with global building cycles, not EV demand directly, but prices are affected by EV competition.

02. Demand Drivers in Construction

Nickel demand in construction is indirect, arising mainly from its use in stainless steel and alloy products for structural elements, cladding, fixings, and building services. Demand is economically driven, closely linked to commercial and industrial construction activity, long-term durability, corrosion-resistance requirements.

01. Stainless Steel Structural Components (Primary Driver)

The single largest source of nickel demand in construction

-

Stainless steel used in structural beams, cladding, reinforcement, and facades.

-

Applications in high-durability, corrosion-resistant construction elements.

-

Strong correlation with commercial, industrial, and large infrastructure projects.

Demand sensitivity: Very high – any change in large-scale construction activity directly impacts nickel consumption

02. Alloyed Fixtures & Building Services (Secondary Driver)

-

Nickel containing alloys used in plumbing, HVAC, electrical, and mechanical systems.

-

Upgrades driven by building standards, fire safety, and durability requirements.

-

Lower volume than structural steel but high nickel content per unit.

Demand sensitivity: Medium – project specific and capital cycle dependent

03. Maintenance, Retrofit & Corrosion Protection

A structurally stable and recurring demand driver

-

Nickel intensive stainless steel and alloy components used in refurbishment, cladding replacement, and corrosion-resistant overlays.

-

Driven by asset longevity and environmental exposure rather than new construction.

Demand sensitivity: Low – provides baseline nickel demand even during construction slowdowns.

03. Middle East Context

In the Middle East, nickel demand is driven by construction and industrial activity, primarily through the use of stainless steel and nickel alloys in infrastructure, industrial facilities, and high specification buildings. Public sector megaprojects, harsh climatic conditions, and stringent durability requirements significantly influence material selection, nickel intensity, and cost sensitivity.

01. Infrastructure and Industrial Led Demand Profile

-

Stainless steel used in transport infrastructure, industrial facilities, desalination plants, and energy projects.

-

Airports, ports, logistics hubs, and large commercial developments through structural, cladding, and mechanical applications.

-

Conventional low rise residential construction has limited direct impact on nickel volumes.

Implication: Demand visibility is tied to government backed infrastructure and industrial investment rather than speculative real estate cycles.

02. Climate Driven Material Specification

-

Extreme heat, salinity, and corrosive environments necessitate greater use of stainless steel and nickel containing alloys.

-

Higher corrosion resistance requirements increase nickel intensity in structural components, fixings, and building service

Implication: The Middle East exhibits higher nickel usage per project compared to temperate regions due to durability-driven specifications.

03. Maintenance, Retrofit & Asset Protection

-

Harsh environmental exposure accelerates corrosion and material degradation in infrastructure and industrial assets.

-

Ongoing replacement, retrofitting, and corrosion-protection programmes create recurring baseline demand for nickel-bearing materials.

Implication: Maintenance and asset-protection spending stabilise regional nickel demand during periods of reduced new construction.

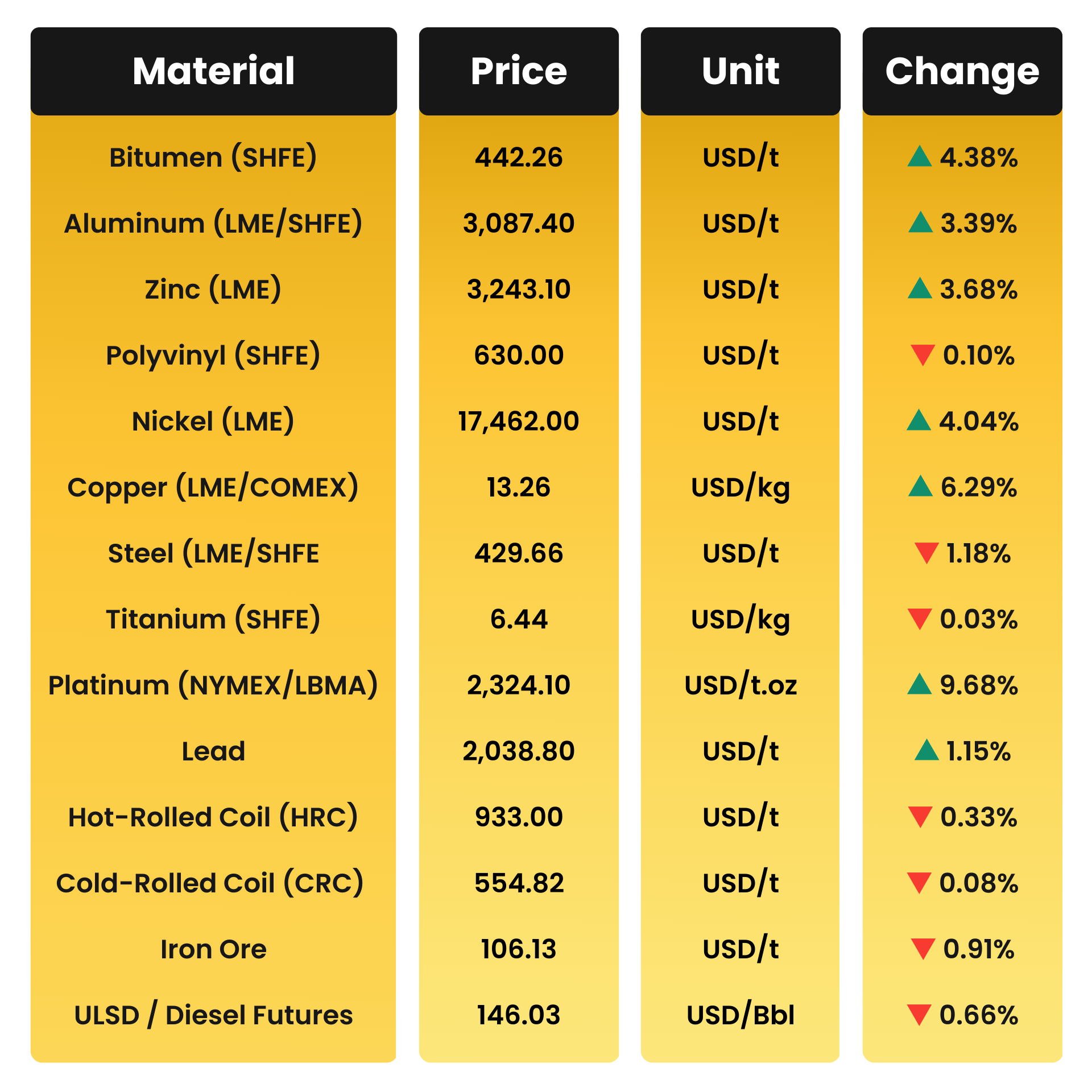

Stonehaven Cost Index (SCI)

Index baseline (01 September 2025) = 100

Current SCI: 105.31 (declined from 105.48 on 30th Dec)

WoW change: ▼ 0.16%

Change from baseline index: ▲ 5.31%

Driver Note

The SCI has softened marginally this week as declines in bulk construction inputs outweighed gains in selected base metals. Steel (-1.18%), HRC (-0.33%), CRC (-0.08%), iron ore (-0.91%), and diesel (-0.66%) provided short-term relief to structural works, logistics, and preliminaries.

This was partially offset by strength in nickel (+4.04%), copper (+6.29%), aluminium (+3.39%), and zinc (+3.68%), sustaining cost pressure on stainless steel, façade systems, and MEP-intensive packages. Overall, the index reflects a balanced correction, with alloy-heavy scopes remaining exposed to volatility despite easing trends in bulk materials

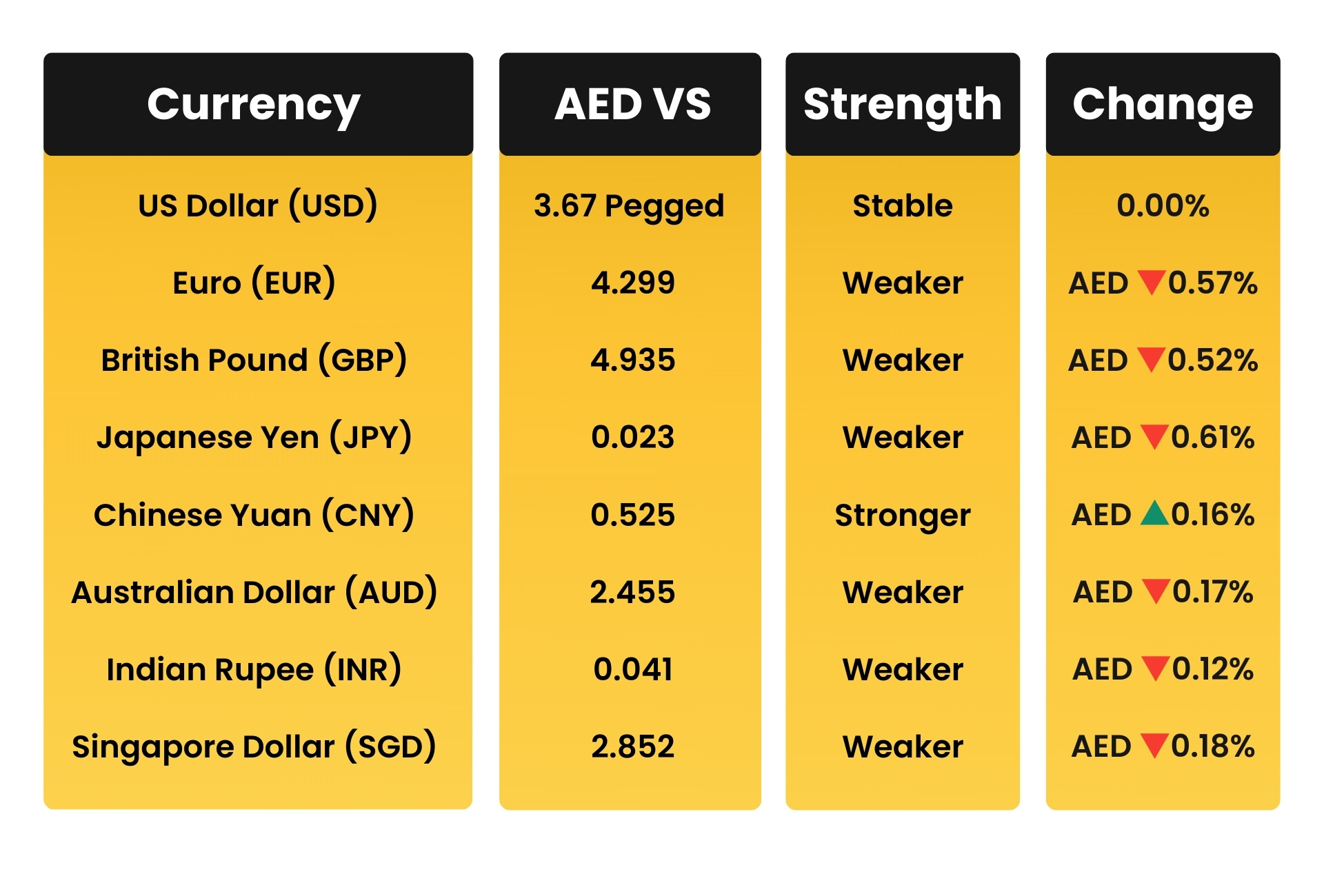

Currency & Inflation Lens

AED vs Key Trading Currencies

*Rates as of 06th January 2026

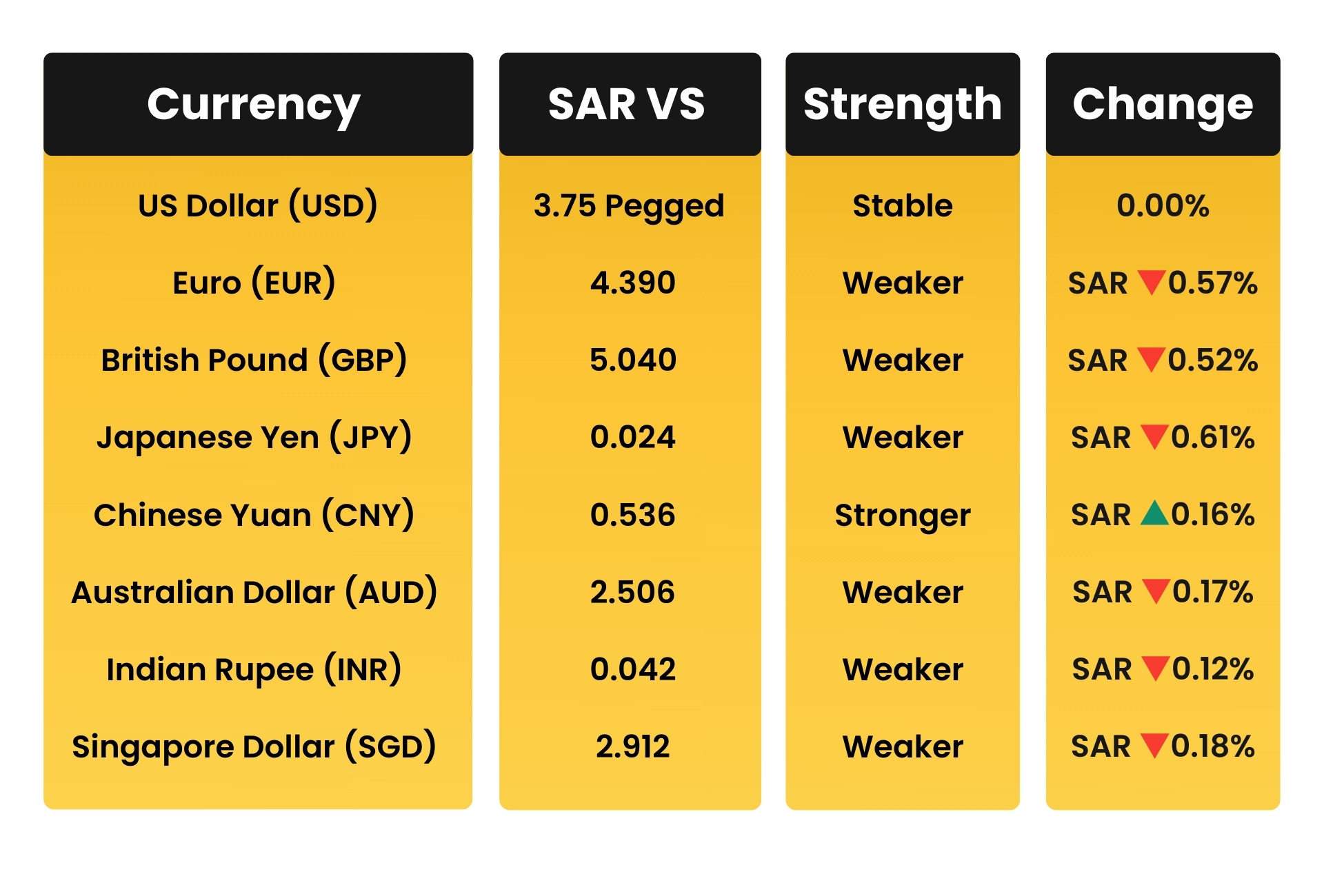

SAR vs Key Trading Currencies

*Rates as of 06th January 2026

Stonehaven Analysis

Against key non-USD currencies, both currencies recorded modest appreciation, most notably versus the Euro, British Pound, Japanese Yen, Australian Dollar, and Singapore Dollar, while movements against the Chinese Yuan were negligible.

Given that the majority of construction commodities are USD-denominated, foreign exchange movements had a largely neutral impact on core material pricing.

However, the slight strengthening against non-USD currencies offers limited cost mitigation on imported equipment, specialist materials, and logistics sourced from Europe and Asia. Overall, foreign exchange conditions remain supportive but secondary, with no material influence on construction cost trends during the week.

Impact On Construction Costs

The recent strengthening of the UAE Dirham (AED) and Saudi Riyal (SAR) against major non-USD currencies provides mild cost support for construction projects across the UAE and KSA.

While the USD peg continues to shield core commodities such as steel, cement, concrete, and fuel from FX volatility, the improved performance against the Euro, British Pound, Japanese Yen, Australian Dollar, and Singapore Dollar offers limited relief for imported finishes, MEP components, specialised equipment, and logistics services.

Projects that rely heavily on these imports may see marginal reductions in landed costs, though the overall effect on budgets is assessed as cost neutral to slightly deflationary.

Despite this, broader cost pressures from energy, labor, and supply chain dynamics remain, meaning currency movements are unlikely to pose immediate risk, but can provide incremental savings for projects with significant foreign sourced materials.

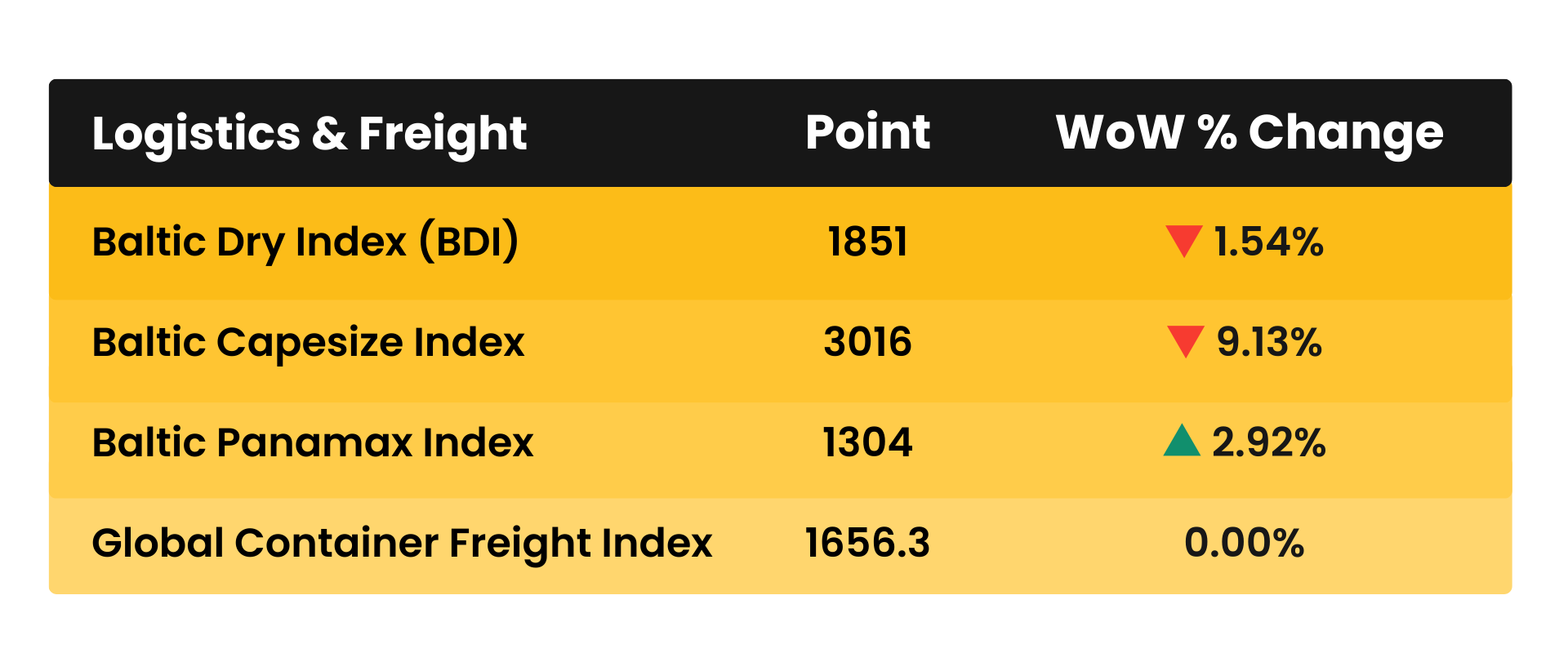

Global Inputs & Freight Benchmarks

Logistics & Freight – Construction Cost Multipliers

*Rates as of 06th January 2026

Stonehaven Analysis

During the week under review, global bulk freight indicators recorded modest movements, with the Baltic Dry Index (BDI) declining by 1.54% WoW, primarily due to a 9.13% fall in the Capesize segment, while the Panamax segment rose by 2.92% WoW.

This reflects relatively stable bulk cargo demand with minor variations in vessel availability across iron ore, coal, and other bulk raw material routes.

In contrast, the Global Container Freight Index remained flat WoW, indicating steady conditions within containerised trade lanes.

From a construction cost perspective, the slight easing in Capesize rates provides limited downward cost support for bulk imported materials such as aggregates, iron ore, and cement related inputs, while stable container freight rates maintain consistent pressure on finished goods, MEP equipment, and packaged construction materials.

Overall, logistics conditions are mixed, with net impacts assessed as largely cost neutral, depending on material type and supply chain exposure.

Conclusion

Overall, the current market environment reflects a largely balanced and mildly easing construction cost landscape, with no evidence of systemic inflationary pressure.

While headline movements in nickel, copper, aluminium, and zinc continue to signal ongoing volatility in alloy and non ferrous metals, these increases remain selective and contained, primarily affecting stainless steel, façade systems, and MEP intensive packages rather than the wider construction basket.

Conversely, the continued softening in iron ore and diesel combined with stable freight conditions and FX neutrality under the USD peg, has acted as a counterbalance, supporting the observed week-on-week moderation in the Stonehaven Cost Index (SCI).

From a regional perspective, Middle East construction remains specification driven, with nickel exposure linked to durability and climate led material choices rather than volume growth.

In commercial terms, the outlook suggests short-term cost stability with pockets of risk, particularly for projects with high exposure to stainless steel, specialist metals, and imported MEP equipment. Bulk construction works remain comparatively insulated.

Active cost management, early procurement of nickel sensitive items, and ongoing monitoring of global metals and policy driven supply risks remain appropriate, but no immediate escalation allowances beyond current assumptions are warranted at this stage.

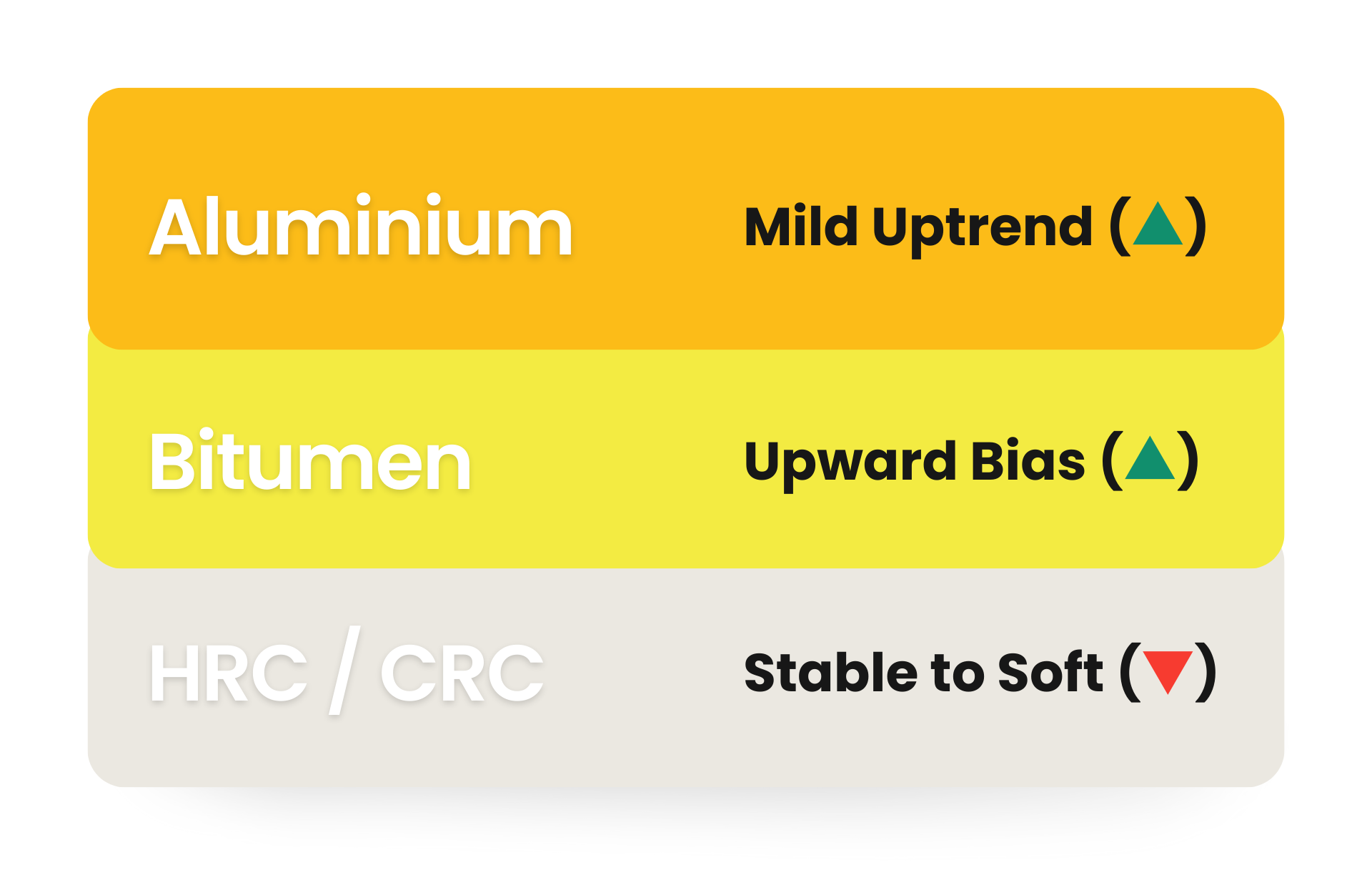

Market Forecast & Watchlist

Aluminium – Mild Uptrend (▲)

Forecast: Aluminium prices are expected to trend modestly upward, supported by energy linked smelting constraints, steady demand from façade systems, and transport and industrial activity. Cost pressures remain manageable but persistent.

Watchlist: Energy costs, smelter capacity utilisation, façade and glazing package awards, and Chinese export volumes.

Bitumen – Volatile with Upward Bias (▲)

Forecast: Prices are expected to remain volatile, closely tracking crude oil movements and refinery output. Near term upside risk persists due to seasonal infrastructure activity and energy price sensitivity.

Watchlist: Crude oil trends, refinery maintenance schedules, regional road and infrastructure programmes, and freight costs

HRC / CRC – Stable to Soft (▼)

Forecast: Flat steel products are expected to remain limited downside, supported by controlled production and steady baseline demand. Significant price escalation is not anticipated in the short term.

Watchlist: Mill capacity utilisation, raw material input costs, regional fabrication demand, and trade policy developments.

Stonehaven Forecast Summary

The near-term construction materials outlook remains broadly stable with selective upward pressure, driven primarily by energy linked inputs and non ferrous metals, while bulk steel products continue to show limited downside risk.

Aluminium is expected to follow a mild upward trajectory, supported by energy related smelting constraints and sustained demand from façade, glazing, and industrial packages. While price pressures are persistent, they remain manageable and are unlikely to trigger sharp escalation in the short term.

Bitumen remains the most volatile input, with pricing closely tied to crude oil movements and refinery output. Seasonal infrastructure activity continues to present near-term upside risk, particularly for roadworks and waterproofing scopes.

In contrast, HRC and CRC are forecast to remain stable to slightly soft, underpinned by controlled mill production and steady baseline demand. Current market conditions do not indicate any material escalation risk for flat steel products in the near term.

Overall, the forecast indicates a balanced cost environment, where alloy and energy sensitive packages require active monitoring, while bulk steel related works benefit from short term stability. No broad based inflationary pressure is anticipated across the construction materials basket at this stage.

Summary & Commercial Guidance

Structural & Stainless Steel Works: Nickel intensive scopes, including stainless steel structural components, cladding, reinforcements, and corrosion resistant alloys, should be treated as a managed risk item. Early procurement, indexed pricing, or short term validity periods are recommended during peak project execution and refinery allocation windows.

Industrial, Commercial & High-Spec Projects: Softening in HRC, CRC, steel, iron ore, and stable polyvinyl prices supports cost certainty for general steel and alloy intensive packages. No immediate escalation allowances are warranted beyond standard contingencies.

MEP, Finishes & Specialist Imports: Mild strengthening of AED and SAR against EUR, GBP, JPY, AUD, and SGD provides limited procurement advantage for imported MEP components, finishes, and specialist equipment. Exposure to containerised freight volatility should be closely monitored.

Procurement Strategy: Adopt a selective early buy approach for nickel and alloy heavy scopes, while maintaining competitive tendering and flexible sourcing for steel, aluminium, copper, and general construction materials.

Overall Commercial Position: Construction cost risk remains selective, manageable, and execution driven, with no evidence of broad based inflationary pressure. Focus should remain on timing, logistics coordination, and supply side discipline, particularly for nickel intensive components, rather than assumptions of systemic cost escalation.

Important Disclaimer

The Stonehaven Cost Index (SCI) is provided for general information only and does not constitute a commitment, guarantee, or offer to contract at any price level. The index is based on publicly available commodity data and internal market assessments as at 06 January 2026.

Actual project costs will depend on project-specific scopes, procurement routes, and commercial negotiations. Stonehaven Project Management Service LLC accepts no liability for any loss arising from reliance on this document without appropriate project-specific advice

Talk To Our Team

The market’s changing every week, so are your budgets keeping up?

Our cost management specialists can help you benchmark, forecast, and protect your project margins using real data from the Stonehaven Cost Index.