This Week’s Cost Intelligence

We created the Stonehaven Cost Index to give project teams a simple, reliable way to track weekly construction cost changes. It shows what is going up, what is stable, and what may affect your project budgets.

Our cost management team reviews real market data each week and turns it into clear, practical insight you can use for estimating, cost planning, and cost control helping you spot risks early and make informed decisions on live projects.

Key Takeaways For Your Projects This Week

-

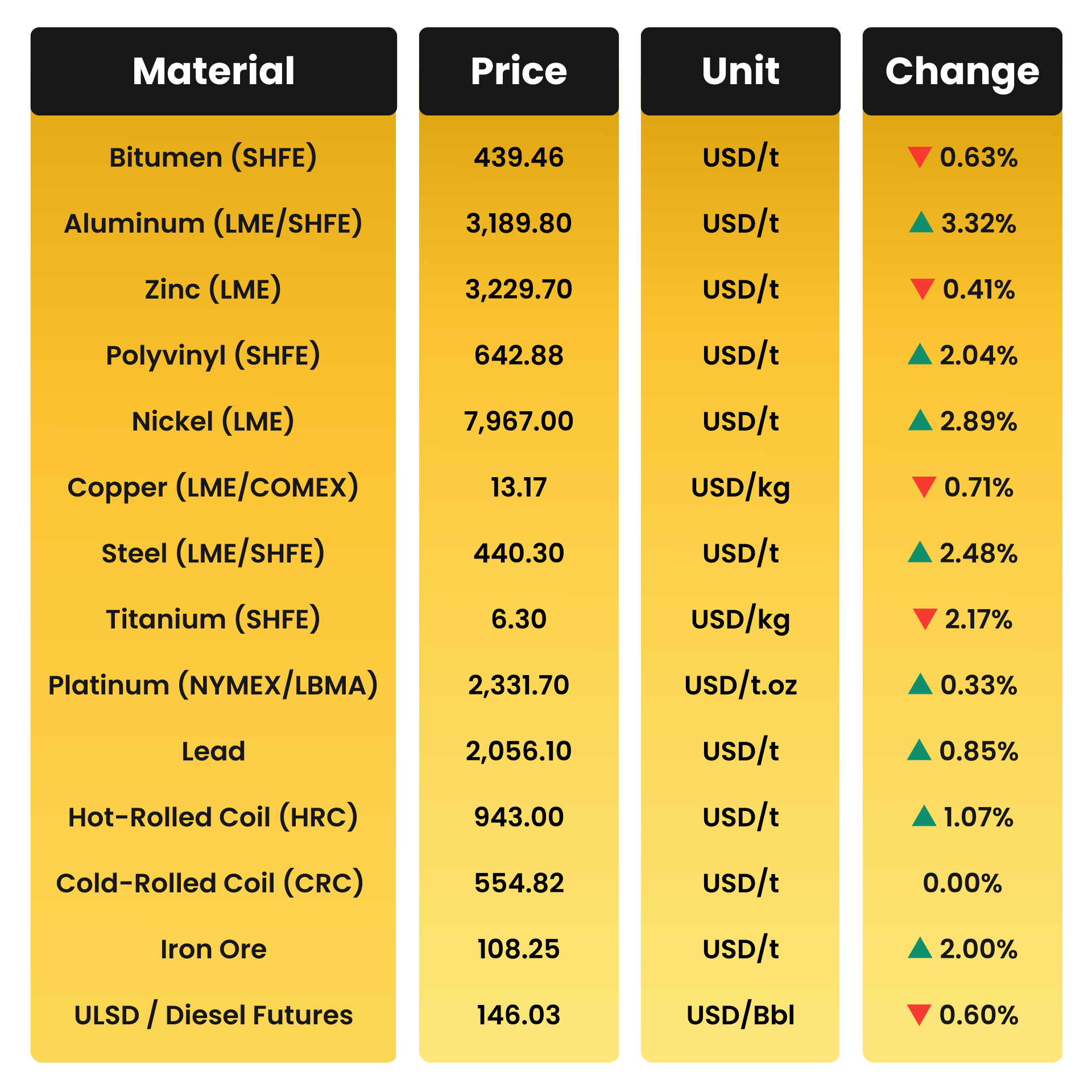

Steel: ▲ 2.48% WoW – Prices increased again this week, adding cost pressure to structural frames, rebar, fabricated steel packages, and plate works. Steel is once again a key short-term cost driver.

-

Aluminium: ▲ 3.32% – The largest increase this week, continuing to push up costs for façades, cladding, curtain walling, and lightweight structural systems.

-

Titanium: ▼ 2.17% – The biggest fall this week, slightly easing costs for specialist alloys and high-performance components used in industrial and MEP applications.

This Week's Market Movers

Material Movement This Week

*Rates as of 13th January 2026

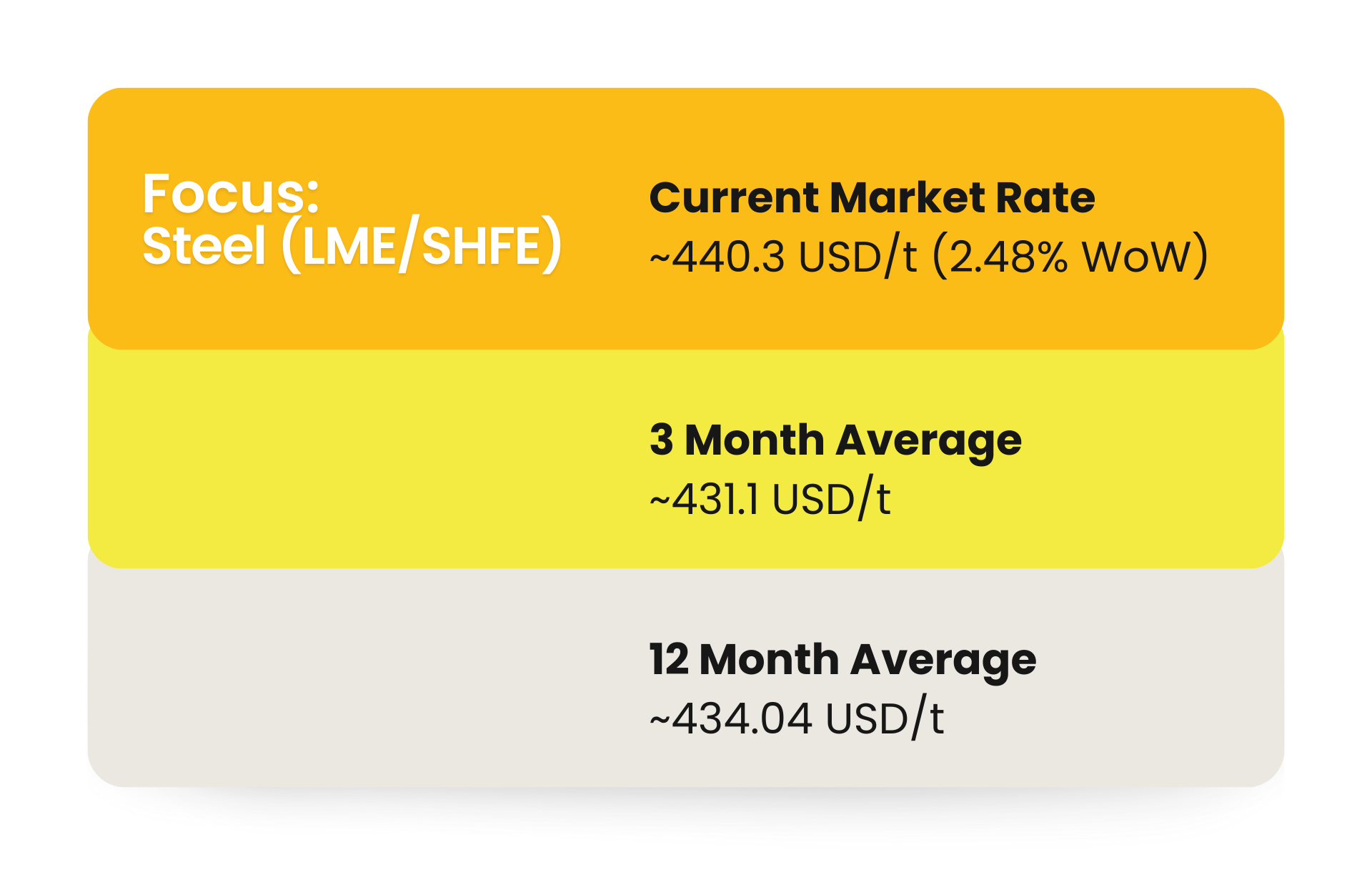

Material of the Week

*Rates as of 13th January 2026

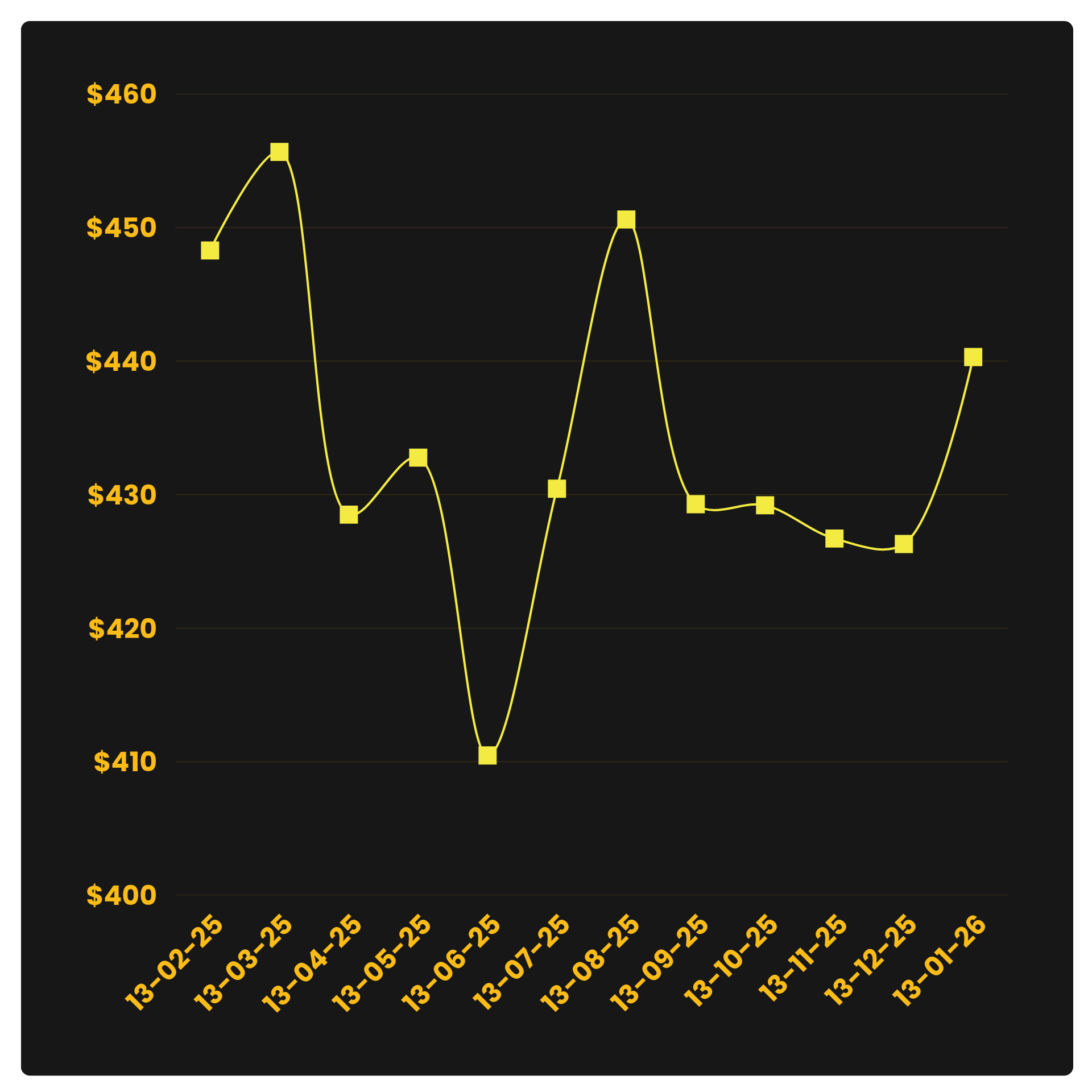

Material Of The Week (Yearly Price Fluctuation)

*Rates as of 13th February 2025 - 13th January 2026

To view the price fluctuations in detail, please download our latest dataset below.

Stonehaven Cost Index (SCI)

Index baseline (01 September 2025) = 100

Current SCI: 105.27 (rising from 104.71 on 06th Jan)

WoW change: ▲ 0.54%

Change from baseline index: ▲ 5.27%

Driver Note

Most construction materials moved only slightly this week, with price changes generally staying within ±0.5%. This included key items such as zinc, platinum, CRC, and ULSD. The Stonehaven Cost Index increased from 104.71 to 105.27, a week-on-week rise of 0.54% and 5.27% above the baseline.

The increase was mainly due to higher steel and energy prices, which outweighed small price drops in some metals and bulk construction materials. Overall, this points to steady upward pressure on construction costs, but not a sharp or widespread jump across the market.

Currency & Inflation Lens

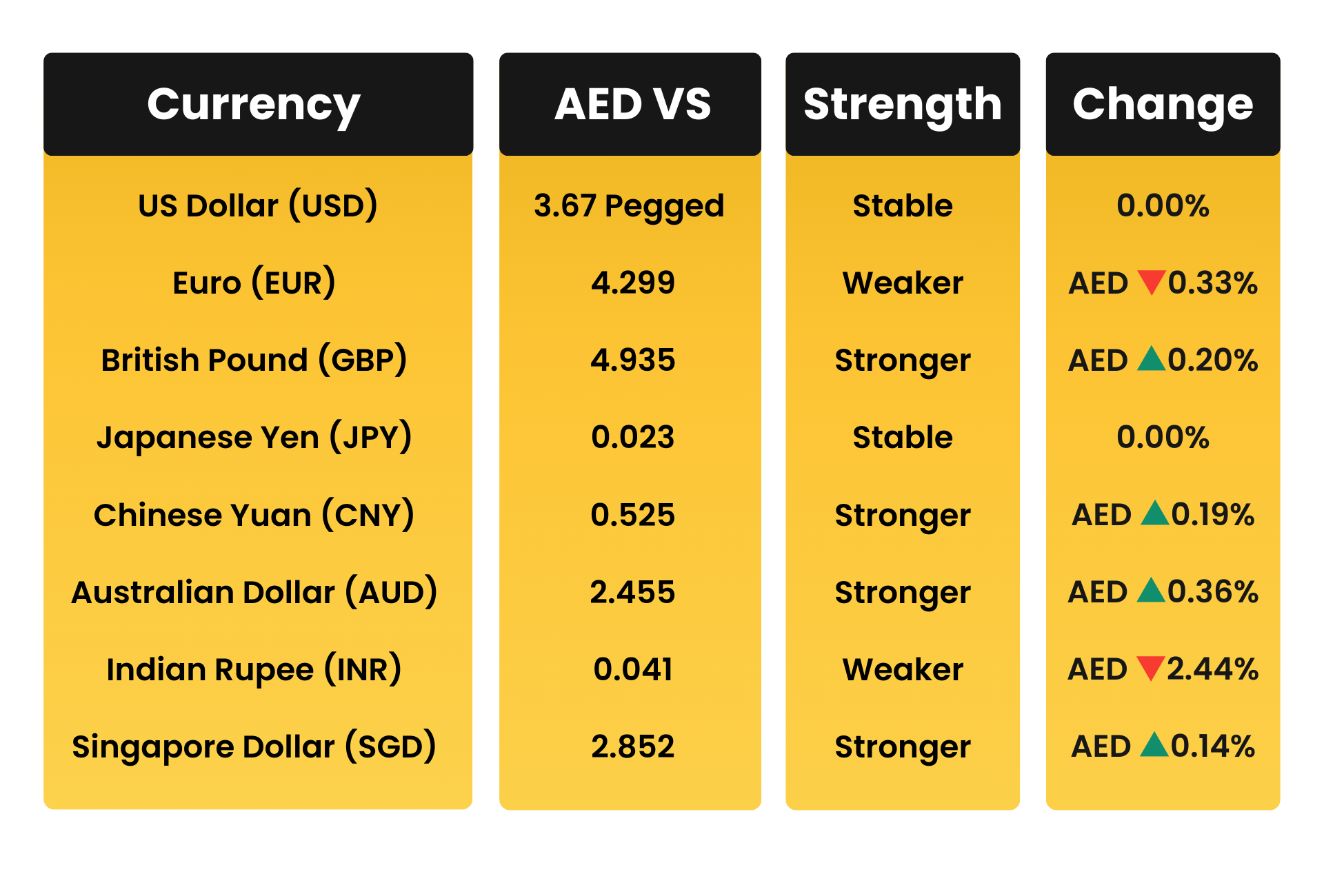

AED vs Key Trading Currencies

*Rates as of 13th January 2026

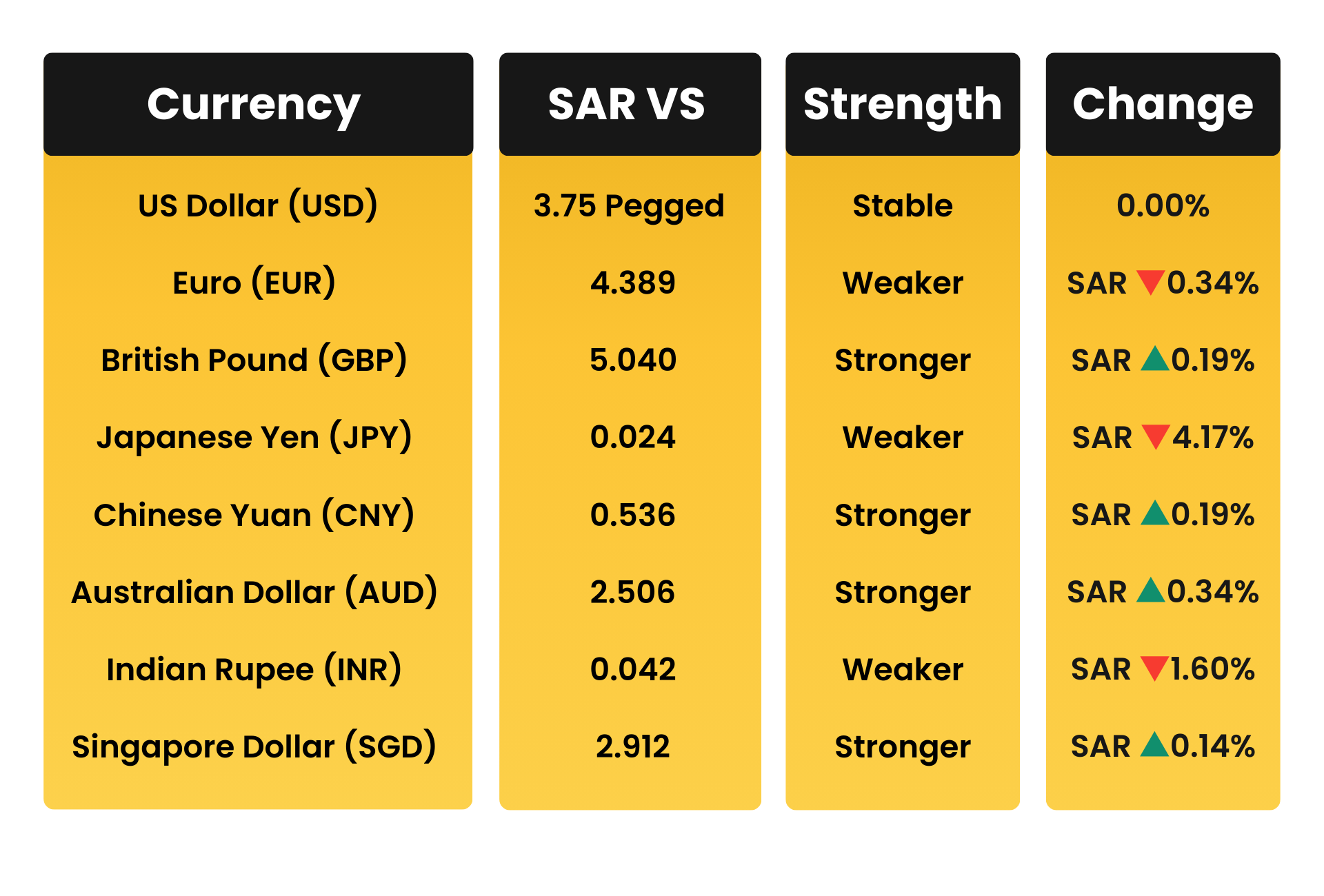

SAR vs Key Trading Currencies

*Rates as of 13th January 2026

Stonehaven Analysis

Currency movements against major currencies (EUR, GBP, JPY, CNY, AUD, INR, and SGD) were minimal this week and largely unchanged from last week.

As most construction materials and specialist imports are priced in USD, exchange rates had no meaningful impact on material costs, plant, or logistics.

Overall, currency conditions remain stable and did not materially affect construction input prices this week.

Global Inputs & Freight Benchmarks

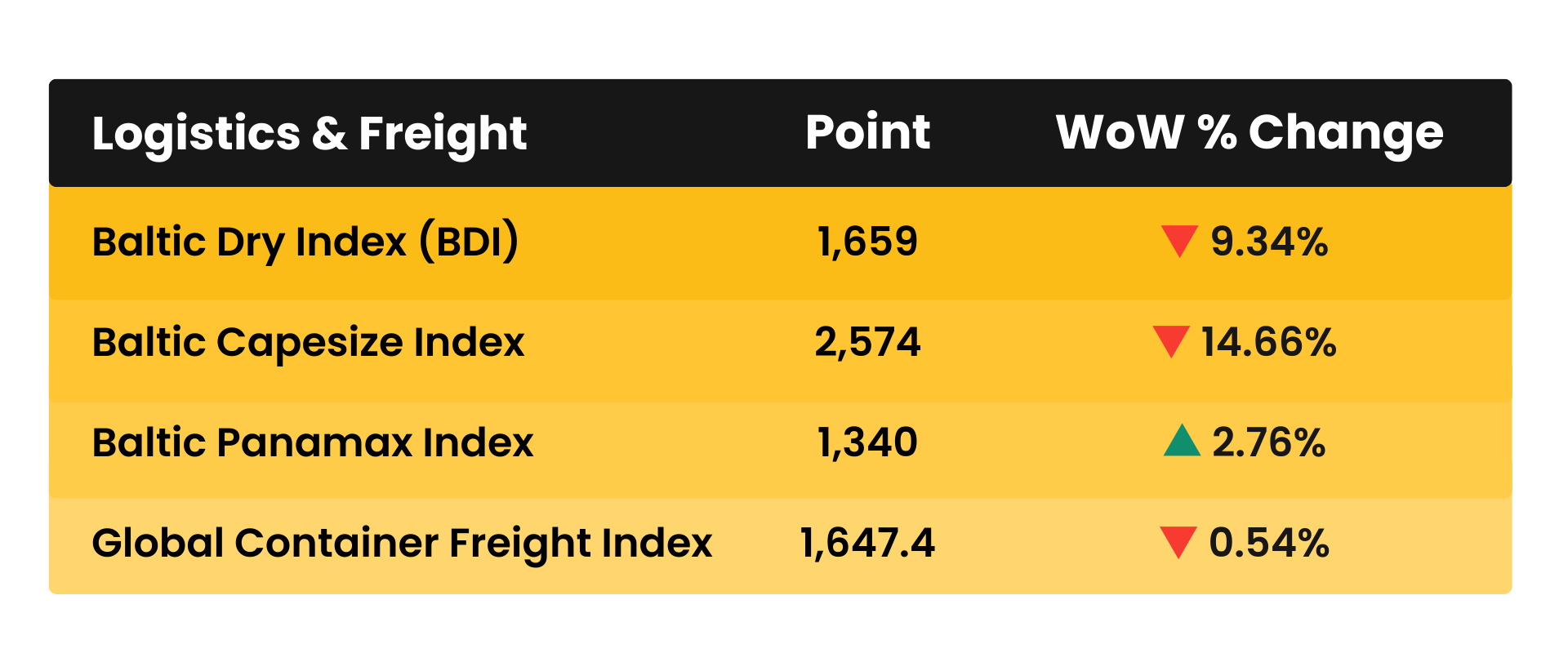

Logistics & Freight – Construction Cost Multipliers

*Rates as of 13th January 2026

Global freight markets moved in different directions this week. The Baltic Dry Index fell by 9.34%, mainly due to a 14.66% drop in Capesize rates, while Panamax rates increased by 2.76%.

Container shipping remained largely stable, with the Global Container Freight Index edging down by 0.54%.

Lower Capesize rates provide some cost relief for bulk materials such as aggregates, steel, and cement inputs, while steady container rates mean no major change in costs for MEP equipment and finished materials.

Overall, logistics conditions remain mixed, with cost impacts depending on the type of material being shipped.

Market Forecast & Watchlist

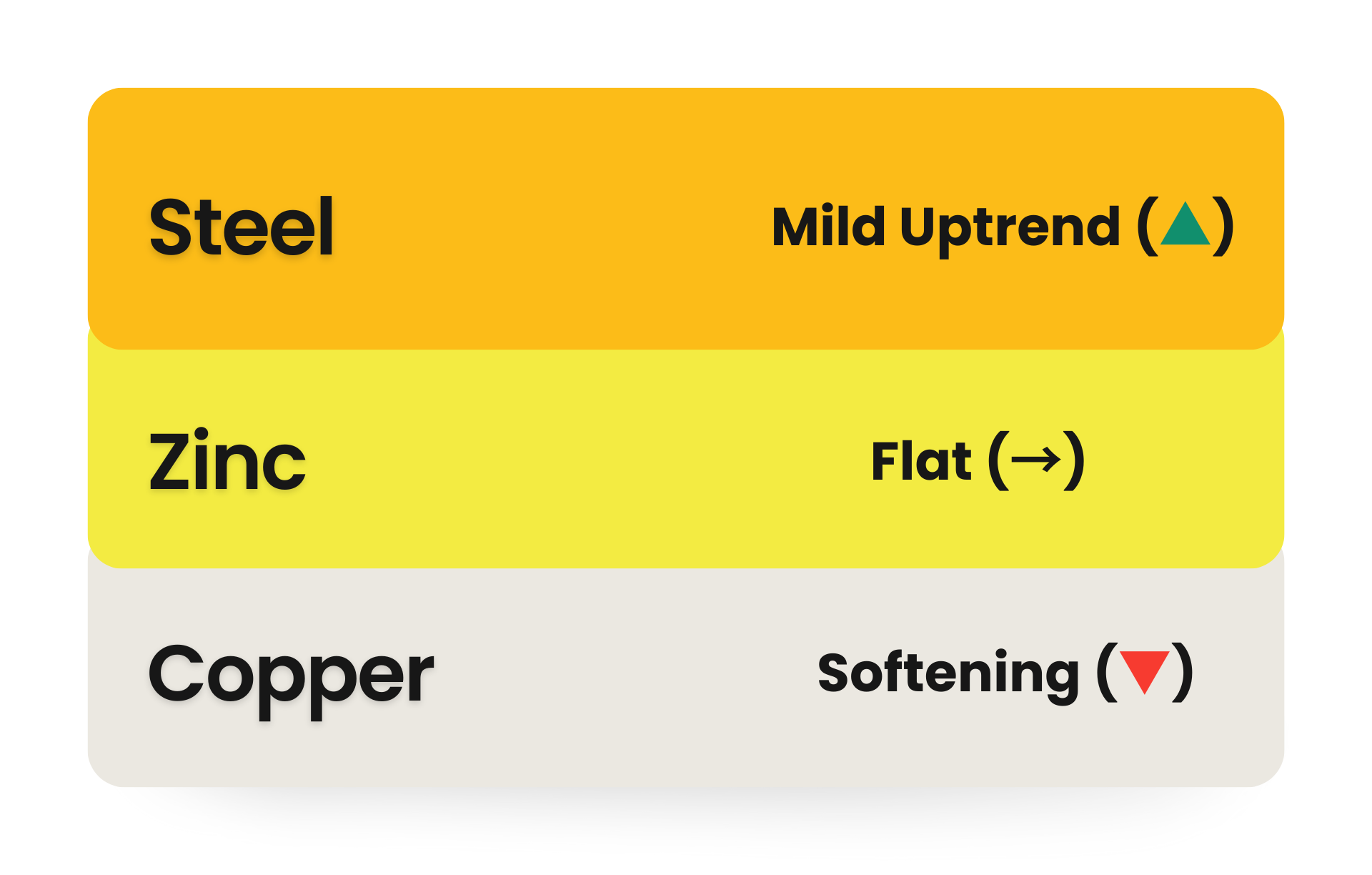

Steel – Mild Uptrend (▲)

Forecast: Near term pricing bias remains mildly upward, supported by steady construction and industrial demand, while supply remains balanced. Bulk freight rate easing provides some cost moderation, but overall steel demand in the Middle East infrastructure and industrial sectors remains firm.

Watchlist: Unexpected production cuts, trade restrictions, import/export policies, and fluctuations in regional construction project activity.

Zinc – Flat (→)

Forecast: Prices are expected to remain stable, reflecting steady industrial and galvanisation demand. Supply constraints are limited, keeping short-term volatility low.

Watchlist: Smelter output, import/export restrictions, and construction project schedules.

Copper – Softening (▼)

Forecast: Prices may ease slightly, driven by moderate industrial demand and stable inventory levels. Cost pressures are limited by sufficient supply.

Watchlist: Refinery output, industrial project execution, and global demand for construction and electrical applications.

Stonehaven Forecast Summary

Commodity markets remain controlled, with no signs of broad construction cost inflation.

Steel prices are likely to continue rising gradually, supported by ongoing infrastructure and energy projects across the Middle East.

Lower bulk freight rates may offset some of the increase, but strong demand keeps upward pressure in place. Key risks include supply disruptions, changes in trade policy, and shifts in regional project schedules.

Zinc prices should remain broadly stable, backed by steady demand for galvanised products and adequate supply. We expect limited short-term volatility.

Copper prices show a slight downward bias due to moderate industrial demand and stable stock levels. In the near term, refinery output and global construction activity will remain the main factors influencing pricing.

Commercial Guidance

This week’s data points to a stable and balanced cost environment across the GCC.

Aluminium recorded the largest increase, titanium saw the biggest decline, while zinc, platinum, CRC, and ULSD remained largely unchanged.

Steel prices continue to rise gradually due to infrastructure demand, but lower freight rates and stable USD-pegged currencies are helping to limit sharp cost swings.

In the short term, the main risks sit with nickel and bitumen prices, project programme changes, and material allocation, rather than wider inflation or currency movements.

-

Structural & Carbon Steel Works: Rising steel, HRC and iron ore prices signal moderate escalation for frames, rebar and fabricated packages. Cost risk is now front-loaded into fabrication and reinforcement scopes. Forward pricing, shorter validity periods and phased procurement are recommended.

-

Industrial, Commercial & Infrastructure Projects: Steel- and aluminium-intensive assets remain demand-supported. Apply targeted contingencies to structural steel, stainless steel and aluminium systems rather than blanket escalation.

-

MEP & Specialist Imports: Pricing remains stable to mildly easing. Standard competitive procurement remains appropriate.

-

Procurement Strategy: Selective early purchasing for steel, aluminium and nickel-intensive packages; flexible sourcing for MEP and CRC-based items.

Important Disclaimer

The Stonehaven Cost Index (SCI) is provided for general information only and does not constitute a commitment, guarantee, or offer to contract at any price level. The index is based on publicly available commodity data and internal market assessments as of 13th January 2026.

Actual project costs will depend on project-specific scopes, procurement routes, and commercial negotiations. Stonehaven Project Management Service LLC accepts no liability for any loss arising from reliance on this document without appropriate project-specific advice.

Talk To Our Team

Speak to our cost management specialists to benchmark, forecast, and protect your project margins, using real data from the Stonehaven Cost Index.