This Week’s Cost Intelligence

We created the Stonehaven Cost Index to give project teams a simple, reliable way to track weekly construction cost changes. It shows what is going up, what is stable, and what may affect your project budgets.

Our cost management team reviews real market data each week and turns it into clear, practical insight you can use for estimating, cost planning, and cost control helping you spot risks early and make informed decisions on live projects.

Key Takeaways For Your Projects This Week

-

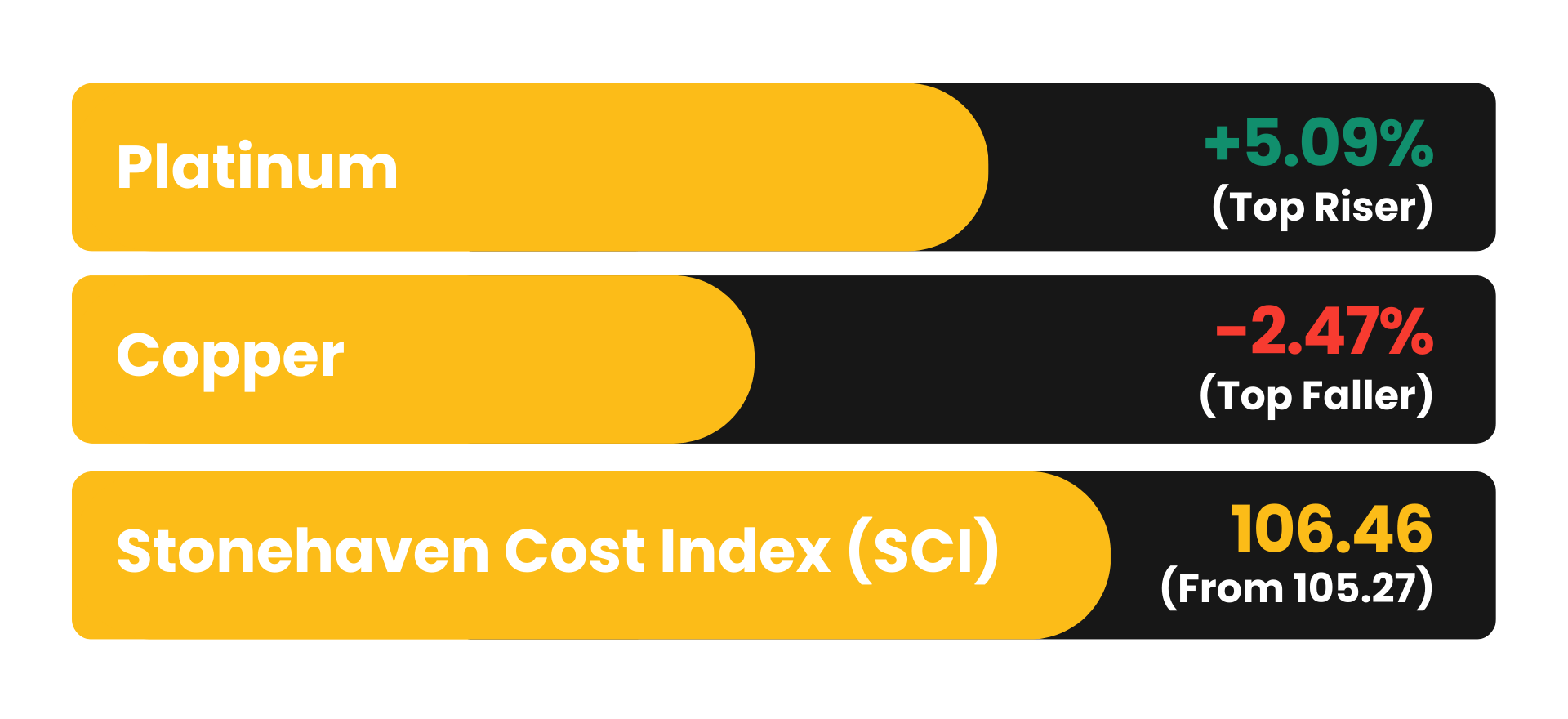

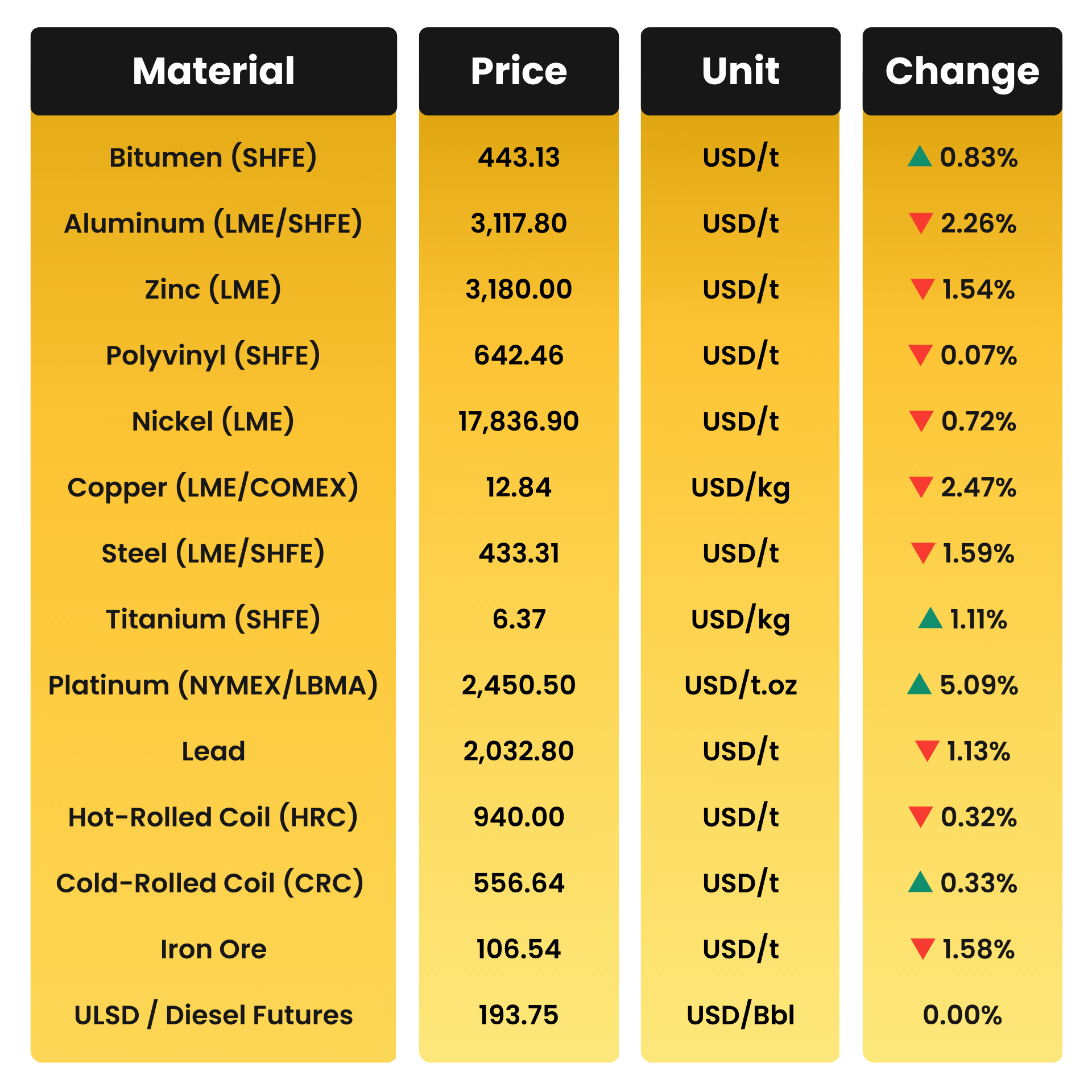

Platinum – This week’s biggest riser. Expect upward pressure on specialist industrial components and high-spec MEP / equipment packages where precious-metal exposure sits in the supply chain.

-

Copper – This week’s biggest faller. Short-term easing for MEP-heavy scopes (cabling, containment, earthing and electrical components), particularly where procurement is upcoming.

-

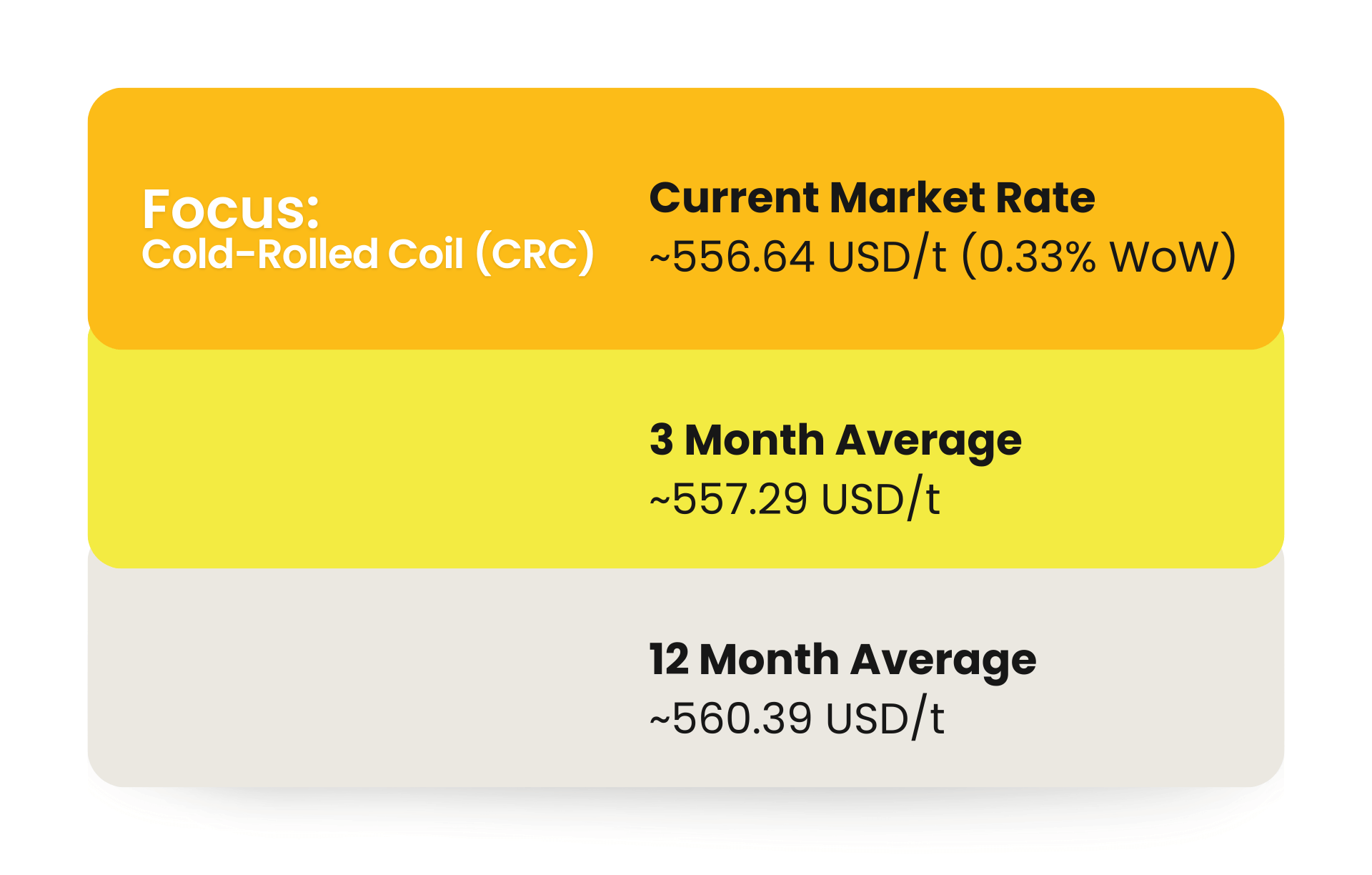

Cold-Rolled Coil (CRC) – CRC held steady this week, supporting near-term cost stability for fabricated sheet-based packages (ductwork, lightweight metal works, certain façade/fit-out metal components), provided lead times and supplier terms remain unchanged.

This Week's Market Movers

Material Movement This Week

*Rates as of 20th January 2026

Material of the Week

*Rates as of 20th January 2026

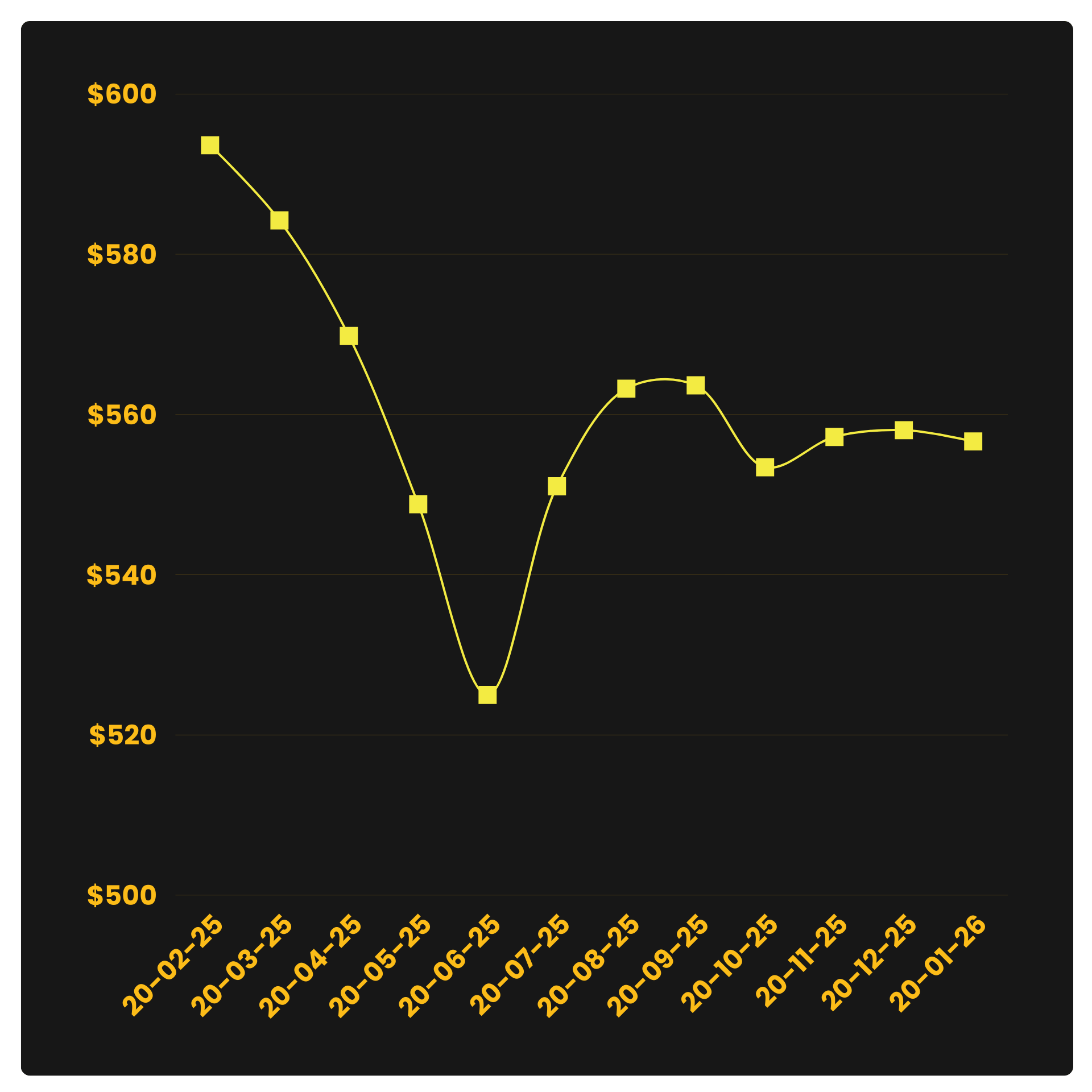

Material Of The Week (Yearly Price Fluctuation)

*Rates as of 20th February 2025 - 20th January 2026

To view the price fluctuations in detail, please download our latest dataset below.

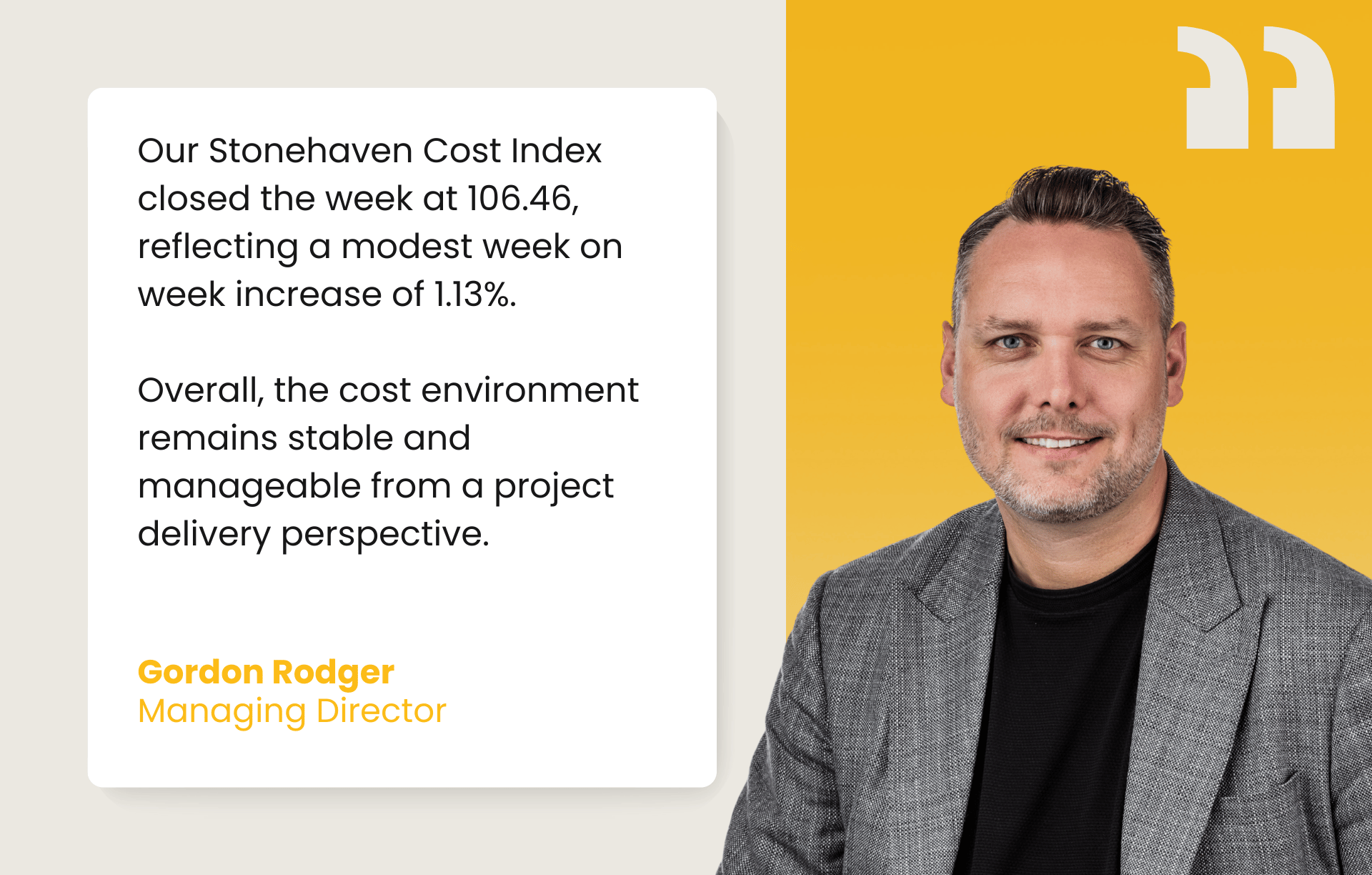

Stonehaven Cost Index (SCI)

Index baseline (01 September 2025) = 100

Current SCI: 106.46 (rise from 105.27 on 13th Jan)

WoW change: ▲1.13%

Change from baseline: ▲6.46%

Driver Note

Commodity movements were mixed, with a sharp increase in platinum prices, offset by a decline in copper, which resulted in some easing across base metals. Key construction materials such as steel, aluminium, zinc, and iron ore experienced mild softening during the week, while polyvinyl, Hot-Rolled Coil (HRC), and Cold-Rolled Coil (CRC) remained stable.

While the index indicates a broadly stable cost environment, actual project outcomes remain subject to procurement timing, specification, supplier terms, logistics, and package specific exposure."

Currency & Inflation Lens

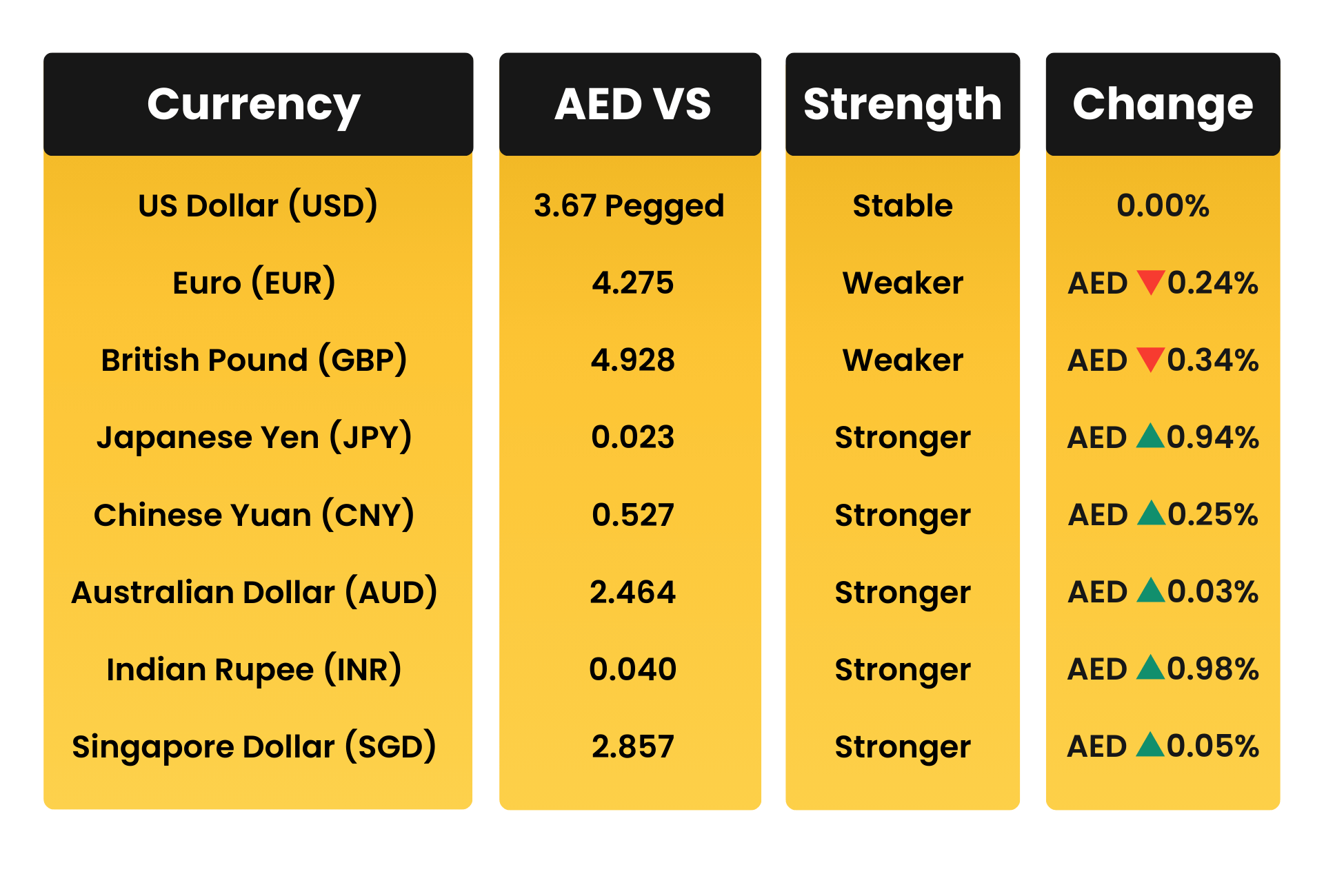

AED vs Key Trading Currencies

*Rates as of 20th January 2026

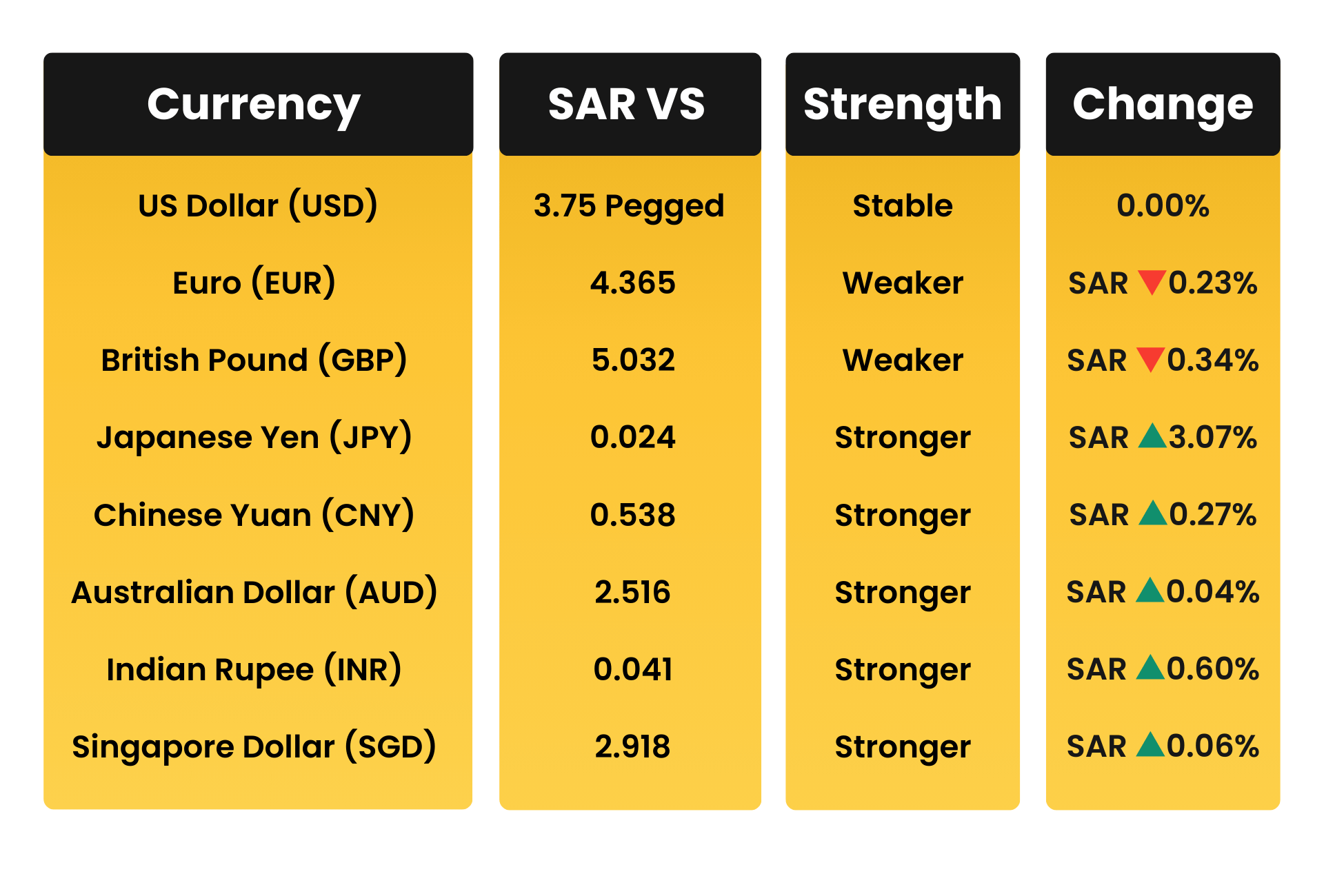

SAR vs Key Trading Currencies

*Rates as of 20th January 2026

Stonehaven Analysis

This week, both the AED and SAR exhibited selective strength against major global currencies, gaining ground against the Japanese Yen, Australian Dollar, Chinese Yuan, and Singapore Dollar, Indian rupee enhancing regional purchasing power for imports.

Conversely, minor week on week weakness was observed against the British Pound and Euro signaling targeted pressure on trade exposed currency pairs.

Overall, the movements reflect a favorable currency environment for Gulf region procurement, with modest fluctuations that may influence input costs and sector specific inflation dynamics.

Global Inputs & Freight Benchmarks

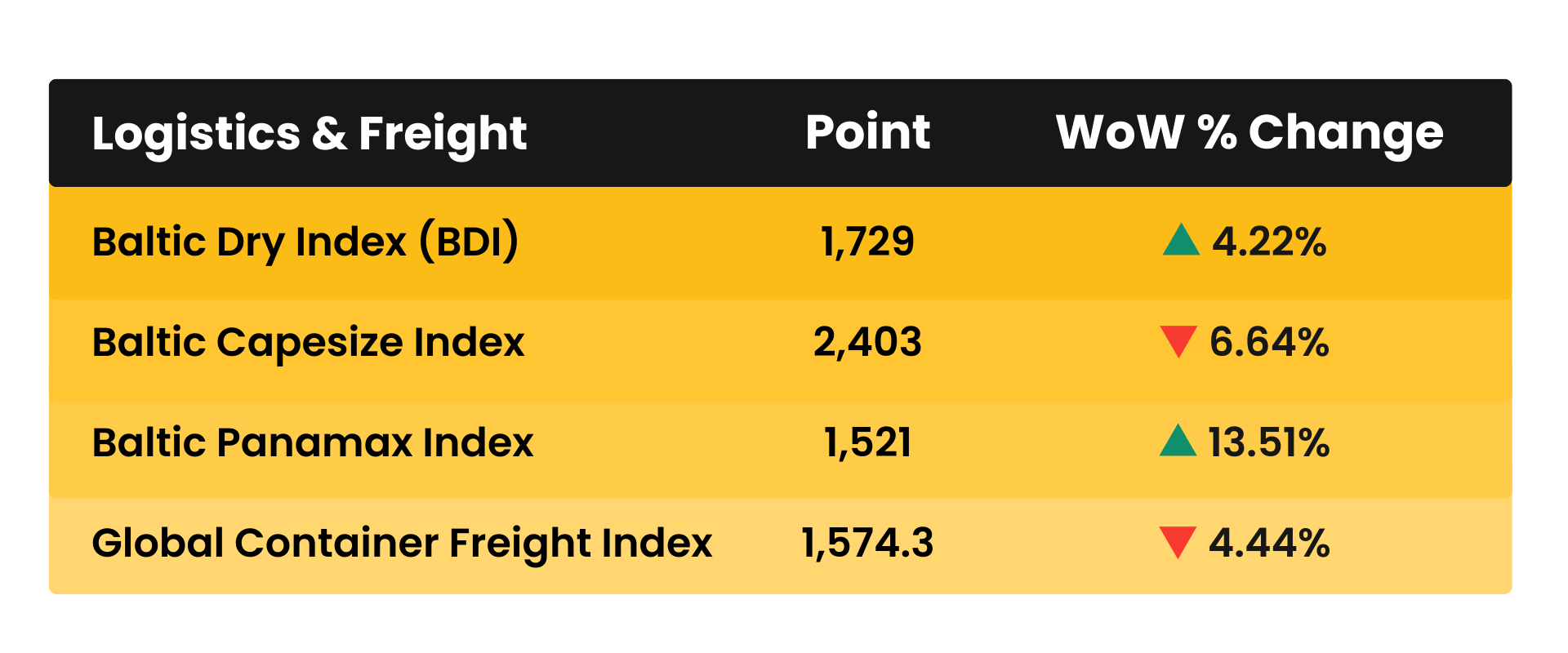

Logistics & Freight – Construction Cost Multipliers

*Rates as of 20th January 2026

The Baltic Dry Index (BDI) rose by 4.22%, indicating a moderate increase in overall dry bulk shipping costs, which could slightly impact the transport of bulk construction materials such as cement, iron ore, and aggregates.

The Baltic Panamax Index surged 13.51% signaling significant cost pressure for mid sized bulk carriers, potentially affecting regional and intercontinental shipping rates for materials like steel and aggregates.

In contrast, the Baltic Capesize Index fell 6.64%, suggesting lower transport costs for very large bulk cargo shipments, while the Global Container Freight Index declined 4.44%, indicating reduced container shipping costs, which may ease expenses for imported construction equipment and packaged materials.

Overall, the data reflect a mixed cost environment, where bulk material transport costs may rise in certain segments, while containerised imports remain relatively stable.

Market Forecast & Watchlist

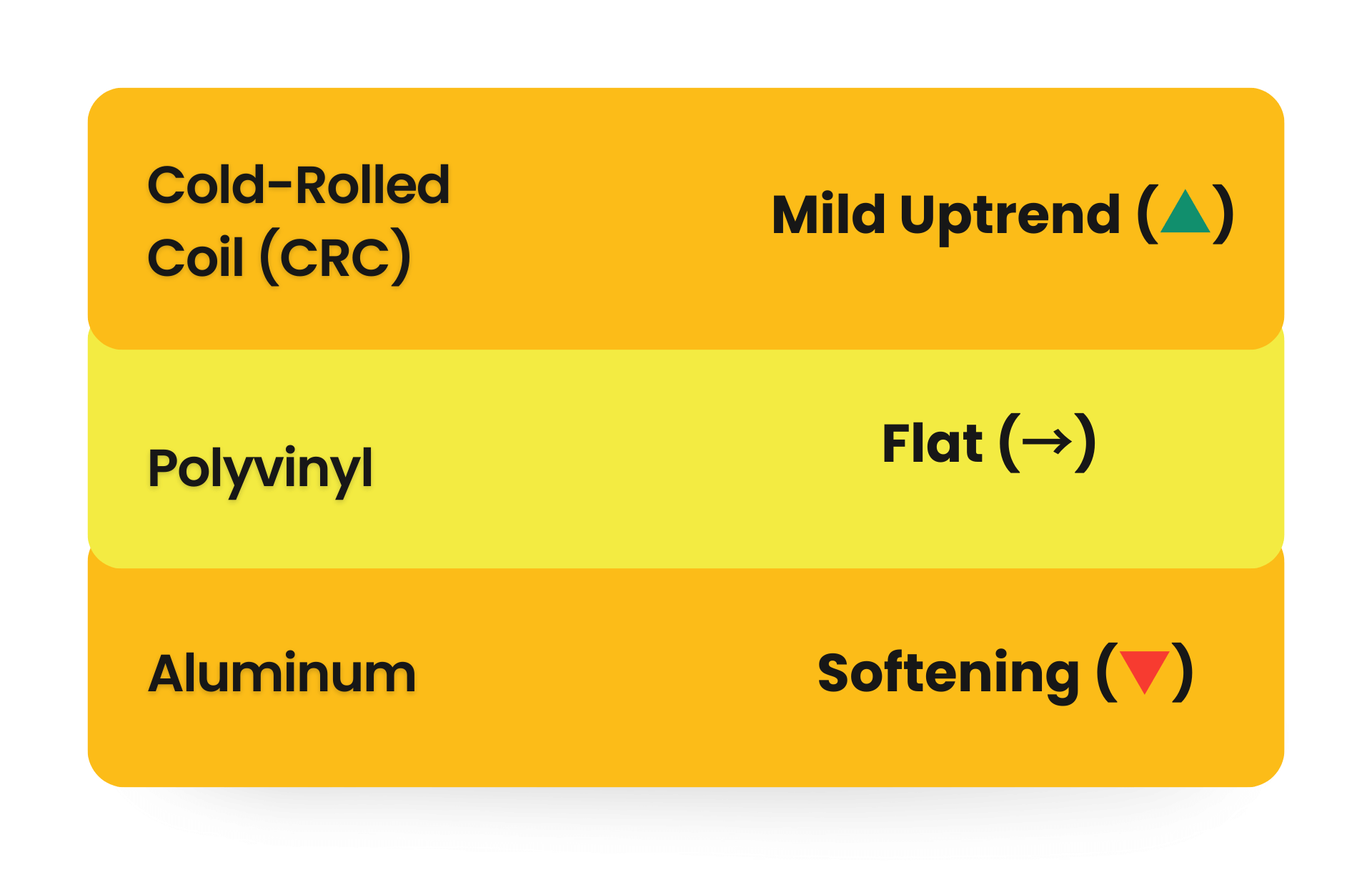

Cold-Rolled Coil (CRC) - Mild Uptrend (▲)

Forecast: CRC prices rose slightly, supported by ongoing demand in architectural, structural, and finishing applications. Price stability over the past 3–12 months provides a reliable benchmark for procurement.

Watchlist : Steel mill output, import/export policies, and construction sector demand fluctuations.

Polyvinyl – Flat (→)

Forecast: Polyvinyl remains nearly unchanged, maintaining stability for polymer based construction inputs.

Watchlist : Feedstock availability, industrial production, and supply chain disruptions.

Aluminum – Softening (▼)

Forecast: Aluminum prices decreased, reflecting easing industrial demand and sufficient supply in global markets.

Watchlist: LME inventory levels, smelter output, and industrial project execution.

Stonehaven Forecast Summary

The current market outlook reflects a generally stable cost environment, with Cold-Rolled Coil (CRC) recording a mild upward trend supported by sustained demand across architectural, structural, and finishing applications, while recent price stability continues to provide a dependable benchmark for procurement.

Polyvinyl remains stable, supporting short term cost certainty for polymer based construction inputs and Aluminum is showing slight softening, indicative of balanced supply conditions and moderate industrial demand.

Overall, cost pressures remain contained, with only limited upside risk associated with CRC and broadly neutral impacts from polyvinyl and Aluminum in the near term.

Commercial Guidance

-

Construction & Industrial Projects: Ongoing demand for aluminum and steel intensive projects remains steady. Freight trends are easing, limiting overall cost escalation. Our recommendation is to apply selective contingencies for high value steel and aluminum components only.

-

MEP, Finishes & Imports: Pricing remains steady; no immediate systemic cost shock is indicated. Our recommendation is to continue with standard tendering and competitive sourcing.

-

Procurement Insight: Focus on early procurement for metal heavy packages, while leveraging CRC and MEP stability to maintain flexible sourcing strategies.

-

Overall Position: Construction cost pressures are contained and selective, allowing projects to proceed with measured risk management.

Important Disclaimer

The Stonehaven Cost Index (SCI) is provided for general information only and does not constitute a commitment, guarantee, or offer to contract at any price level. The index is based on publicly available commodity data and internal market assessments as at 20 January 2026.

Actual project costs will depend on project-specific scopes, procurement routes, and commercial negotiations. Stonehaven Project Management Services LLC accepts no liability for any loss arising from reliance on this document without appropriate project-specific advice

Talk To Our Team

Speak to our cost management specialists to benchmark, forecast, and protect your project margins, using real data from the Stonehaven Cost Index.