The construction market moves fast. Material prices shift, currencies fluctuate, and project costs can change overnight.

To help our clients and partners stay ahead of the curve, we’re proud to introduce Issue 3 of The Stonehaven Cost Index a concise, data-led snapshot of the market’s most influential movements.

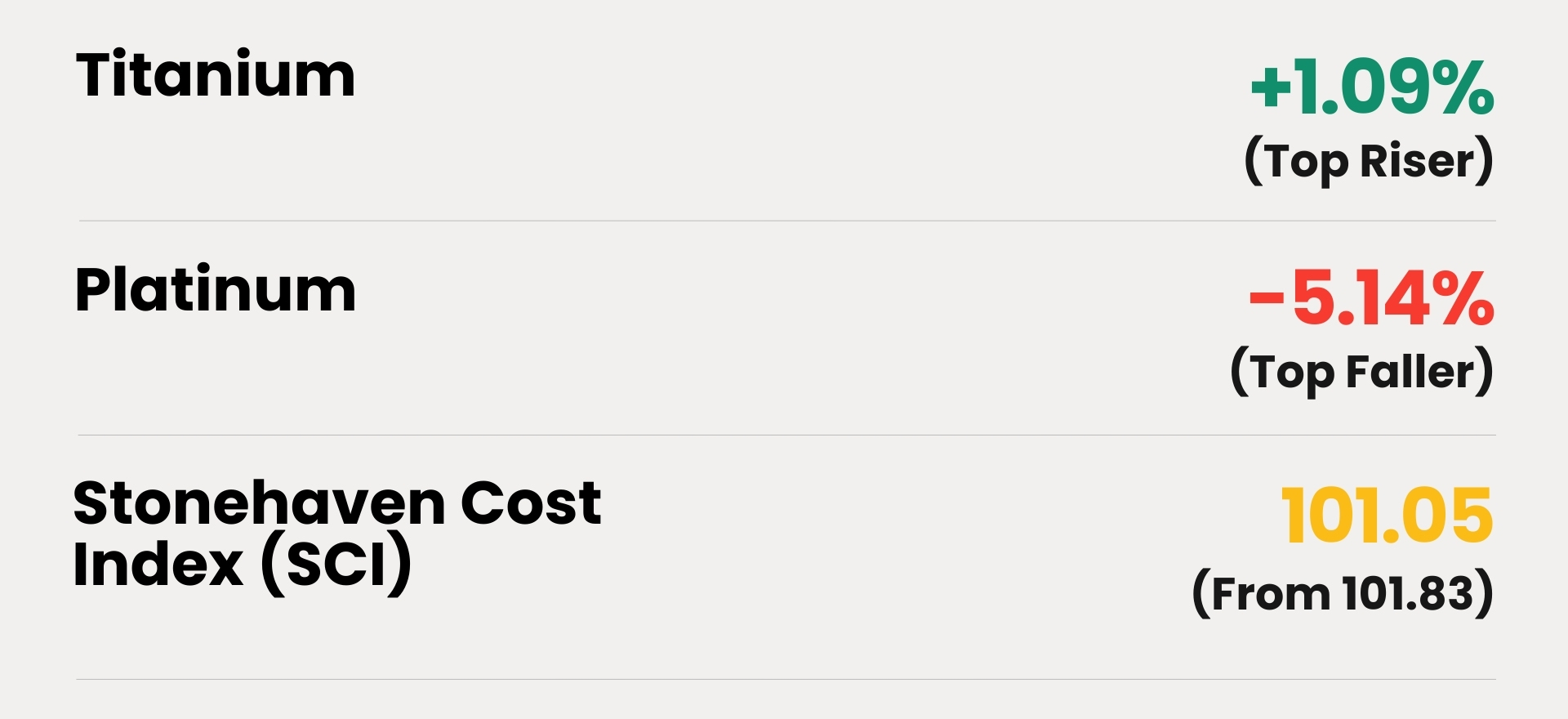

This Week's Market Movers

Every week, our cost management and data intelligence teams will analyse material trends, foreign exchange rates, and inflation drivers that shape project budgets across the GCC. The result is a clear, actionable index that translates market volatility into insight, helping developers, contractors, and consultants make informed cost decisions.

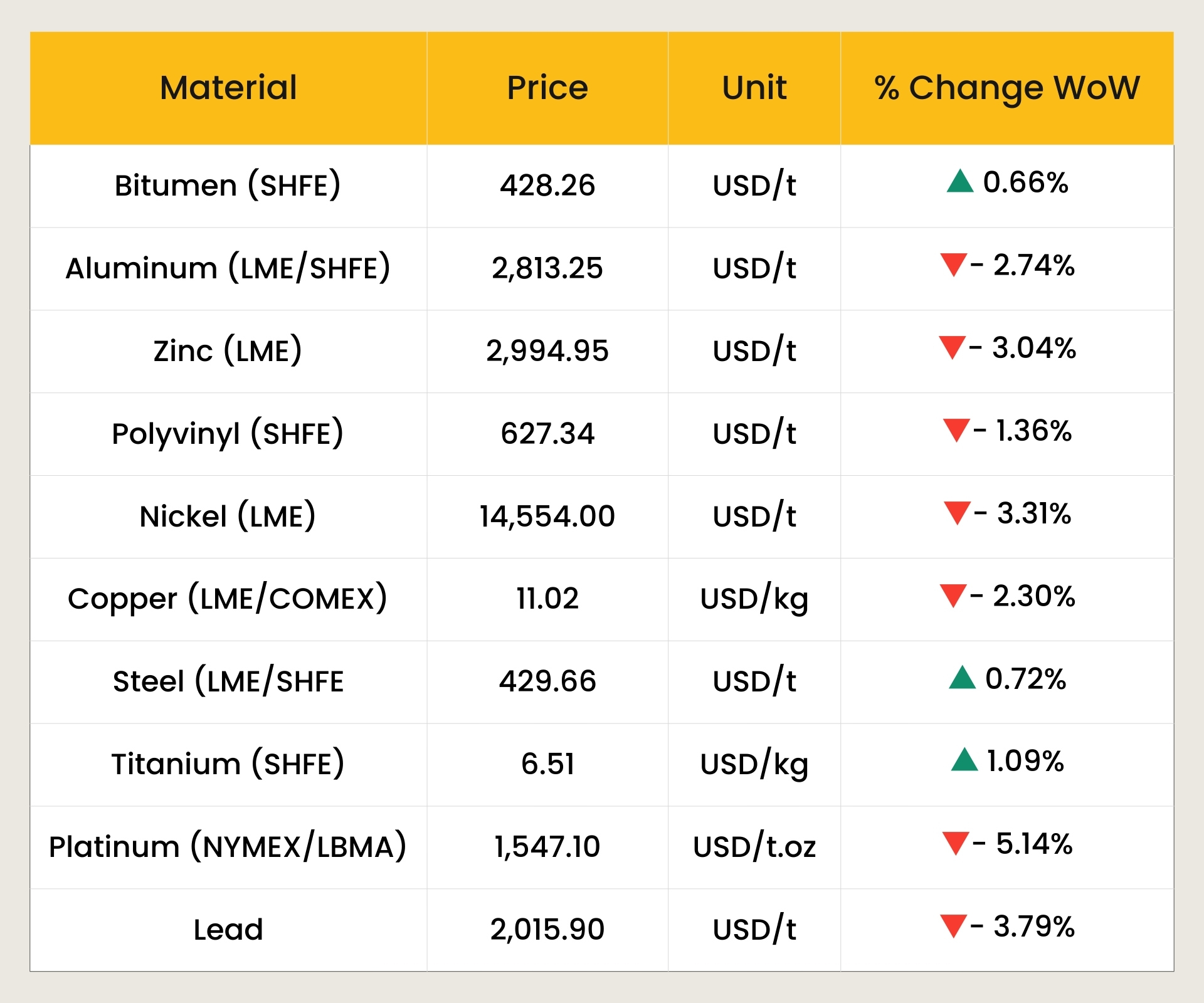

WoW % change (Week on Week Change)

Material Movement This Week

The chart below illustrates week-on-week changes in key construction materials, showing how prices fluctuate across global exchanges and their impact on regional cost trends. It highlights market movement at a glance on which materials are rising, which are stabilising, and which are easing. This will help project teams visualise short-term pricing dynamics that influence tendering, procurement, and overall construction budgets.

*Rates as of 24th November 2025

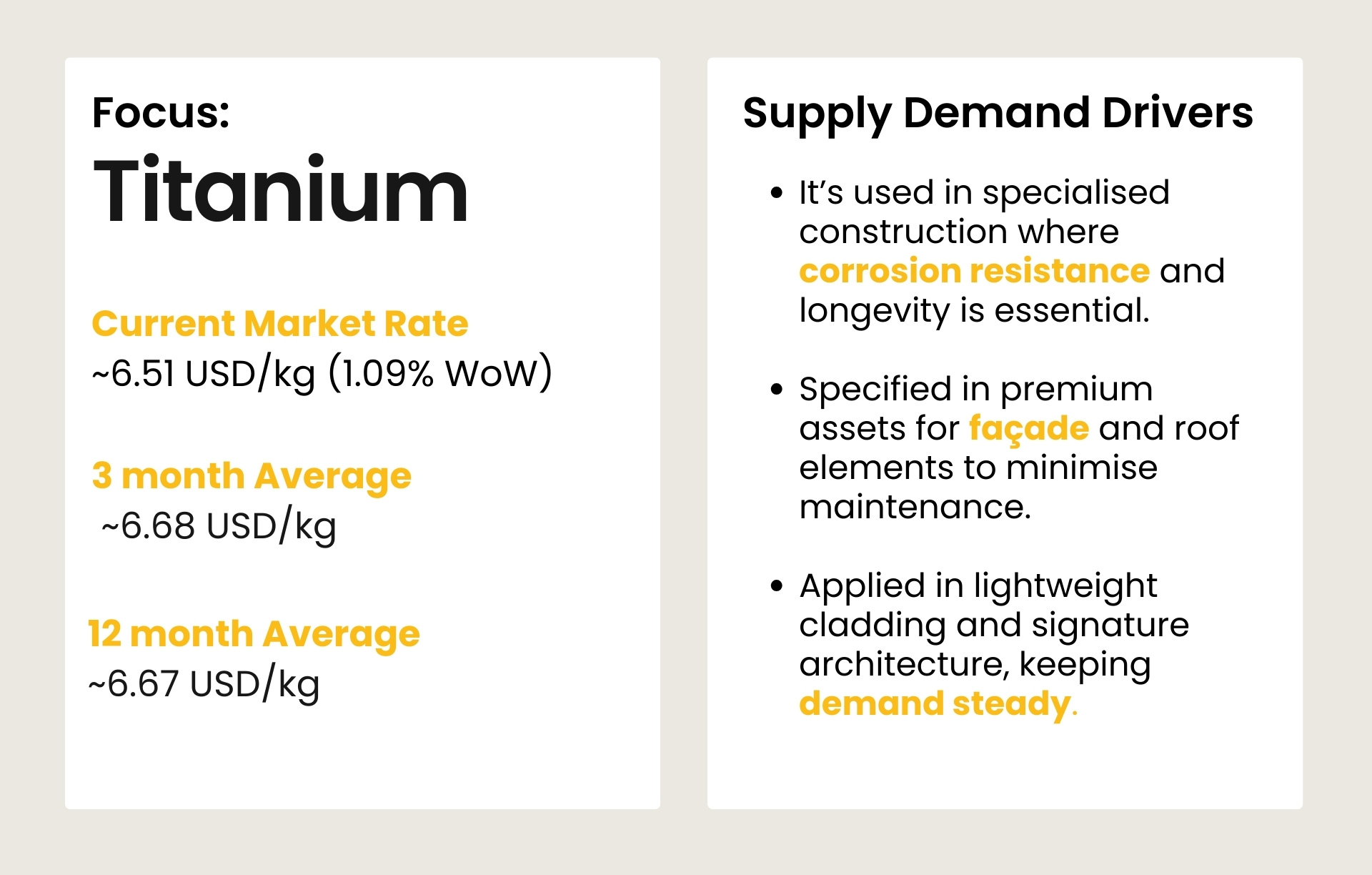

Material of the Week

*Rates as of 24th November 2025

Supply - Demand Drivers

01. Global Supply–Demand Overview

- A major share of titanium metal consumption is in the aerospace sector (aircraft structural components, engines, landing gear) and industrial applications (chemical & process plants, oil & gas, desalination and marine).

- Increasing applications in medical implants (biocompatibility), automotive (light-weighting), renewable energy and defence are emerging.

- Recent commentary (Oct 2025) indicates the titanium market (especially upstream like sponge & concentrate) is moving from surplus towards potential supply-tightness as demand recovers faster than incremental supply.

02. Demand Drivers in Construction

Although titanium is not a mainstream construction metal like steel or aluminium, specific high-performance segments of the built environment increasingly depend on titanium due to its technical advantages. Therefore, price movement of titanium aligns with the following demand drivers.

Longevity & Life-Cycle Cost Efficiency

As premium projects (museums, airports, high-humidity facilities) prioritise long-life, zero-maintenance materials. Titanium remains preferred for critical façade/roof components and structural connectors, supporting steady demand and contributing to the price increase.

Lightweight Architectural Applications

Architects continue specifying titanium for lightweight cladding, large-span roofs, canopies, fins, and shading structures, especially in luxury or iconic developments. This niche but consistent architectural demand underpins the mild uptick in titanium pricing.

Sustainability & ESG-Driven Material Selection

In most of countries developers emphasising durability, recyclability, and reduced long-term O&M. The titanium remains attractive for green-building compliant designs. This long-term material bias contributes to sustained pricing resilience despite broader metal market softening.

03. Middle East Context

In the Middle East-particularly the UAE, Saudi Arabia, Qatar, and Oman titanium demand in construction is shaped by environmental conditions, infrastructure investment, and design preferences unique to the region.

Corrosion-Resistance Requirements

Titanium is superior resistance to chlorides and aggressive environments keeps demand stable across coastal and marine structures, desalination plants, and industrial facilities. GCC’s heavy investment in these assets maintains upward pressure on titanium mill product prices.

Harsh Environmental Conditions

As governments expand waterfront developments, island projects, and Red Sea mega-zones, titanium remains a preferred material for exposed structural components, façade brackets, canopies and mechanical equipment that must withstand chloride-rich environments.

Additionally, during the extreme summer temperatures (45–55 °C) reinforce demand for titanium’s thermal stability, supporting its price resilience as GCC projects specify materials capable of long-term performance without heat distortion or coating failure.

Iconic Architecture & Premium Developments

Titanium’s price resilience is supported by its increasing use in signature façades, high-end cladding, and premium architectural features across GCC landmark projects such as luxury hotels, museums, airports, and waterfront promenades.

Developers in Dubai, Abu Dhabi, NEOM, and Lusail continue to prioritise long-life, zero-maintenance materials, keeping titanium demand firm despite wider metal volatility. Its adoption in fins, membranes, shading systems and lightweight roof structures driven by superior durability, strength-to-weight performance and stable finish under UV, humidity and sand exposure further reinforces upward pricing pressure.

Stonehaven Cost Index (SCI)

Index baseline (01 September 2025) = 100

Current SCI: 101.05 (from 101.83 last week)

Driver Note:

The SCI eased to 101.05 this week, a 0.77% decline driven by broad softening across core construction commodities. Zinc, aluminium, copper, nickel, PVC and lead all moved down as global supply steadied and logistics pressures continued to ease.

For the construction market, this translates into short-term relief across MEP, façade, and structural packages, with contractors seeing slightly improved procurement conditions. It’s a market correction rather than a long-term trend, but it does provide a marginal cost advantage for projects currently moving through tender and early procurement stages.

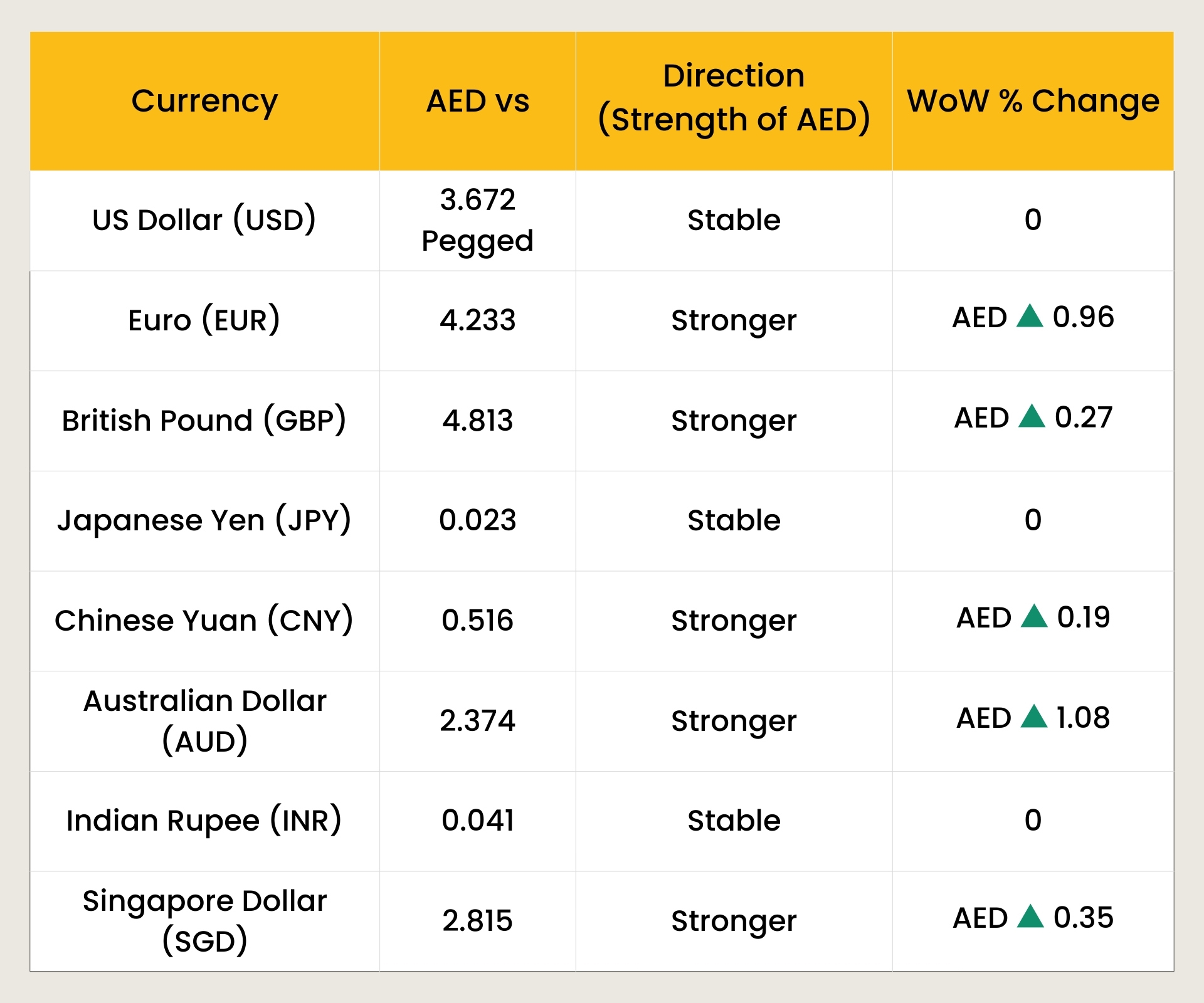

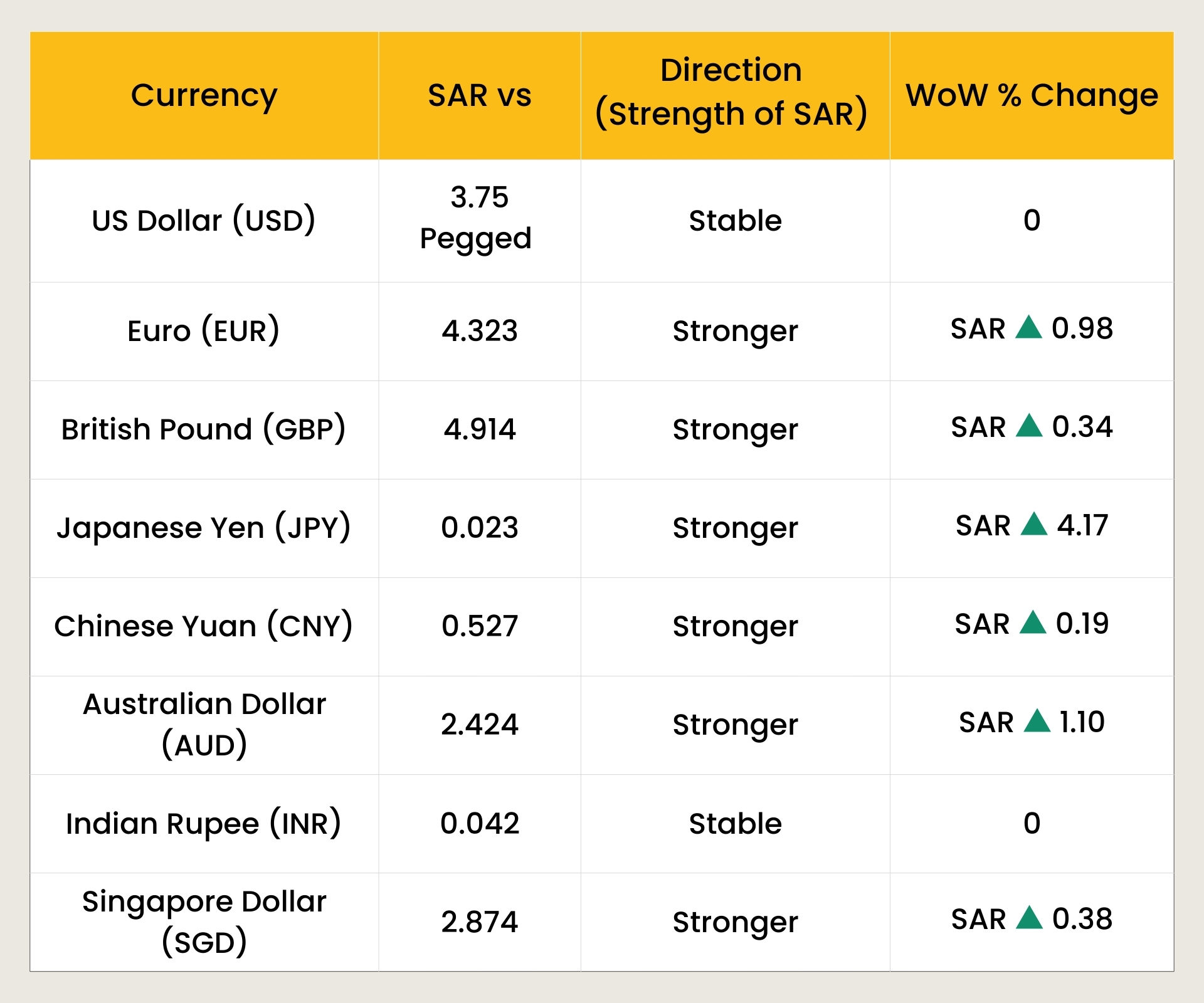

Currency & Inflation Lens

*Rates as of 24th November 2025

*Rates as of 24th November 2025

Stonehaven Analysis

Both AED and SAR remained stable against the USD due to their currency pegs, while showing moderate strengthening against EUR, GBP, CNY, AUD and SGD this week. This provides mild cost relief for Euro- and Asia-sourced construction materials, while USD-denominated commodities remain unchanged.

Continued weakness in the JPY supports favourable pricing for Japanese-origin technical equipment for UAE projects. Overall, the strengthing of AED and SAR present a positive and supportive FX environment for GCC construction this week, easing costs across a range of imported materials and equipment.

Impact on Construction Costs

Contractor Pricing & Risk Allowances

FX stability against the USD, combined with AED/SAR strength against other currencies, is prompting many contractors to hold or slightly reduce risk allowances for foreign-sourced materials. However, shorter validity windows mean contractors may include time-sensitive FX clauses in quotations to protect themselves from future volatility.

High-Spec Equipment & Specialist Systems

The continued weakness of the JPY supports more competitive pricing for Japanese-origin technical systems for plants (such as Pumps, generators, chillers), Precision MEP components as well as Control systems & sensors. This can reduce variation exposure on specialist packages and improve procurement leverage in UAE.

Imported Materials

With AED and SAR strengthening against EUR, GBP, CNY, AUD and SGD, imported materials from Europe and Asia are now relatively cheaper in local currency terms. This provides cost relief for:

- Façade systems & glazing hardware

- Lifts, escalators & vertical transport

- Architectural lighting & specialist MEP equipment

- FF&E, timber, stone and finishing materials

Conclusion

AED and SAR strength create a favourable short-term pricing environment for most imported materials, easing pressure on cost plans and variation assessments. Only packages heavily dependent on USD-denominated commodities (steel, copper, aluminium) remain unaffected.

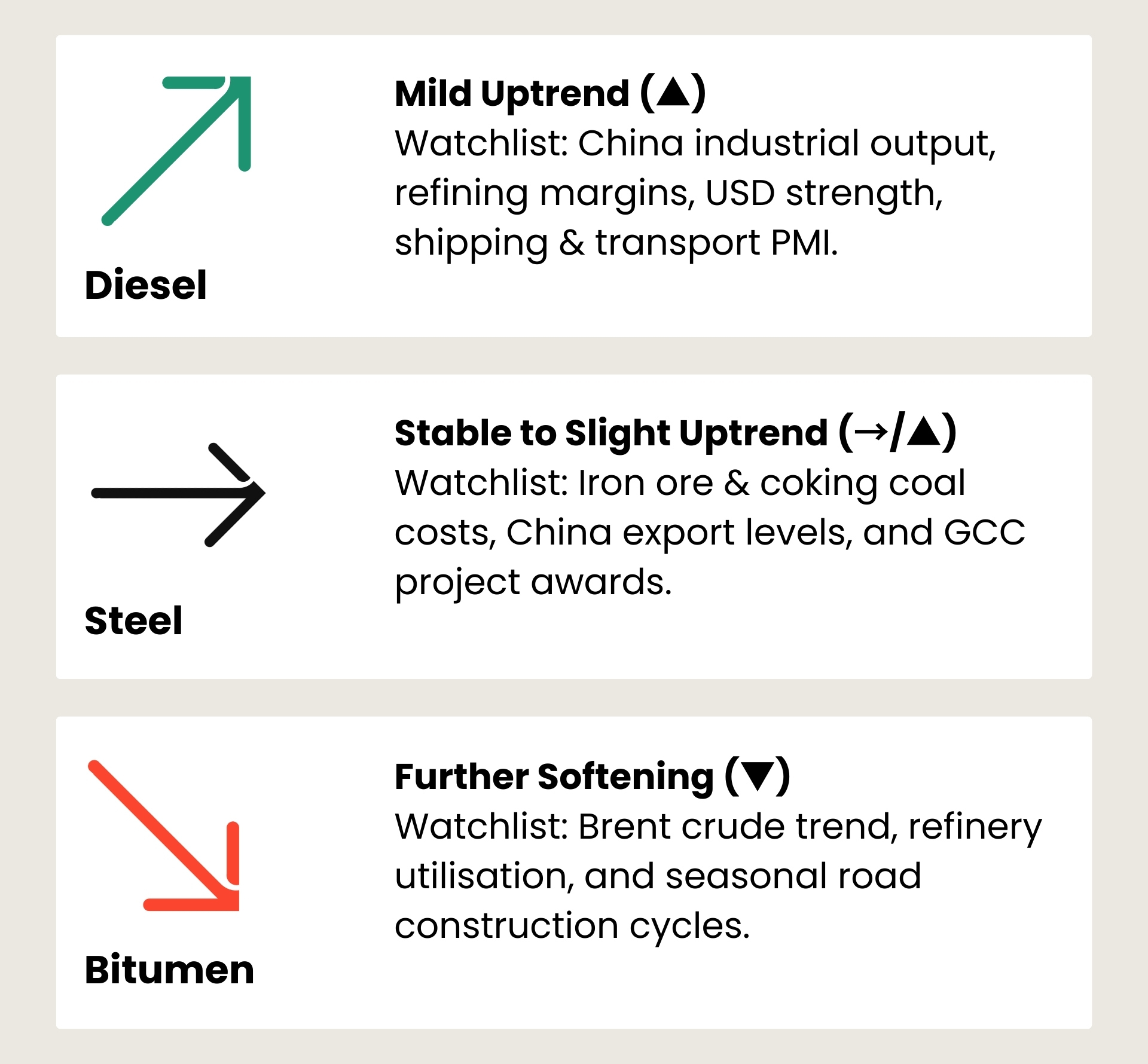

Market Forecast & Watchlist

Diesel – Mild Uptrend (▲)

Forecast: Stable to slightly higher (+0% to +2%) – demand supported by freight, logistics and regional construction activity.

Watchlist: China industrial output, refining margins, USD strength, shipping & transport PMI.

Steel (LME/SHFE) – Stable to Slight Uptrend (→/▲)

Forecast: Flat to +1% – global softness offset by regional GCC project demand.

Watchlist: Iron ore & coking coal costs, China export levels, GCC project awards.

Cement – Regional Stability (→)

Forecast: Stable (0%) – pricing driven by local market dynamics rather than global commodity trends.

Watchlist: GCC project pipeline, fuel/energy costs, clinker capacity, transport/logistics costs.

Bitumen – Further Softening (▼)

Forecast: Gradual decline (–1% to –2%) – tracking weaker crude sentiment and slower roadwork demand.

Watchlist: Brent crude trend, refinery utilisation, seasonal road construction cycles.

Stonehaven Forecast Summary

Next week’s outlook indicates stable pricing across core construction materials such as steel, diesel, and cement, while bitumen show a softening trend, offering some relief for civil and MEP infrastructure packages.

Closing Notes

Overall, the week reflects a broadly stable construction cost environment, with easing prices across several non-ferrous materials and supportive FX conditions driven by stronger AED and SAR. Titanium remains firm due to sustained demand in high-spec façade and marine applications, while bitumen and PVC softening provides relief for civil and MEP works.

Diesel, steel, and cement remain steady, and favourable currency movements reduce pressure on imported equipment and finishing materials. Looking ahead, cost risks are concentrated mainly in specialist MEP systems and premium architectural packages, while core structural materials remain largely stable.

Talk To Our Team

The market’s changing every week, so are your budgets keeping up? Our cost management specialists can help you benchmark, forecast, and protect your project margins using real data from the Stonehaven Cost Index.